When we started Shares we were unwavering with our commitment to build a world-class experience around investing with friends. We’re still committed to that, but we’re going about it a different way.

Making this decision took us the best part of 6 months, but after a lot of careful consideration we strongly believe this will fit our users’ needs better. In what follows (see what I did there), we’ll take you through our experience of making this decision, which we hope can serve as a playbook for other companies experiencing some of the same challenges we’ve been up against. The below contains the signals, failed solutions and thinking that got us to where we are today.

Let's start here 👇

From the top

Since we started Shares, “Investing with friends” has been a core part of our proposition. We built our brand around it, and forged expectations for the experience we were trying to create.

And while it sounded great, it makes some pretty far out assumptions that we need to address. It assumes that you have friends in the first place to invest with, and that there's intrinsic value in bringing them to Shares.

Our mission is fundamentally about making investing more collaborative. For the longest while we thought investing with friends was the best (and only) way to do this. Mistake number 1.

Turns out people don’t (for the most part anyways) have friends that invest, and even fewer people would listen to their friend’s advice. We’ve run heaps of user interviews only to find that the majority of our users are first time investors. It’s not uncommon that they’re the first in their family to start investing, too. They come to Shares by themselves looking to learn and connect with people that can teach them a thing or two.

So, we scratched our heads a bit. This was a problem. We had built a product that heavily leverages network effects i.e the more friends or people you know on Shares, the better your own experience is. Just like on Monzo how it’s easier to split bills and make payments when your friends are also using it. So, how were we going to fix this? Churn was high and we weren’t seeing users bring their mates aboard.

Non-starter

Earlier in the year our CPO, Harjas, shared an insight given to him by Andrew Chen, author of the Cold Start Problem. To build a great product, users need to experience the value you’re providing in repeatable loops as quickly as possible. If you nail this then retention becomes easy, and you’re on your way to product-market fit (PMF).

Simple, right? Not quite. Our “friends” connection model had limitations that mean these flywheels never started turning. I’ll explain. Until recently, 50% of users on Shares didn’t have friends on the product. This means that there was nobody to chat with or learn from. If our value proposition is anchored to collaborative investing, there’s nothing further from it than starting your investing journey alone. For these users, Shares felt like a ghost town.

Now I’ll preface and say there are many ways to (attempt) to solve this problem. Your first port of call should probably be to think about how users find friends on your product, or how you’re acquiring users generally. We’ve done all of this to varying levels of success so I’ll gloss over it and focus on what matters. We found our “friends” problem (or lack of) to be more systemic.

Fundamentally, our users don’t have people in their network that invest. We can pull our hair out optimising how a user makes their first connection and how to bring their IRL friends to Shares, but if they simply don’t have friends who invest in the first place the solutions you find probably won’t move the needle.

Initially we thought we had a discoverability problem. To address this we tried adding “Add friend” CTAs across the whole product. And when this didn’t work, we started suggesting users to befriend during onboarding. And when that didn’t work we thought it was a problem with the friend suggestions we were making, so we amended the logic there too. That didn’t work either. The problem went much deeper but we didn’t know it yet.

Once we acknowledged that our users were coming to Shares alone, our next port of call was to make other users (strangers in effect) feel more accessible with profile picture, bios, and profile interests. We hoped that’d drive new connections and while it did to some extent, the quality of those connections weren’t great. They didn’t amount to a better experience. Not to the extent we wanted anyway.

It turns out that people think long and hard about who their “Friends” are, whether offline or online. People have natural scepticism or mistrust when asked to add friends in online settings. Put simply, users on Shares don’t feel comfortable adding randoms. That’s fair enough. Characterising these connections as “friends” was the problem, it wasn’t representative of the relationship these people have (or don’t).

Challenging our connection model

At this point we called into question our connection model. We knew it had flaws, but we were also super protective over it. Investing with friends was (and still is) a core part of our business model, so changing it wasn’t a decision to take lightly.

The first thing we did was look at other social products like Instagram. Instagram is great because it allows you to maintain close connections with friends via close-friend stories and private messaging, but it also connects you with people beyond your circle with stories and public profiles. At the same time, Instagram gives you the tools to control the extent to which you’re visible to others. It puts your protection and privacy first, and we liked that a lot.

We also looked at YouTube, Substack and Patreon. We resonated with their commitment to democratise access to user-generated content, and found it easier to draw parallels to what we’re trying to do at Shares. It’s popular for services like these to use a ‘subscribe’ connection model. Subscribing is an intentional decision someone makes to continue receiving content from that person/channel. It’s also an endorsement for the content they’re sharing.

Lastly, subscribing can also feel transactional. You typically expect something in return when you subscribe, and that’s why it’s often used to describe content that you might have to pay for (Patreon, Substack).

Lastly, we looked towards LinkedIn for the answers. They seemed to entertain two connection models simultaneously: “Connect” and “Follow”. To this day I still don’t really understand it. Users of Linkedin can connect with someone AND follow them via two different CTAs on their profile. Feels kinda weird, sounds kinda weird and is kinda weird. We thought our users would feel the same. We tried to entertain this for Shares but it made for an incredibly complex user experience, and it felt massively over-engineered. Imagine a world on Shares where you have friends (connections), followers, and people that follow you. What if we wanted users to subscribe to profiles in the future to receive content as well? My head hurts just thinking about it.

The Solution

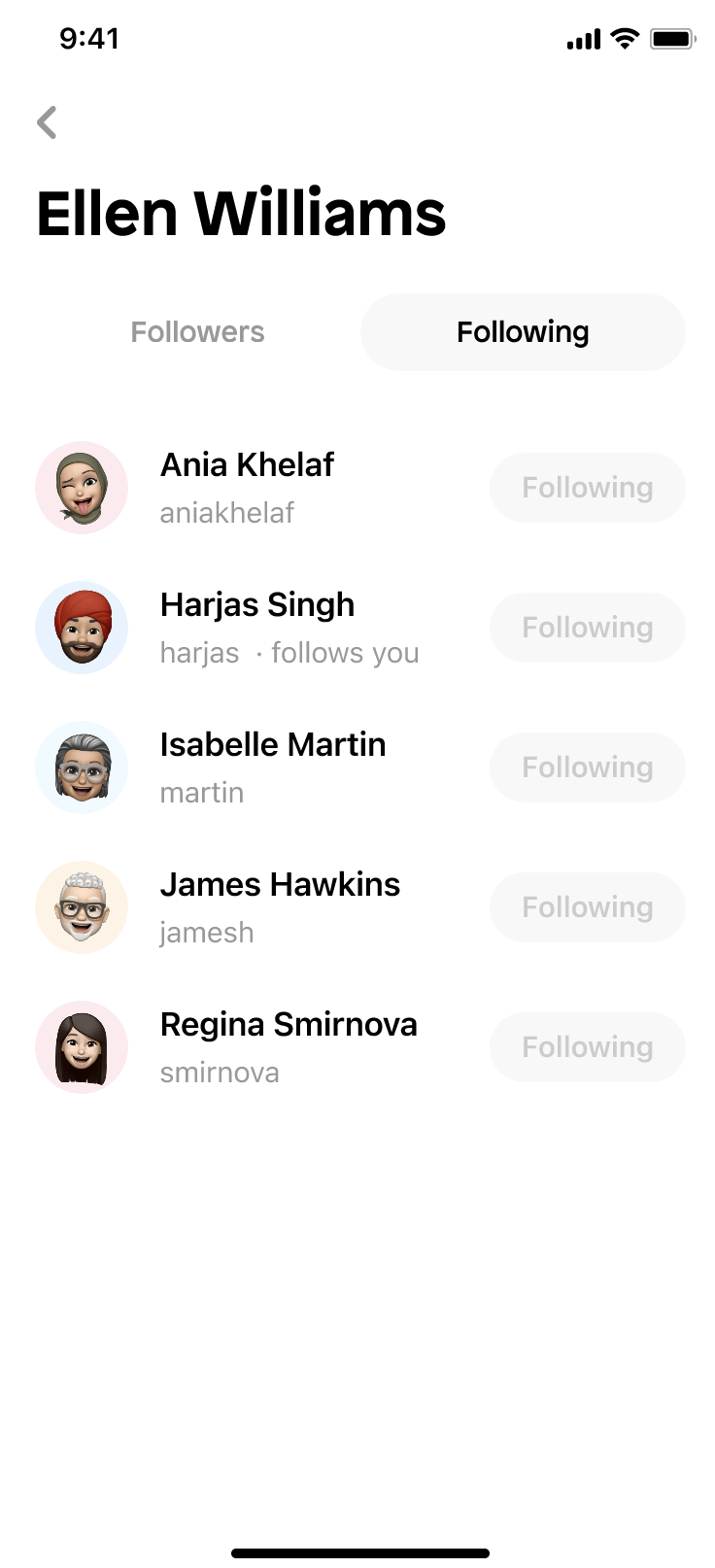

Anyways, we figured we needed to be bold and decisive to change our connection model, but also not reinvent the wheel. “Follow” felt like it solved the problem best, and would be the most familiar to our users. It also gives us the room to protect and enhance our commitment to investing with friends.

To stay true to that we’ve only made it possible to private message between users with two-way connections e.g when you and someone else both follow each other. If the connection is mutual, we also think you’re more likely to be friends (in the traditional sense). This change better respects your privacy, reduces the prevalence of spam, and gives you a stronger motivation to connect with someone in the first place.

We’re determined to build an experience that allows you to have those close-circle interactions with people you know and trust, while at the same time letting you tap into a much wider network of aspiring investors. However you’re investing, whoever you’re investing with, do it on Shares.

I’ve added some images below to give you a better feel of the experience we’ve created!

We’ll be back shortly to report on whether or not it’s having the desired impact. Early signs (even though it’s only been a few days) are pretty positive so far.

Stay tuned! 🎧

Make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330). Shares App Ltd is a company registered in England and Wales with company number 13374448.