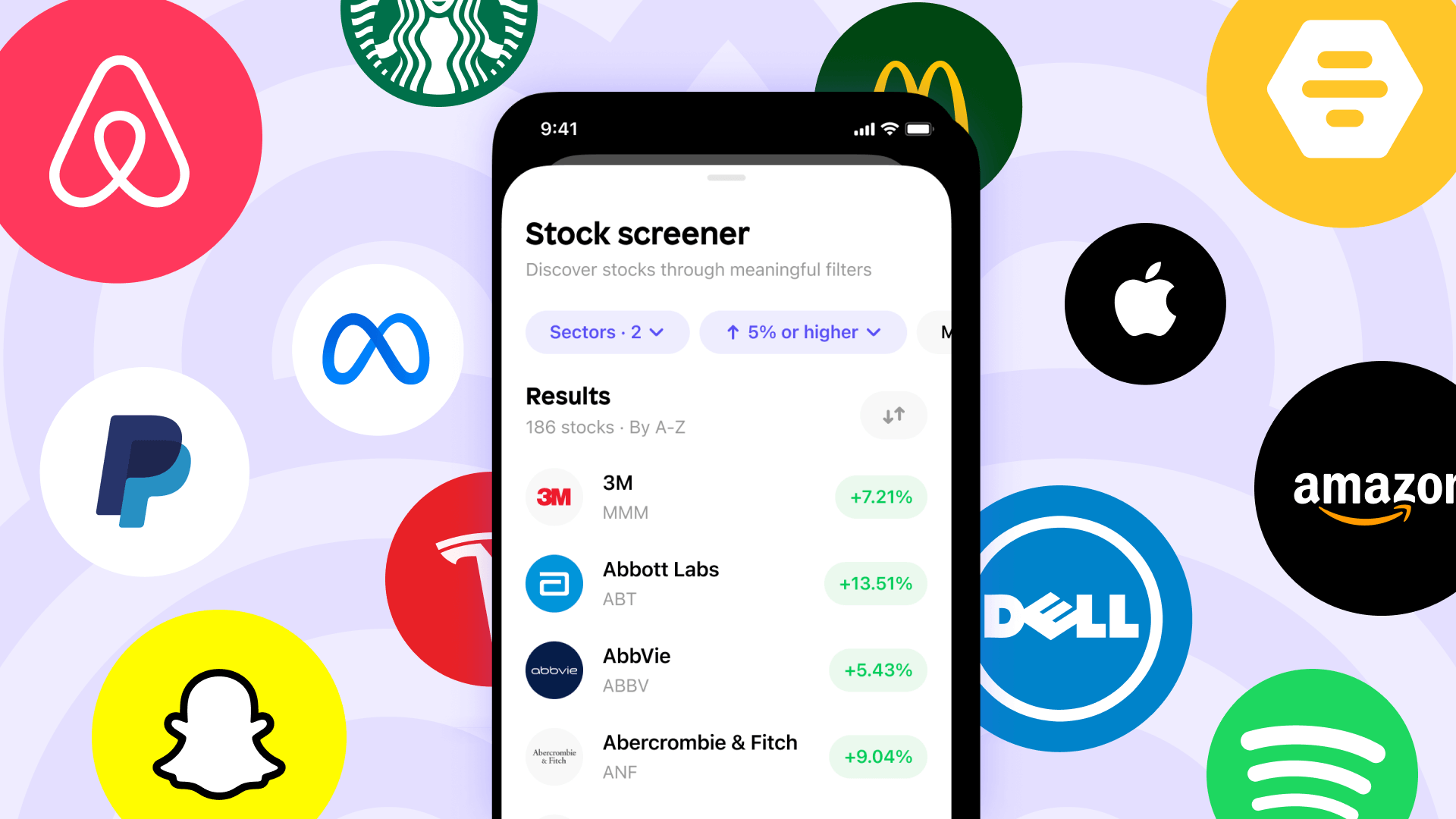

That's why we are thrilled to introduce our newest feature: the stock screener! Our stock screener is an amazing tool that allows you to filter through thousands of stocks on the Shares app using three main metrics:

📈 Performance

💼 Sector

💰 Market cap

Let's dive into each of these metrics to learn more about how they can help you find the right stocks for your investment portfolio.

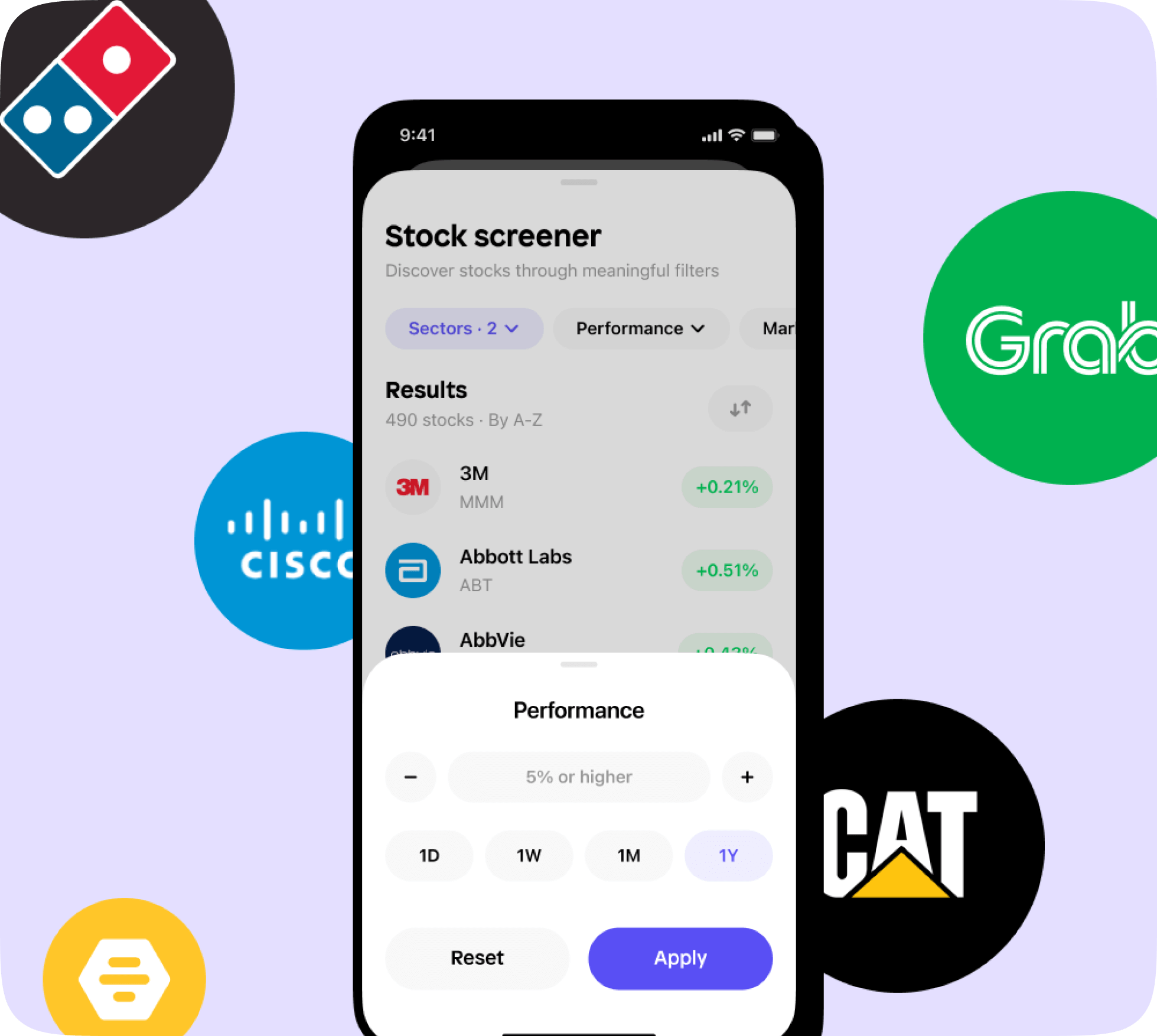

Performance

One of the most critical metrics when it comes to stocks is performance.

Our stock screener lets you search for stocks that have gone up or down a certain percentage in the last day, week, month or even year. This might benefit you because:

You can identify companies that are doing well in the current market conditions

You're able to track performance over time, instead of just looking at a snapshot price movement

It can also help you to avoid companies that are underperforming, which can be a good way to minimise risk in your portfolio

You can identify trends in high-performing stocks

💡 Now, it's not to say a stock that is up 20% is necessarily a good buy, or that a stock which has fallen 10% is a bad buy. These recent price movements could over/under value the stock's true value, but filtering by performance should help you identify trends when conducting your research.

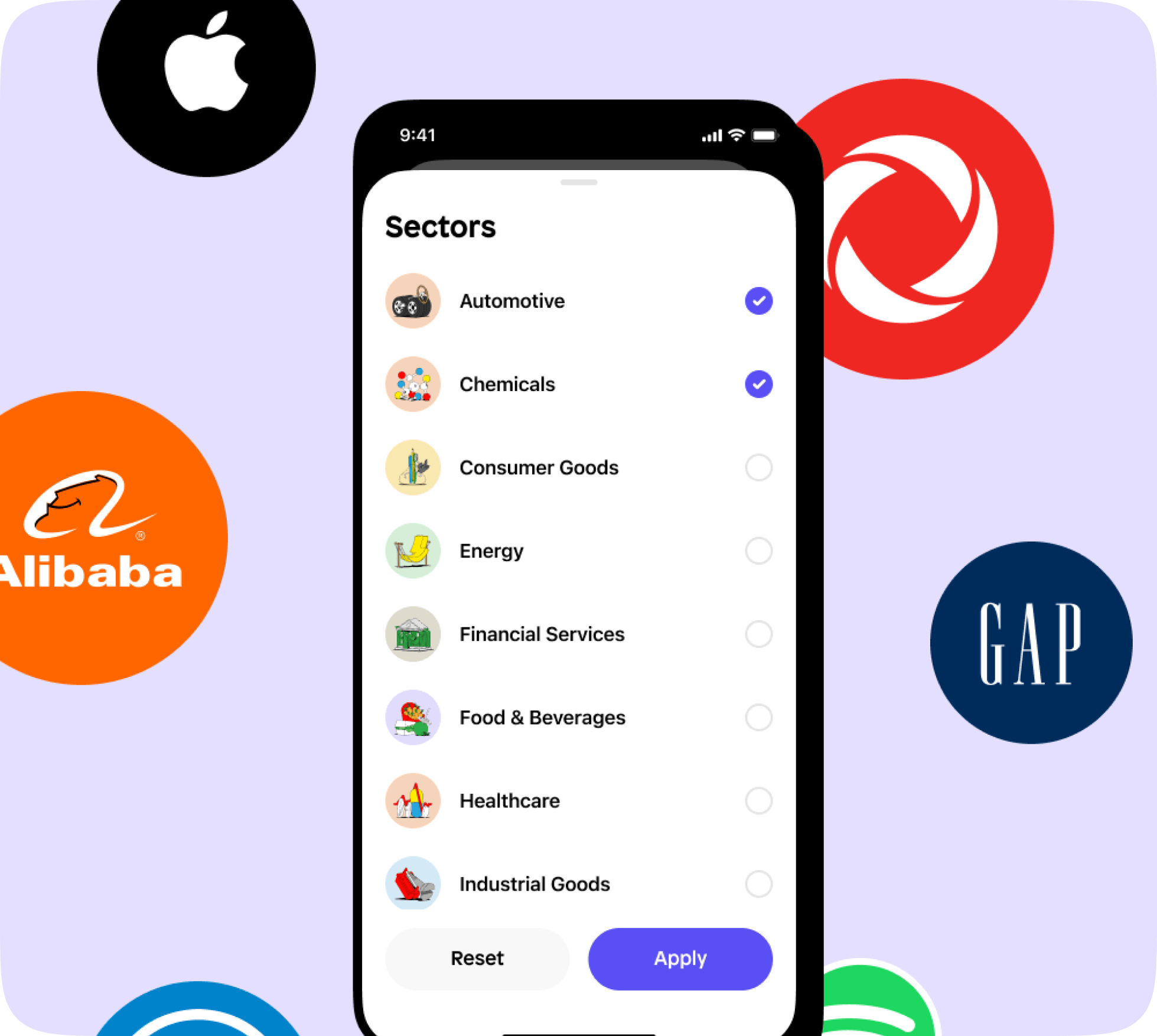

Sector

Our sector filter is another powerful metric that can help you find the right stocks for your investment strategy.

By selecting a particular industry or sector, such as technology, finance, energy, or healthcare, you can easily narrow down the stocks that match your investment goals.

Searching by sector may benefit you in the following ways:

You can learn more about the overall trends that are impacting companies within a particular industry

It makes assessing risk and return across different sectors more straightforward, as naturally, some industries are riskier than others

It's easier to compare different companies within the same industry when you search for stocks by sector

It helps you diversify your portfolio

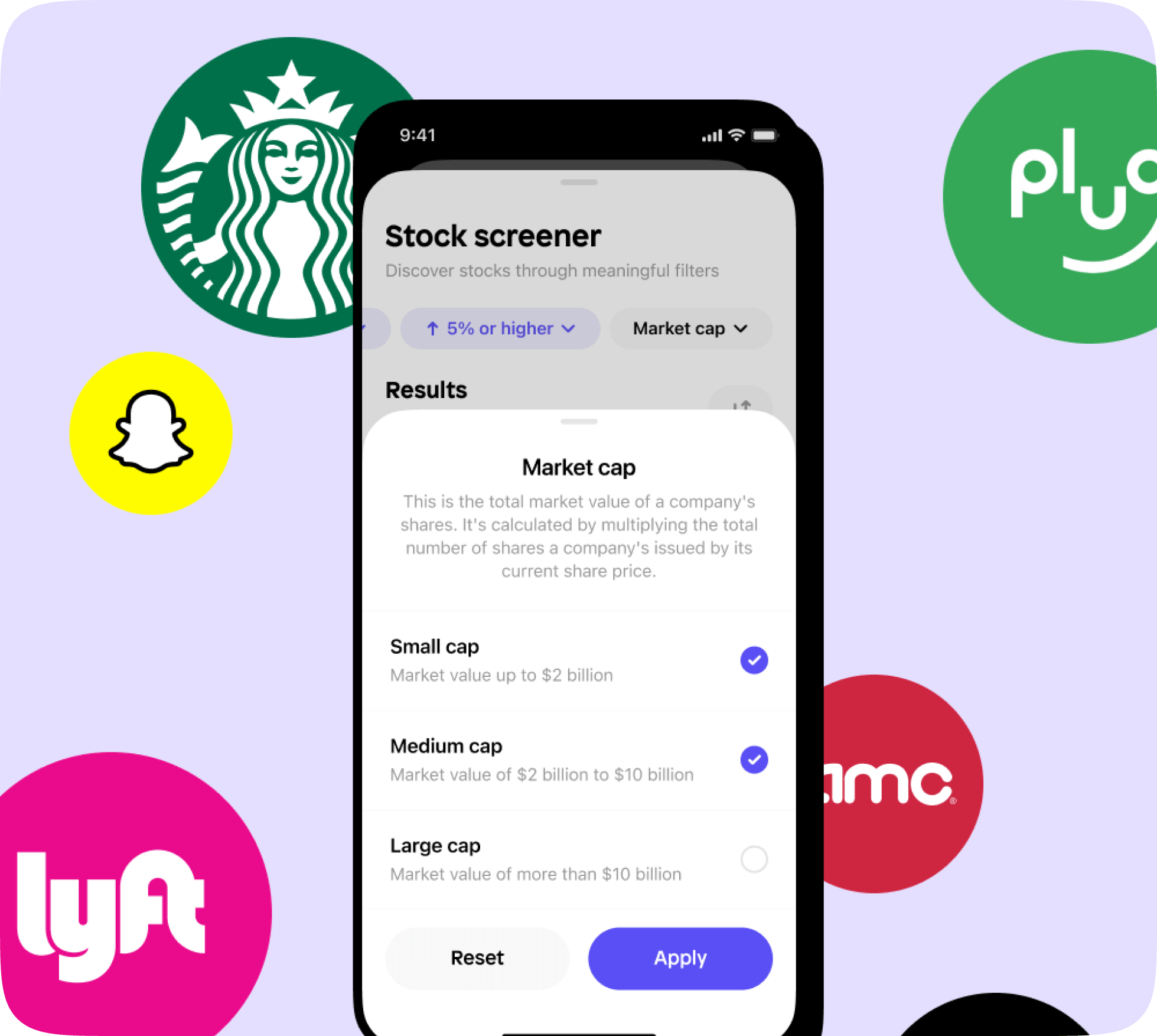

Market Cap

The market cap (short for market capitalisation) filter allows you to search for stocks based on their size.

You can choose between small, medium, or large-cap stocks, depending on your risk tolerance and investment strategy. Here are some ways of how market cap might feed into your strategy:

Searching for small-cap stocks ($2 billion market cap or lower) - these have potential for higher returns as they have more room to grow. They are considered riskier, as often, they aren't established in the market.

Searching for medium-cap stocks ($2 billion to $10 billion market cap) - these have less room to grow, but have established themselves into the market

Searching for large-cap stocks (a $10 billion or higher market cap) - these often make for a more stable investment, as typically, they're market leaders. Of course, their room to grow is much smaller.

Filtering by market cap can help you focus your search on companies that are already established and have a proven track record

It can also help you to avoid companies that may be more risky or speculative, as smaller companies with lower market caps may be more volatile

💡 Remember, the stock screener is there to support your research, not replace it

Want to check out the stock screener in action? Download the Shares app and give it a go!

Make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

Shares does not provide investment advice. If you are unsure about anything, please seek advice from an authorised financial advisor. Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.