Shares has partnered with Plaid, an open banking company that enables you to safely connect your bank accounts with financial and investing apps like Shares. (If you haven’t heard of open banking before then fear not, we’ll explain the juicy details shortly).

Plaid is regulated by the Financial Conduct Authority (FCA), which is an institution that aims to make financial markets work properly so consumers like you get a fair deal.

The FCA ensures over 50,000 financial firms in the UK are acting as honestly, competitively and fairly as possible. It’s also accountable to the Treasury, which is responsible for updating Parliament on the UK's financial system.

You can view Plaid's FCA Registration here.

So, what is open banking?

Open banking allows you to share your banking data, such as your balance and transaction history, with authorised providers (for example money management or investing apps).

Sound a little scary? Don’t worry. There’s a reason why in 2018 it became the law for UK banks to let you share read-only financial data and spending transactions with authorised providers. What was the aim of this? Simple. To give you a better experience with products and apps.

With open banking, you can more easily move, manage and make more of your money with innovative products. It also encourages more competition for banks, challenging them to offer better products and services at better prices.

Open banking in the UK is regulated through the Payment Services Regulations 2017 meaning it's a safe, government-led service regulated by the Financial Conduct Authority (FCA).

How does open banking work?

You’ll be prompted to give your consent when first connecting your bank account in the Shares app. As long as you’re happy, go ahead and give your consent. From this point on, there’s nothing else you need to do. Magic!

Behind the scenes, open banking uses something called Application Programming Interface (API) technology to help institutions receive your transaction data. For more FYIs on APIs, visit Open Banking’s API page.

The advantage of open banking is simple – there’s no need for you to fill out long forms to give third party apps the data it needs. Thanks to mobile banking, open banking can access this data digitally.

If you want to read more on Plaid, open banking or the FCA, we'd recommend the following resources:

Is the Shares app legitimate?

Yes, the Shares app is legitimate.

As well as open banking, we have bank-grade security and monitoring to keep your investments safe:

We are FCA regulated

We’re an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.

Your funds are covered

Your money’s eligible for protection by the Financial Services Compensation Scheme up to £85k.

Your data’s safe

We use bank-level encryption to keep your private information safe.

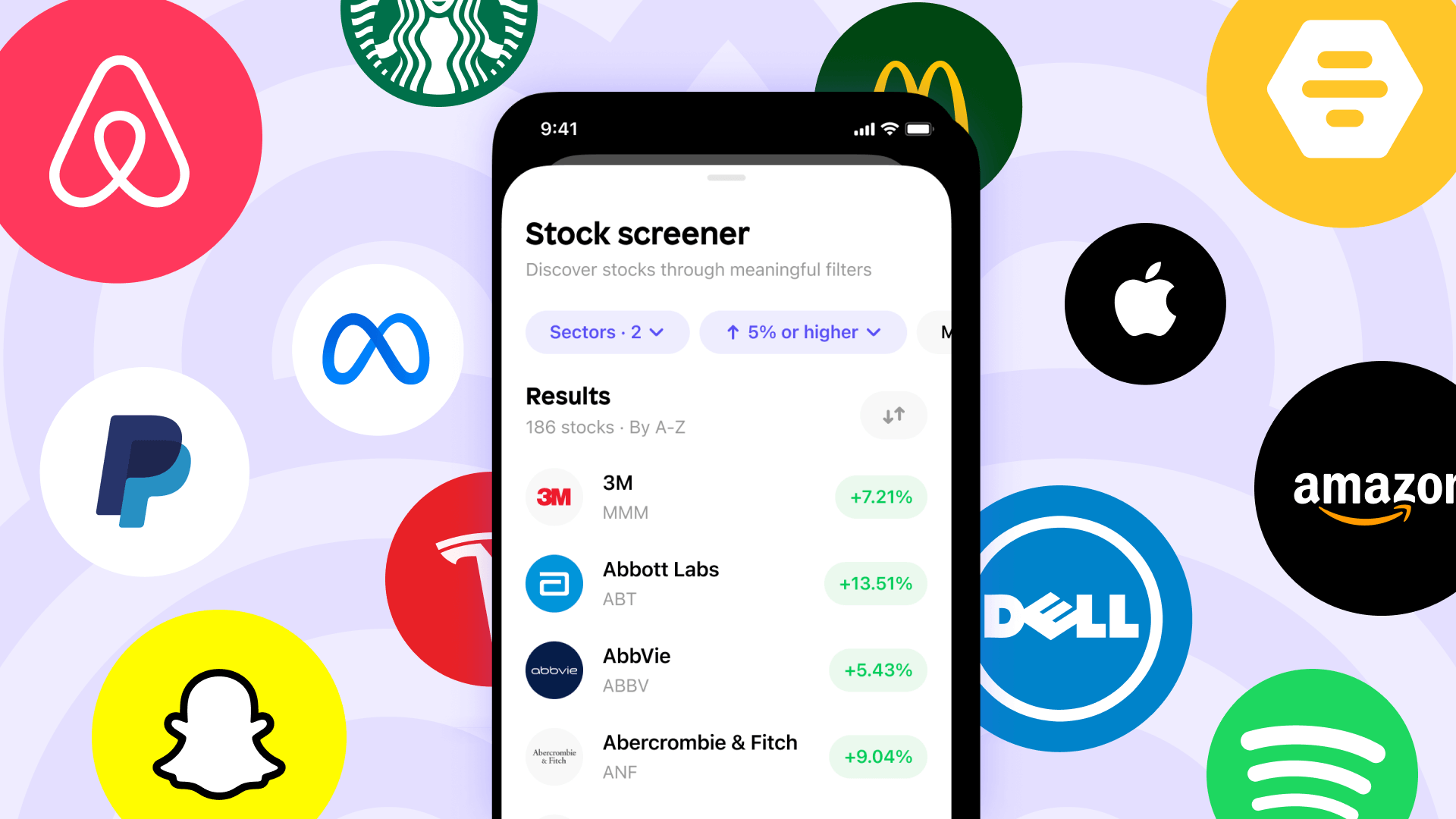

Keep up-to-date with more of Shares' features like:

Download the Shares app and make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.