💡 Thankfully though, here at Shares we have a little feature known as fractional shares.

No, don’t worry, we’re not going to make you explain the difference between proper, improper and mixed fractions. It’s actually far simpler than the days of GCSE maths!

Fractional shares mean you don’t have to buy one whole share of a company. Instead, you can buy part of a share – so you could spend as little as £2 on McDonald's shares, for example.

The Shares app allows you to buy fractional shares of stocks automatically, so you can specify how much you want to spend in terms of money value rather than the number of shares.

Advantages of fractional shares

There are two main benefits of fractional shares:

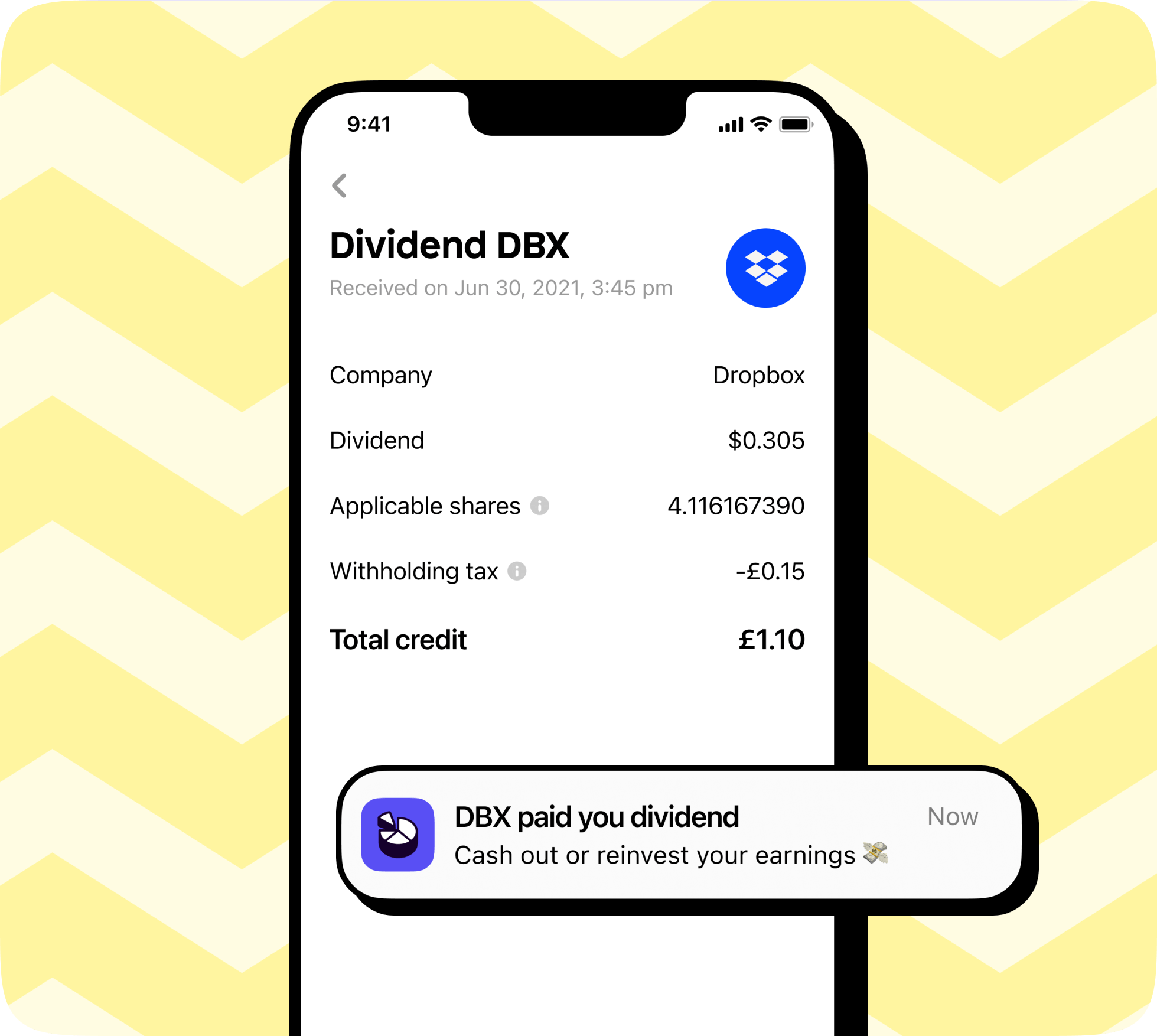

Fractional shares pay dividends

Yes, dividends are still paid out on fractional shares, providing the stock purchased pays dividends. A dividend is a payment made to you for simply owning a stock. Just keep in mind that the dividend payment received is relative to the amount of shares owned.

Of course, dividends have their own advantages relating to compound interest and passive income which you can read in our article, what is a dividend? A guide for beginners.

Diversification

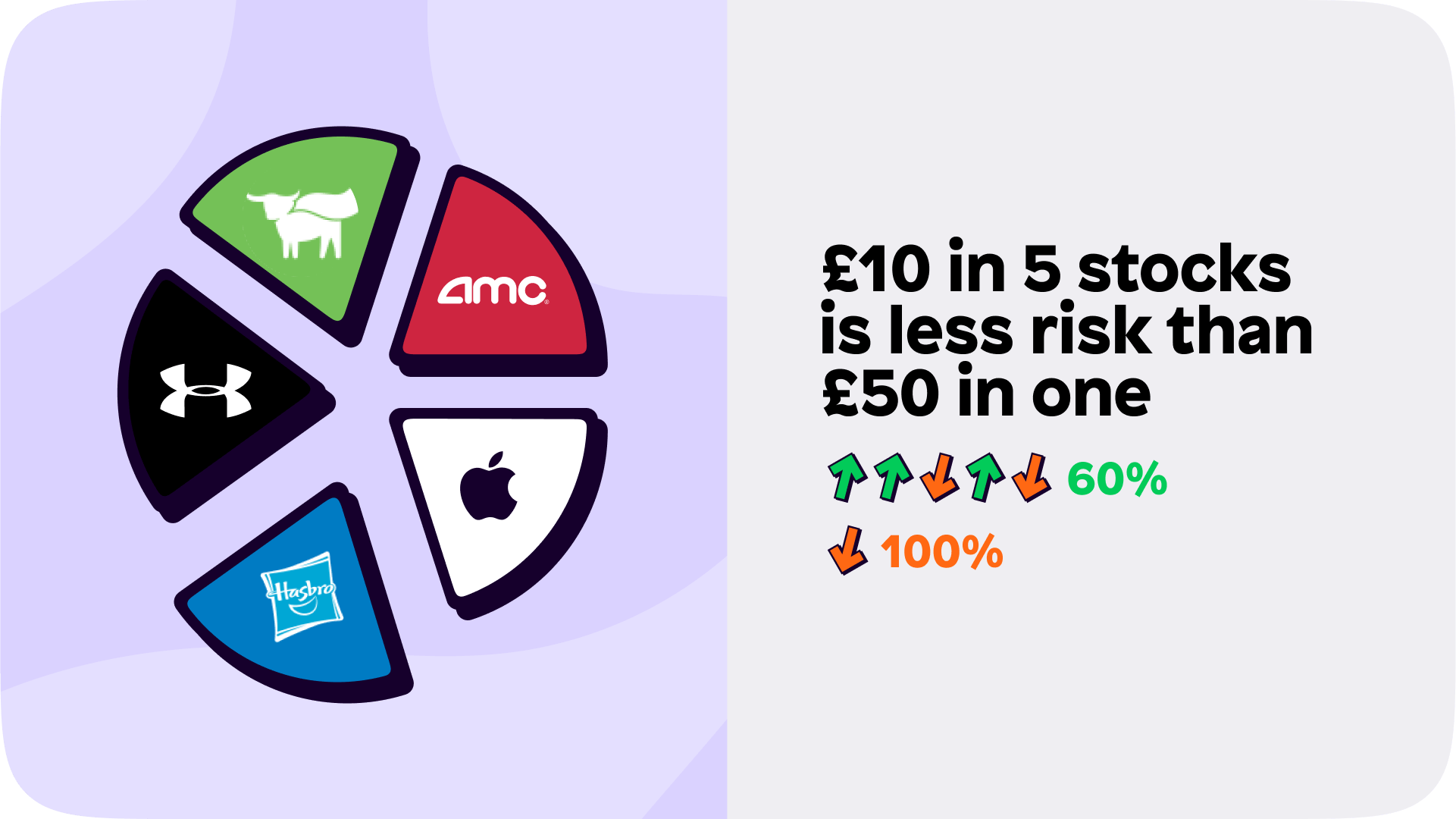

Fractional shares also let you diversify your portfolio by not placing all your eggs in one basket. It’s often safer to spread five £10 investments across the stock market than putting £50 straight into one stock. Fractional shares help you do this.

It’s also quite nice for the next time you’re out with friends and you want to show off how many investments you have! 😉

Remember though, you can’t technically call yourself a shareholder in a company until you own at least one share.

Disadvantages of fractional shares

As with all investing, buying fractional shares can come with some disadvantages if you aren't careful.

Here are some things to watch out for:

New investors typically gravitate towards fractional shares, and typically, it's newer investors who can be more reckless with money. Make sure when buying fractional shares you aren't being reckless, and to check if buying them aligns with your investing goals.

Companies with high share prices may see their prices inflated due to all the retail investors who can now buy their shares. This can overvalue a company, arguably making it a bad investment.

Owning a very small fraction of a share, may result in you not getting your dividend. If the amount is so small, it costs the stockbroker more to pay out than what it's worth, the chances are you won't receive it. Just double-check a stockbrokers T's and C's before committing to a fractional share!

Normally, shares are issued by companies and are tradable on the stock exchange. With fractional shares, it is a little different – the fractional bits of shares only exist in the records of your particular custodian. This has a few drawbacks:

They aren’t transferable. If you want to move your account to another provider (we hope that you don't!), you will have to sell your fractional shares for cash and move the cash to a new provider.

Take care in distressed market conditions. In normal market conditions the price you trade a fractional at is the same as that of a whole share on the stock exchange. However, there is no guarantee this will work in distressed market conditions, and you may get a worse price whether buying or selling.

If the custodian fails, you will likely be a creditor of the custodian. While it's expected that the investor compensation scheme will cover this up to a limit, this may create delays in getting your money back.

While some providers out there are offering fractional shares in an ISA, it is not clear that this is allowed by HMRC and there is a risk of the whole ISA being invalidated because of the presence of fractional shares.

So, now you know what fractional shares are, their advantages and what to watch out for!

Join us!

Ready to join the Shares community? Download the app now.

As with all investing, your capital is at risk.

Shares is a trading name of Shares App ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.