We'll be answering the what, why and how when it comes to dollar-cost averaging, starting with the what.

What is dollar-cost averaging?

Dollar-cost averaging is a way of investing into the stock market. It involves investing equal amounts of money into the market at regular intervals, despite whether the market or individual asset price is rising or falling.

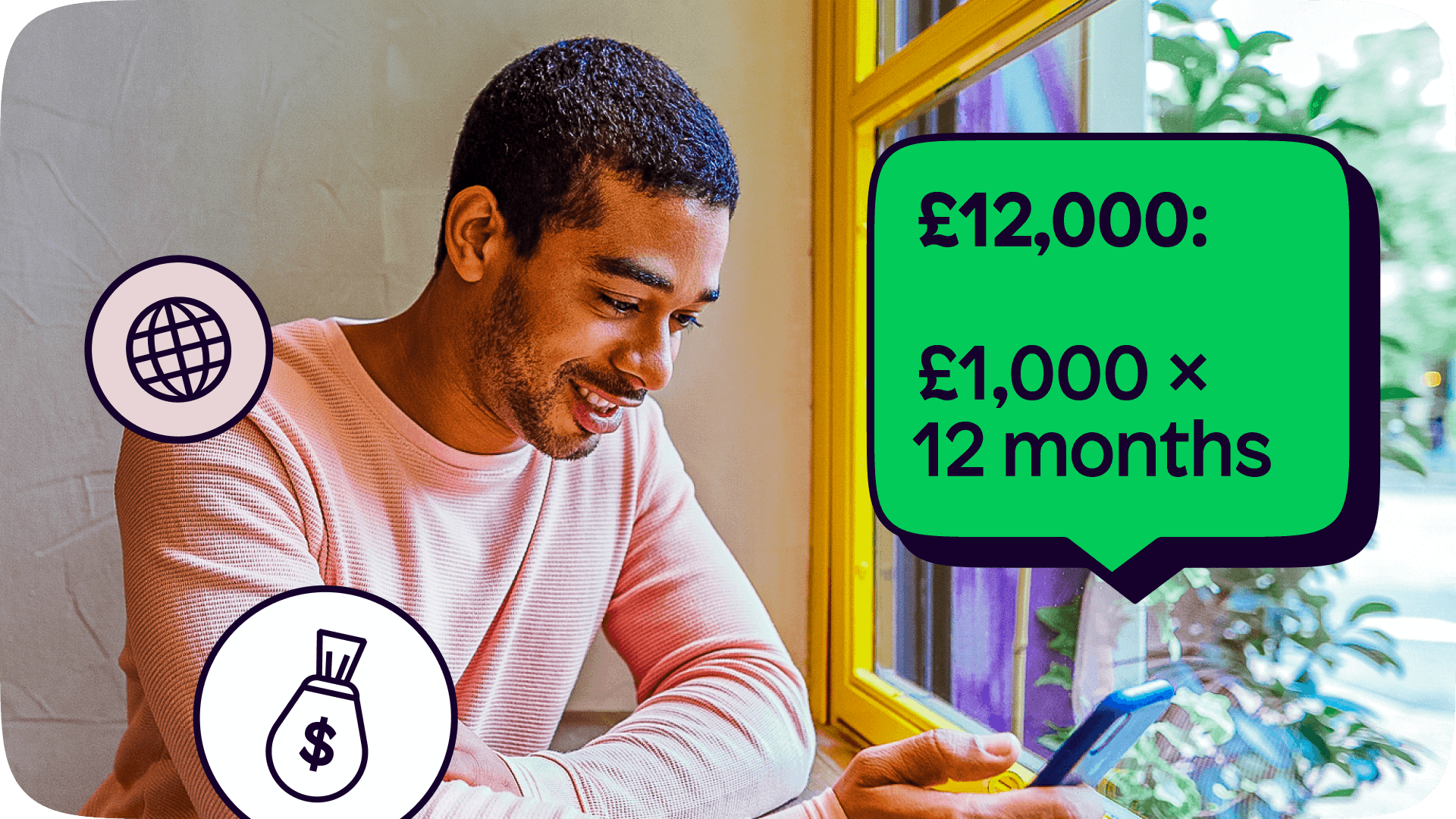

Let's say that Sa'ad had £12,000 to invest, but he didn't want to invest it all at once in case the market suddenly went down.

Sa'ad chooses to invest £1,000 a month for a year instead. This way, he has invested a total of £12,000 at the average monthly price of the stock market in that year.

Of course, not every decision has to centre around what's most accurate. For many of us with busy lifestyles, it is a lot more practical to invest on the same day each month.

Dollar-cost averaging is often used as we begin to enter bear market territory as people are fearful that the market could keep going down. It's a bit like making your way down a pitch black well – you have no idea what's down there, so why jump when you can edge your way down slowly? Not my best analogy to date, but you get the idea.

Why dollar-cost average?

Whether you should dollar-cost average is a personal decision and comes back to your overall financial goals. If your goals are to buy-and-hold investments, and you gear more towards long-term strategies, then it’s definitely worth considering.

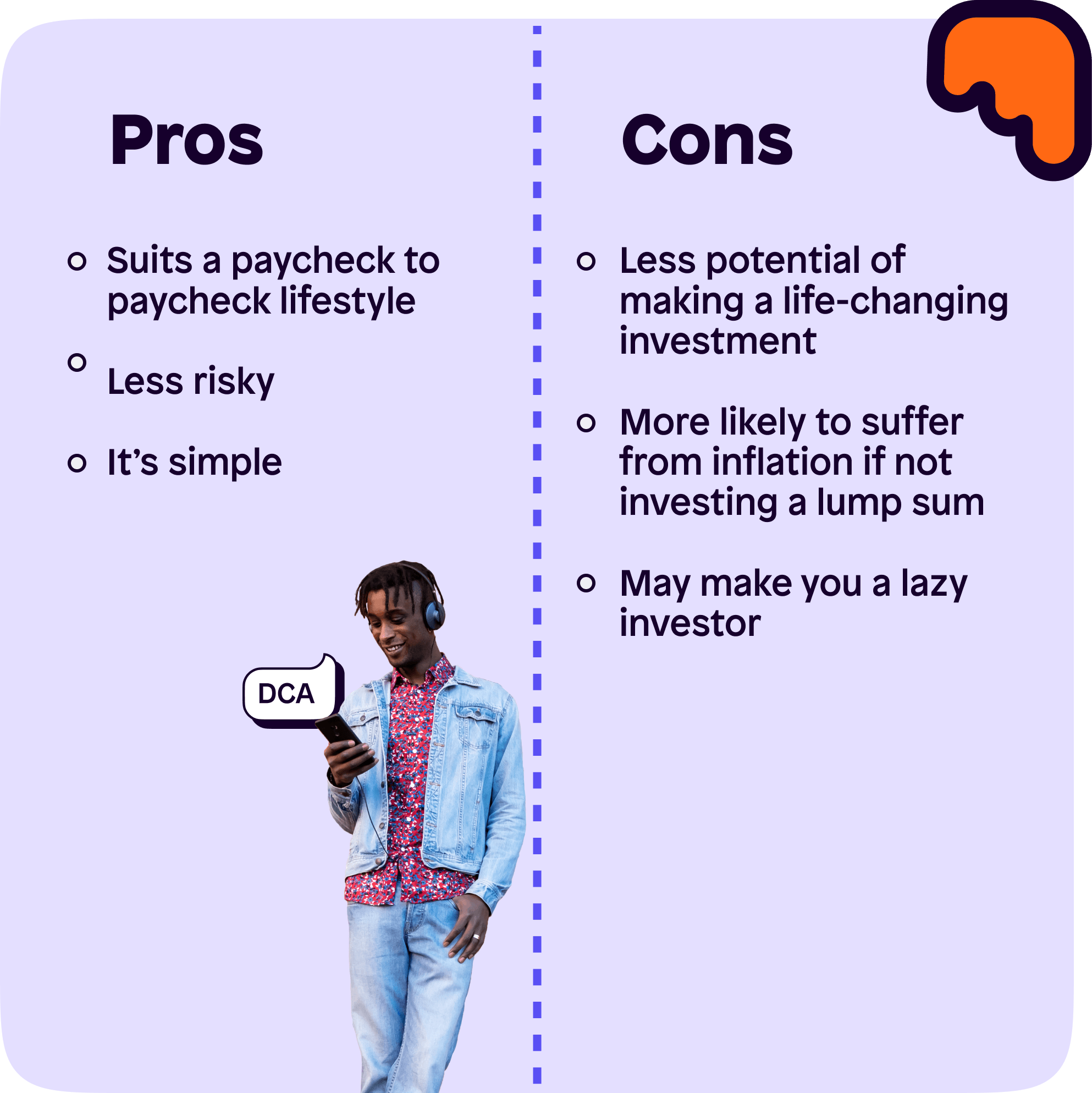

We have put together a little infographic outlining some pros and cons which may help you decide if this strategy is right for you.

Pros of dollar-cost averaging

It suits a pay cheque to pay cheque lifestyle – as we mentioned, a benefit is you can line up your investments with all other direct debits and standing orders. If you’re the type of person to organise your payments for Netflix, Spotify and rent all on the same day then this could work well for you.

Less risky – the very aim of this strategy is to find the average. You’re not trying to make life changing amounts of money overnight, and you’re comfortable knowing you’ve taken on less risk. You might even view this strategy as a way to diversify from keeping all of your savings in a bank account.

It's simple – simplicity in the investing world is highly underrated in my book. There’s a myth that investing needs to be complicated and confusing, but it’s time that was left in the past. There’s no reason why simple can’t sometimes be better. After all, who wants to track back through ad hoc days when we made investment decisions? I personally like knowing that the 1st of the month is investment day!

Helps manage emotions —investing can be a rollercoaster of emotions and dollar-cost averaging helps enforce the habit of buying whether the market is up or down. Keeping control of emotions is important as the last thing you want to do is make a rushed decision with little thought!

Cons of dollar-cost averaging

Less chance of making that life changing investment – if what you’re after is large gains over a short amount of time, then this might not be for you. This is a longer-term strategy and should be avoided if these don’t align with your investment goals.

You will suffer from some inflation – one of the reasons for investing is to prevent cash from suffering from inflation. With dollar-cost averaging though, we are actively keeping chunks of cash in the bank. In the example of inheritance, it might be a few years before someone invests the full amount when dollar-cost averaging. But, the alternative would be to invest it all at once, which comes with its own set of risks. As always, do your research and decide what’s best for your situation.

It can make you a lazy investor – once you’re in the groove, dollar-cost averaging becomes very habitual. Almost too habitual if you’re not careful. It's always worth revisiting your portfolio and checking it's still aligned with your initial finance goals. For example, if you’re investing into some dividend stocks, it’s important to check those companies are still paying dividends later down the line. Perhaps your financial goals changed due to new circumstances such as a new job or a new financial commitment that may make you want to change your strategy.

How to dollar-cost average into the market

There are plenty of ways to get started with dollar-cost averaging, but step 1 involves making sure you have the Shares app downloaded.

💡 On the Shares app, you can set up recurring payments to help automate dollar-cost averaging

Step 1: Head over to the Shares app

Step 2: Tap to buy your chosen stock

Step 3: Change 'market order' to 'recurring order'

Step 4: Place your order!

✏️ Scoop tip – if you haven’t invested before, starting with as little as £1 a week can let you get used to the process of investing. There is a lot of value in learning which buttons to press on the app, so don’t be scared to get stuck in. Once you’re comfortable, you always have the option to increase your amount, should you wish.

Join us!

Got any questions on dollar-cost averaging? Join the Shares community and add me (@ashoo) on the app! Make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.