Does this mean you can’t learn a few things to help with your decision-making? Absolutely not.

TL;DR

Buying stocks is about assessing how great a company is and if it's fairly priced

To decide whether to buy a stock, think about your goals, the present and the past

When deciding to sell, think about profit, damage control and better opportunities

When is the best time to buy stocks?

Let's make a two point checklist when evaluating whether to buy a stock.

✅ Is it a great company?

✅ Is it fairly priced?

When looking at a stock, if it ticks these two boxes then you may want to consider tapping buy on your app.

Although market leading companies are considered to be great by many, sometimes stock prices can be overvalued due to product hype or an assumption they’ll continue to perform well.

Sure, Amazon offers next day delivery on a global level, but if the stock is a few hundred pounds over its actual worth, I ain't touching it!

The tough part is knowing which companies are and aren’t overvalued, and by looking at the stock’s past and present, we may be able to make some educated assumptions.

But first, let’s focus on something we always bang on about here at Scoop. Your investing goals!

1. Bring it back to your goals

We say it all the time. Step one is knowing your investing goals.

You’ll never feel like there’s a right time to buy a stock if you don’t know why you’re buying it. How do you think J.K. Rowling knew when to finish Harry Potter? She wrote the final chapter seven years before publishing the first book (true story!)

The same goes with investing. Having some sort of goal in mind, whether it’s to outperform a savings account over the next year, build enough to buy a house or even retire early, a goal will help you justify a stock purchase; not leave you feeling like it was a spur-of-the-moment-decision.

Let’s look at two examples of people with different goals:

Billy is fed up with low interest on savings accounts, and just wants something in the short-term which may yield a better return. But, he doesn’t have the time to research which specific stocks he should buy. He may find his situation and goals are quite aligned with investing in a fund such as the S&P 500.

Bob on the other hand has lots of time to dedicate to investing and wants to retire before 50. His plan is to grow the value of his stock portfolio and either sell it or live off the dividend payments come retirement.

Knowing your goals might not give you a black and white answer when to buy stocks, but knowing them will certainly help.

2. Look at the present

Looking at how a company is performing today can help assess whether it’s a good buy.

There are subjective and objective ways of analysing a stock, and for those subjective fans, bear with me - I promise point number 3 will be up your street!

For the more objective fans out there though, ratios might be worth looking into. Sure, they come with intimidating names and seeing numbers surrounded by colons is enough to make anyone relive their nightmares of GCSE maths.

But don’t worry, whilst there are plenty of ratios in the stocks and shares world, we’re only going to focus on the most well-known. For a more in-depth piece, visit our article on ‘Understanding ratios’.

We can understand how a company is doing in the current day using this ratio:

Price-to-Earnings Ratio (P/E)

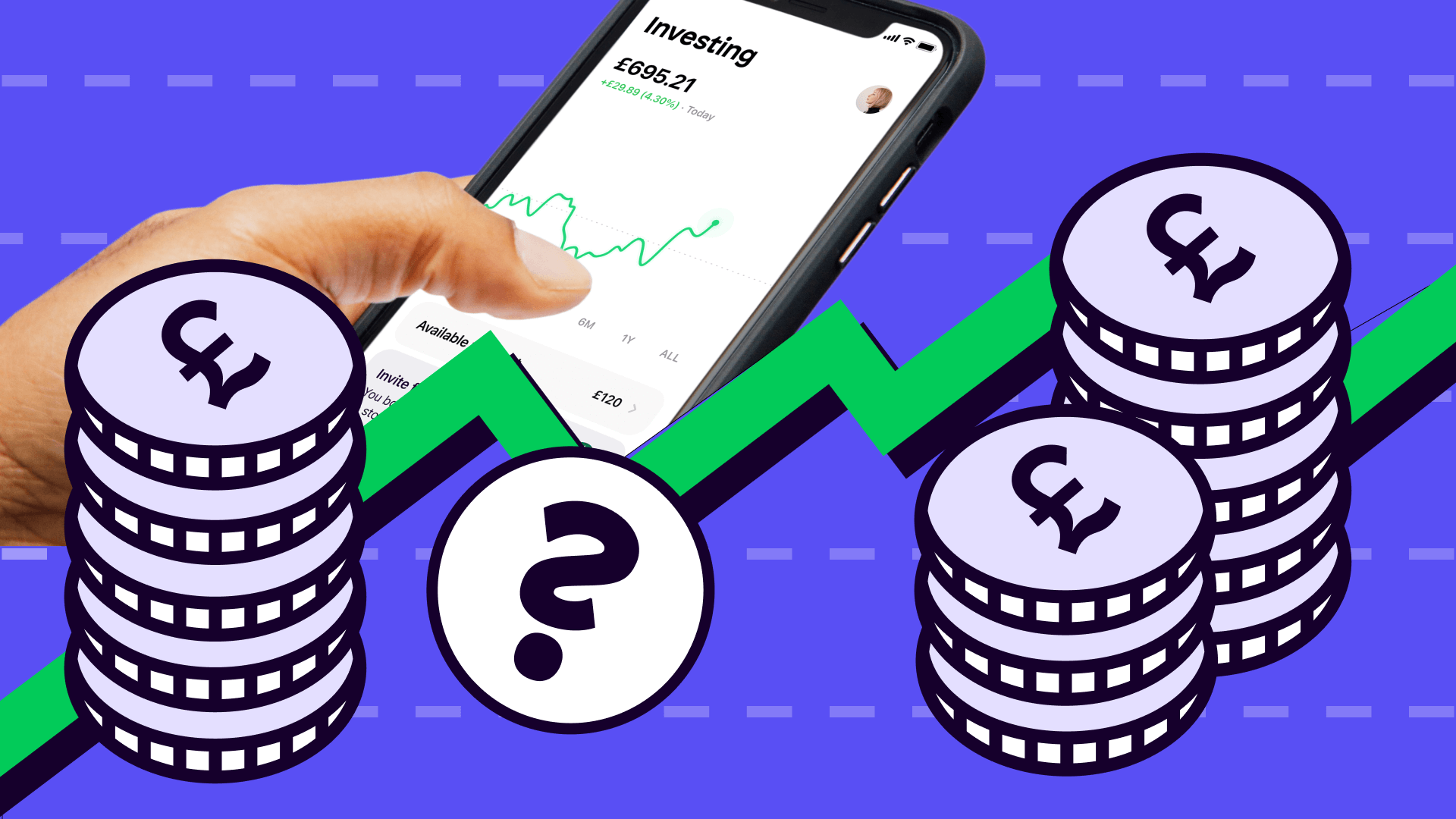

The price-to-earnings ratio tells you how much a company is worth, by dividing its current share price by its earnings per share.

How much a company is worth is useful for any investor, especially a newer one, as stock prices can be confusing at first.

So, first things first we need to know two things:

A company’s current share price (easy, just look on our app)

A company’s earnings per share (kinda’ easy, this is a company’s earnings divided by the amount of shares available on the stock market)

Simply divide the share price by the earnings per share, and boom, we have the P/E ratio. Great. But how does this help us?

Well, the lower the P/E ratio, the more undervalued a company is. And as an investor, we want to be purchasing undervalued shares! Think of it like snapping up a bargain.

Still not making sense? Don’t worry, here’s an example:

If a company called ‘Jay’s Shoes’ is valued at £50 a share and a company called ‘Harry’s Kickers’ is valued at £10 a share, a new investor may think Harry’s Kickers is the better buy as its stock price is cheaper. But this isn’t true.

A stock is considered undervalued when its price is low relative to the amount of money the company earns, rather than comparing it to the price per share of a similar company. That’s why we use ratios to simplify a company’s worth, they give us an apples-to-apples comparison.

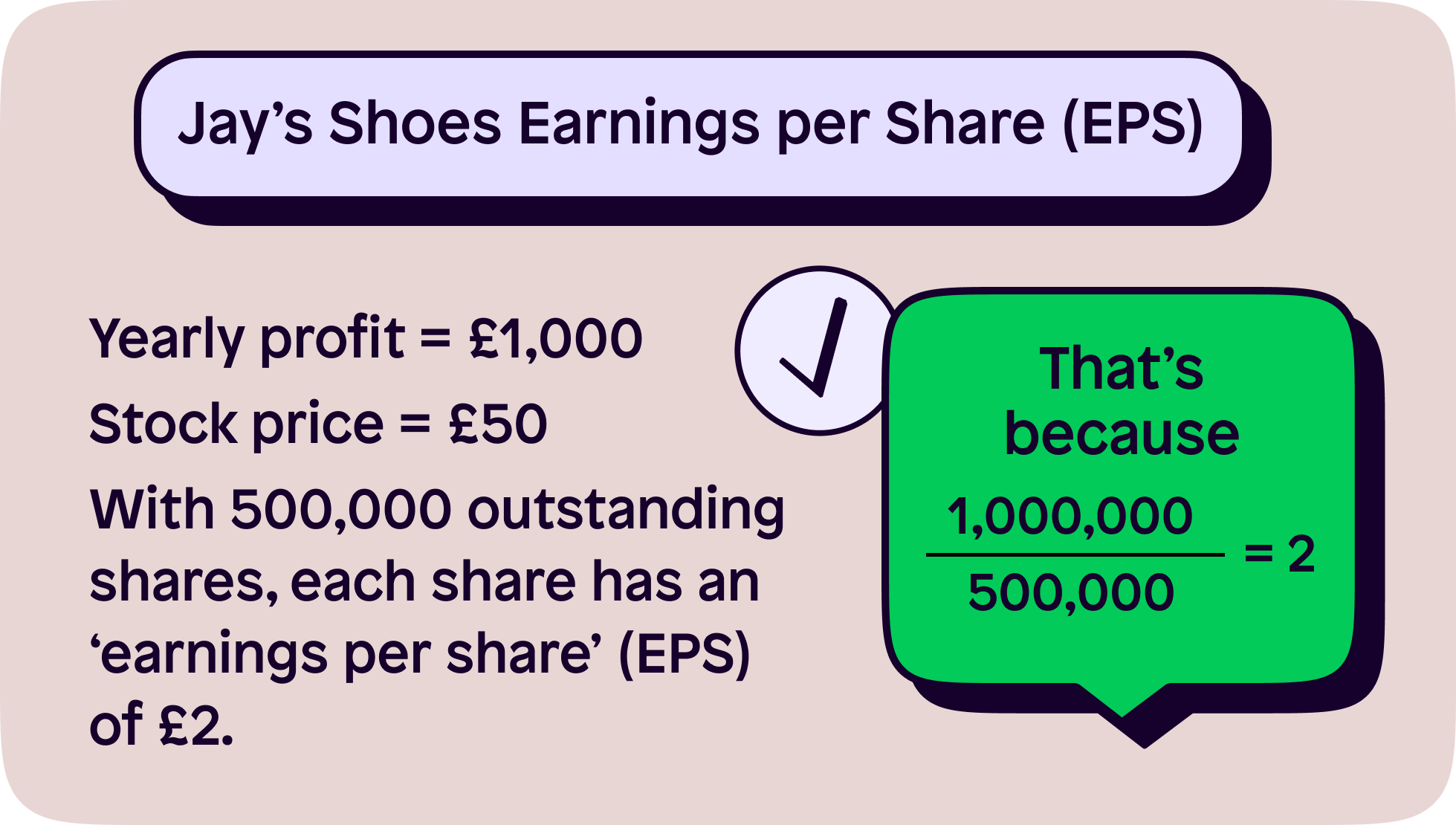

If Jay’s Shoes earns a profit of £1,000,000 a year and the stock price is £50 with 500,000 outstanding shares, each share has an ‘earnings per share’ (EPS) of £2. That’s because 1,000,000 / 500,000 = 2.

So, now we have the EPS, we can work out the price-to-earnings ratio which is the stock price / EPS.

£50 / 2 = means that Jay’s Shoes has a P/E ratio of 25. This means its stock is trading at 25 times its earnings per share. Of course, investors like to look out for low P/E ratios, as it may show a company is undervalued.

3. Look at the past

If you are brand new to stocks then you’ll have no concept of what a current stock’s price is in relation to its past.

That’s why graphs can be super useful.

When focusing on a stock’s historical performance, you may begin to notice trends. Does the company’s price dip at a certain time each year? Do they tend to increase after releasing their quarterly earnings? And what happens to their price when the economy is struggling/ thriving?

Becoming knowledgeable on what has caused a stock’s price to rise and fall in the past can help justify if it’s right to part with your hard-earned funds. This is a more subjective way of analysing a stock than using a ratio, but it can be just as insightful.

A relevant example would be ‘non-cyclical’ sectors such as healthcare, utilities and consumer staples which tend to hold their value during pandemics and recessions, compared to tech stocks. On the other hand, tech stocks surged during the dot.com bubble.

Once we start connecting the dots on what causes can affect a certain stock, our random stock picks can become educated assumptions.

Right, that’s buying stocks covered. Grab a cuppa, and recharge yourself. We’re now onto selling stocks.

When is the best time to sell stocks?

There is no right time! Instead, you can only make logical decisions dependent on your situation. Here are three instances you may want to consider selling:

1. To take profit

Often, this is done when you no longer have reason to buy or hold your stock. If keeping a stock isn’t meeting your goals any more, perhaps it’s time to sell.

There always seems like a reason not to sell. Perhaps your £50 investment that's now worth £100 will go up more. If you sell now, you might lose out on profit, right? Wrong. If you sell now, you've made £50. Profit is profit, and taking it is never a bad thing.

2. Damage control

Yep, most of us have been there when we've bought a stock, only to see it plummet in price (cough, cough, thanks Coinbase, cough, cough). Sometimes, people will sell knowing they're making a loss to avoid making a greater loss. It's no fun, but it's part of the investing game.

3. A better opportunity awaits

Once you've found your groove in researching a stock, you'll begin to find lots of opportunities. When you feel a better opportunity is out there, you may want the cash to invest in it. Selling your stocks releases cash and lets you invest in your new, potentially more profitable idea.

If you're still unsure whether to sell, perhaps it's time to whip out the ratios we spoke about earlier. Restart your analysis, and you might find objective numbers help you make up your mind.

For more beginner guides to do with investing, make sure to check out:

Download the Shares app and let us know how you get on in one of our communities! Make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.