In the olden days, you may have had a paper certificate to prove you owned the shares. But that’s so 1900’s. Nowadays, electronic trading has meant everything can be kept digital and so your shares are viewable on your investing platform or app.

So to recap, the stock market is simply a place you buy shares in a company.

Why would a company want to be on the stock market?

You can only buy shares in companies that are on the stock market, or in other words, are ‘public’. This means it’s not possible to buy shares in private companies like SpaceX and Huawei, unless doing so through private markets, which of course isn’t done via the stock market. So, why is it that some companies go public and some don’t?

It largely depends on the company’s strategy and vision, but a lot of businesses go public as a way to raise more money. They sell shares in their business for cash and reinvest the cash into growing their business. Simple.

When a company goes live on the stock market, it's called an 'initial public offering' (IPO) and this has to happen before everyday folk like you and me can buy their shares. When this happens in the investing world, people tend to get pretty excited about it!

Stock market vs stock exchange

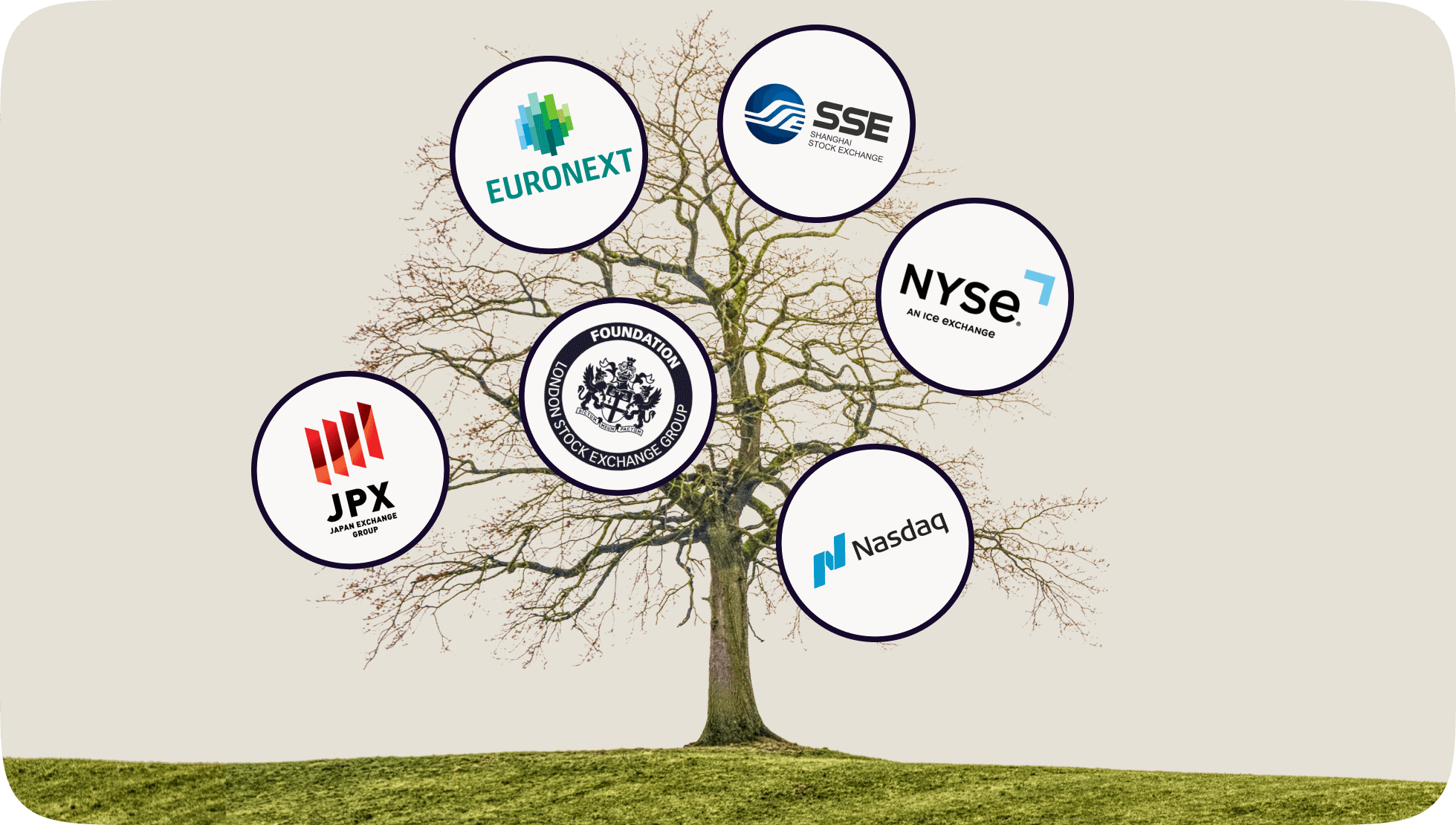

Now, you may have heard the term ‘stock exchange’ before. But what is this and how does it relate to the stock market?

Well, there are hundreds of stock exchanges around the world and when we speak about them collectively, we refer to them as ‘the stock market’.

For example, here are some of the most famous stock exchanges:

Keep in mind, a region isn't limited to just one stock exchange. In the case of the U.S, they have the New York Stock Exchange and the NASDAQ. (If you want to learn more, make sure to read our article on the differences between these two exchanges).

What causes stock prices to go up and down?

You might have heard in the news things like, “Twitter share prices are down 4%”, or “Apple’s up 2%.”

But why do stock prices change?

Put simply, it’s all about supply and demand. The more demand there is for a company’s stock, the higher its share price will be, and vice versa.

Let’s say Apple has a great quarter, and lots more people suddenly want to buy its stock. But, there’s only a fixed number - or ‘supply’ - of shares. If the demand for Apple’s stock overtakes its supply, then the share price will go up.

Let’s say, however, that Apple comes into major supply chain issues, and lots of people suddenly want to sell their shares. The supply of shares in the market will increase as people sell them. If the supply of shares overtakes the demand, then the share price will go down.

📈 If more people want to buy a stock (demand) than sell it (supply), then the stock’s price goes up.

📉 If more people want to sell (supply) a stock than buy it (demand), then the stock’s price goes down.

If lots of stocks fall in value on a large scale, it will impact the whole stock market. That’s often when you’ll hear the news report that ‘the stock market is falling’. (And vice versa if lots of stocks increase in value).

Pretty straight forward, right? What's less straightforward is understanding what makes people want to buy or sell a particular stock (this is sometimes called investor sentiment or confidence).

There are many factors that can affect this. We can split these into two types - micro and macro factors.

1. Micro factors – these are things a business can control:

💰 Company's earnings – if a business reports good earnings, it may increase investor confidence

👥 Redundancies – a large amount of company redundancies can shake investor confidence, leading to the stock being sold

🤝 Relationship with suppliers – if a business's supplier ups its prices, this can cut into the business’s profit margin

📥 Relationship with customers – increases in the price of a product/ service might frustrate customers and cause them to switch to a competitor (just look at the public reaction to Tesco upping the price of their meal deals!)

2. Macro factors – these are things a business cannot control:

📉 A recession and cost-of-living crisis may make people sell their stocks, so they can have cash-in-hand (many investors would rather take the hit of inflation over the risk of a falling market)

⚖️ Current affairs in law, politics and society – if a government changes a law that subsequently impacts a business's earnings, there's not much a company can do. For example, in 2012 the government banned cigarettes from public view in shops. I’m sure cigarette companies were de-lighted with this (pun intended, anyone?)

🌐 War and global conflict – international trade often stops during times of global conflict. For example, farmers in Ukraine haven't been able to plant as many crops this year, due to Russia's invasion, meaning Ukraine hasn't benefited from business. Other countries must also look elsewhere for crops, increasing their demand, and as a result, their price.

📰 The news – when a story hits mainstream news, it can cause a global reaction. A prime example would be the GameStop saga.

How do you invest in the stock market?

Using a trading app like Shares, anyone can invest into the stock market.

For example, you’re able to browse stocks that are of interest to you, and after conducting necessary research, you can select companies that you wish to purchase. Of course, it’s important that these align with your investing goals and your risk appetite.

Once you’re happy with your decision, you’re able to buy the stock. Now, you don’t need to worry about which stock exchange your stock is listed on. Shares will handle this transaction which will be viewable in your order review, right before you confirm your order.

How do you know when the stock market is up or down?

As the stock market consists of a collection of stock exchanges, there isn’t one stock that can accurately represent the entire market. Instead, we often refer to something that measures part of the stock market, called an index.

For example:

The S&P 500 is a stock market index that tracks the performance of 500 large public companies in the United States

The FTSE 100 is an index comprised of 100 companies listed on the London Stock Exchange with the highest market capitalisation

The news often reports on the economy by referring to what’s happened in the stock market. But typically, what they’re technically referring to is an index.

Yep, if you’ve ever heard someone say ‘the footsie is down’, they are in fact referring to the FTSE 100. Please don’t confuse this with an invitation to tap toes under the table. Those are two very different things.

Universally, the terms ‘bear market’ and ‘bull market’ are used to describe when a certain market is up or down respectively.

📉 Bear market – when the market is down by around 20% or more

📈 Bull market – when the market is up by around 20% or more

For more info on these terms, click the articles above.

What time does the stock market open?

As there are numerous stock exchanges, there isn't one universal opening time. Instead, they each open at different times depending on their time zones.

For a full list of what time major stock exchanges open across the globe, visit our article on what time does the stock market open and close?

Got more questions on the stock market? Head over to the Shares app and ask away in one of our communities!

Make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.