TL;DR

Trading is when you buy and sell of assets, with the goal of making profit in the short term

Investing involves buying assets with the goal of holding them long term before selling, or for the asset to maintain/steadily increase in value while providing regular income

Some assets people invest in include stocks, bonds, ETFs, mutual funds and cryptocurrency. Traders will also buy and sell stocks, cryptocurrency and Forex (foreign exchange), but typically avoid things like ETFs and funds.

What is trading?

Traders aim to buy and sell assets frequently, often reaching 100 trades a month or more. 'Technical analysis' is often used, which involves studying chart patterns to predict short-term price movements.

Technical analysis can be done by examining a stock's past prices and volume using a live chart - those that practice it believe price and volume data are the only factors moving a stock’s price. Of course, not everyone believes technical analysis is a legitimate strategy.

For example, they might look at a stock's price over time and notice that every time it reaches a certain level, it tends to go up or down. They can then use that information to make decisions about buying or selling the stock.

Sound like hard work? That's because it is. Trading isn't for the faint-hearted, especially as a few seconds can make all the difference. Yep, best make sure that Wi-Fi speed is running nice and fast if you're thinking about entering the trading game.

What is investing?

Investing also involves buying assets, but with the long term in mind. The idea is for this investment to grow in value over time, or even provide extra income along the way.

A long-term investor won't focus on technical analysis, but will instead focus on fundamental analysis (ever heard of Warren Buffett? He’s the king of this!). This is fancy talk for 'things businesses should be doing well if they want to succeed'. We talk more about this in our article, when is the best time to buy and sell stocks?

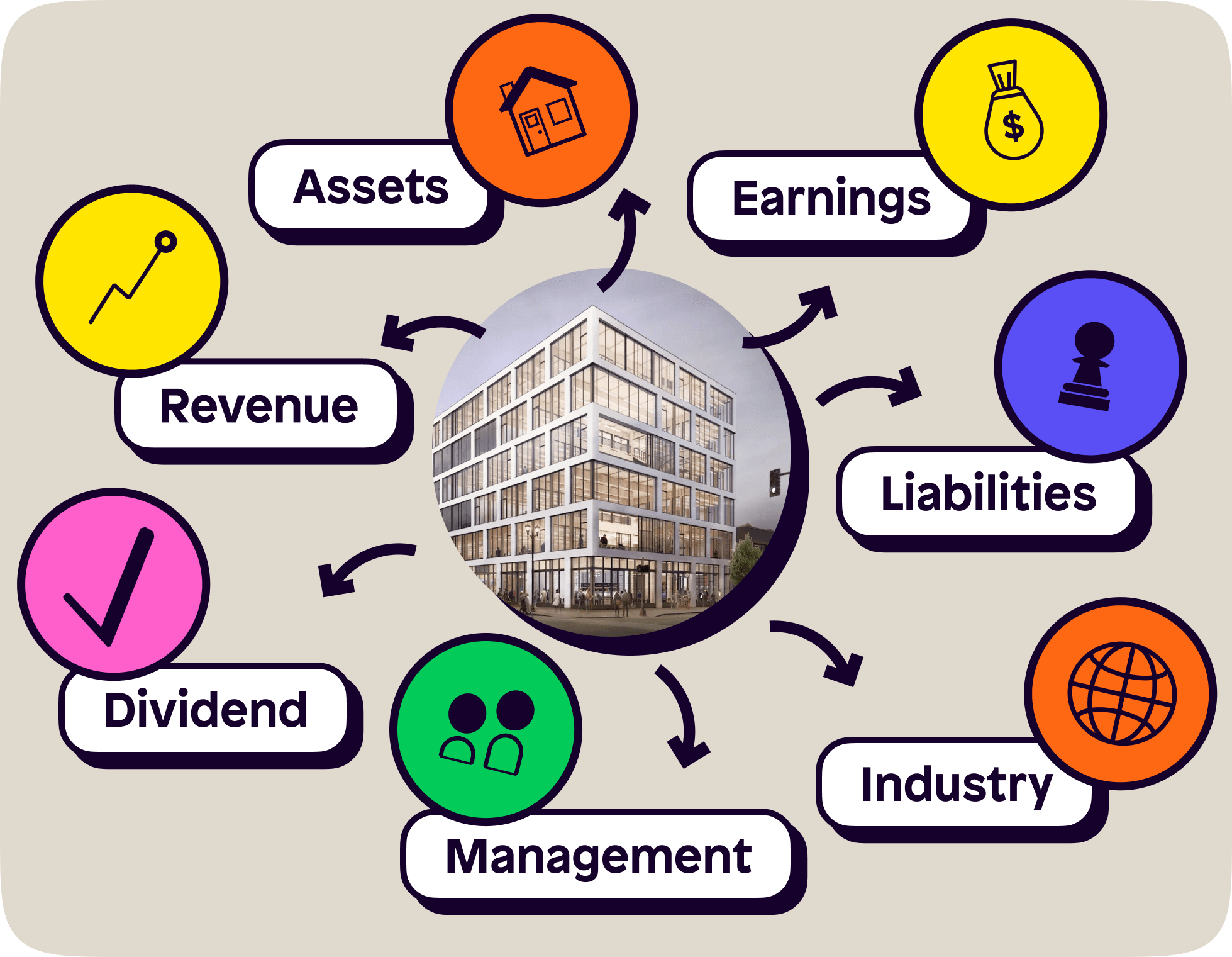

Here are some examples of what to look to for when conducting fundamental analysis:

Revenue - the amount of money a company brings in from selling its products or services

Earnings - the amount of money a company makes after expenses

Assets - the things a company owns, such as property, equipment, and cash. Strong companies typically have a lot of assets.

Liabilities - the things a company owes, such as loans and debts. Companies with high liabilities may have a harder time generating profits and may be considered riskier investments.

Management - the team behind a company. Investors may want to research the backgrounds and experience of a company's management team to get an idea of how well they are likely to run the company. The CEO’s background is particularly important for investors.

Dividend - a portion of a company's profit that is distributed to shareholders. Companies that pay dividends regularly may be considered more stable than those who don't.

Industry - the market size of the industry the company operates in

Here's an example of how a dividend stock investment can both grow in value and provide income over the long-term:

Larry purchases 100 shares of a dividend paying stock worth £50 a share (£5,000 total invested)

The stock pays a 4% dividend yield. So, 4% of 5,000 = £200

Over the course of that 10 years, the stock doubles in price to £100

Larry now sells his 100 shares at £100 each, pocketing him £10,000

Overall, Larry has profited £5,200: £5,000 capital gains and £200 in dividends

Now, if you're wondering, 'what if Larry hadn't sold and reinvested his profits?' then check out our piece on what compound interest is.

Is it better to invest or to trade?

That depends on your own strategy.

Typically, for a beginner, investing is a lot more straightforward. Whilst fundamental analysis sounds very 'jargony', it's really just common knowledge - the better a business's fundamental operations are, the more likely it is to succeed. Makes sense, right?

If you're charts are your thing, have time to dedicate and possess a finger on the pulse attitude with a high risk tolerance, then trading may be something worth looking into. Due to its short-term nature it can be less predictable, increasing your risk of losing money, so do proceed with caution.

If investing sounds like your jam, then check out the following articles:

If you'd like to know more about trading, then step number 1 is knowing what time different markets open and close. Check out these articles for more help:

Want to chat more on trading and investing? Download the Shares app and get involved with our communities!

Make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

This content is for educational purposes only. Shares does not provide investment advice. If you are unsure about anything, please seek advice from an authorised financial advisor. Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.