💡 If you want these updates delivered to your inbox every Friday, sign up here

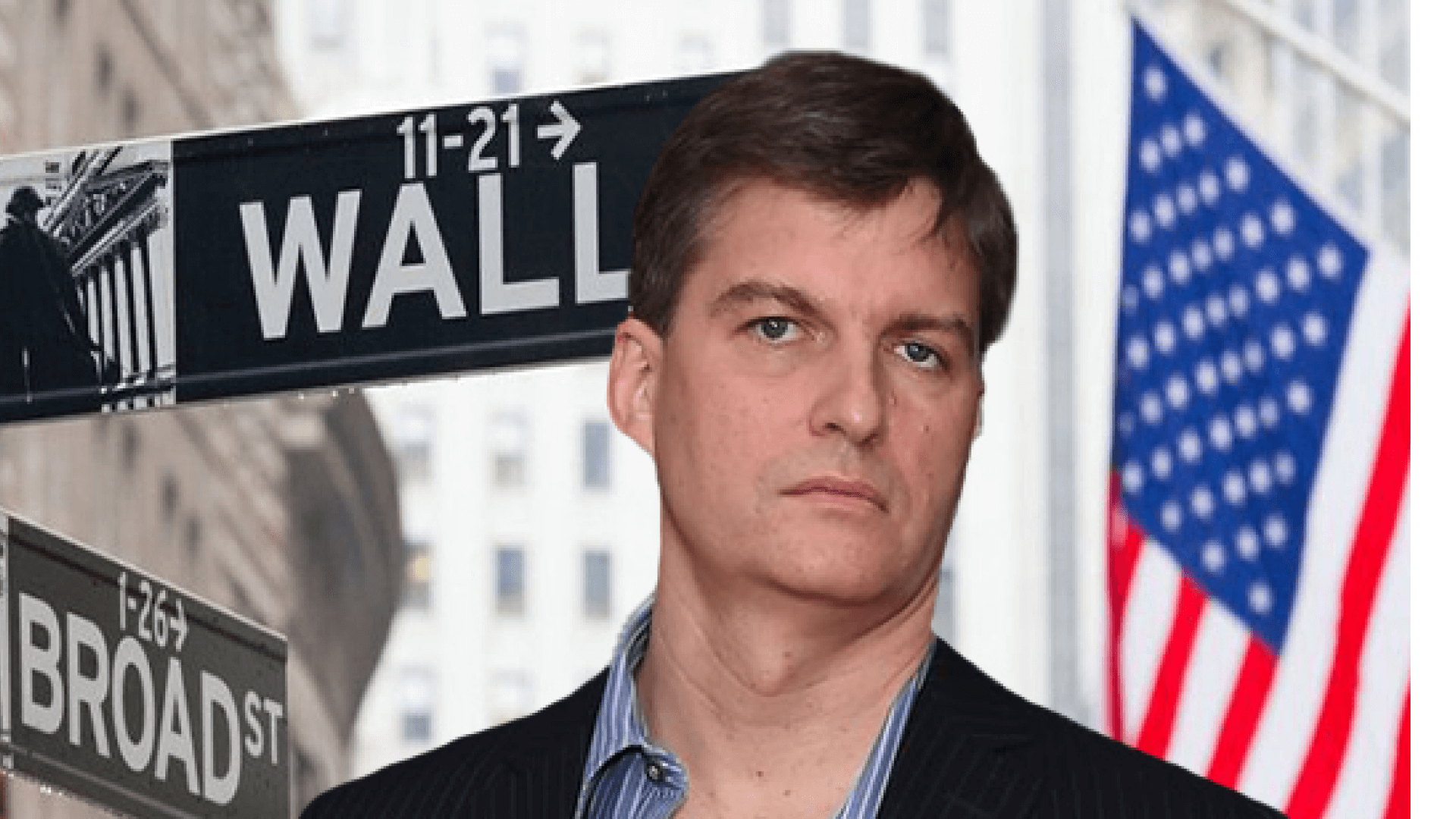

Alibaba jumps 6% due to The Big Short’s Michael Burry 🛒

The big… long: Michael Burry, the money manager made famous in The Big Short, is going long on Alibaba. The stock has become Burry’s 2nd biggest holding, making up 10% of his Scion Asset Management portfolio (he’s doubled his holdings and now owns 100k shares worth $10 million!)

A soft spot for ecommerce: It wasn’t Burry’s only market move into a Chinese ecommerce stock. He also tripled his holding in JD.com, taking his total shares up to 250k. This sits as his number one holding, worth a staggering $11 million.

A true contrarian: Alibaba and JD.com are both in the red year-to-date, but The Big Short fans will know Burry is quite the maverick, and loves to prove people wrong. So far, he really is going against the grain as Alibaba shares fell 4% yesterday after it missed its revenue targets.

Disney+ becomes Disney minus as shares fall 9% 📺

Frozen earnings: Last Thursday, Disney reported some cold earnings, and the stock has been taking a beating ever since. But what stole the headlines? You guessed it, Disney+.

Plus by name, minus by nature: Disney lost 2% of its global subscribers this quarter, mainly because the monthly price of its ad-free tier was raised from $7.99 to $10.99, a 38% increase.

Finding glory: But, it is a testament to Disney’s pricing power that more subscribers weren’t lost. Savvy long term investors recognise this could significantly increase Disney’s monthly revenue.

Ford stalls 6% as investment in China scales back 🚙

The West is second best: Ford plans to scale back future investments in China, as CEO, Jim Farley, warned there was “no guarantee” western carmakers could win against local electric vehicle rivals.

Following in Nissan’s footsteps: Ford’s decision echoes warnings from Nissan last week that the rapid pace of production of Chinese carmakers was piling pressure on international manufacturers as they struggle to compete for market share. Instead of EVs, Ford will strategically focus on commercial vehicles like delivery vans in China.

China’s in the driver’s seat: Despite the EV market struggling, it’s undoubtedly the future of the automobile market. But Farley feels “if you just reinvest in EVs in China, there is no data that would suggest the western companies win”. Will this strategic move from Farley fling Ford forward? Time will tell.

What have we learned this week? 🤓

Fame isn’t everything, but it goes a long way: Famous investors have the power to single-handedly move stock prices. Michael Burry is no different; when he makes a big market move, the world listens.

Companies will copy each other’s strategies: Does a free streaming service with ads sound familiar? It might be because Netflix introduced the idea towards the end of 2022. It paid off in the long run, and Disney will be hoping the same happens for them.

China’s EV market is extremely competitive: EV makers in China are popping up left, right and centre. So much so, they’re struggling to penetrate their own market, which leaves international carmakers like Ford in an even tougher position.

Thanks for tucking in! Want to receive these updates every Friday? Sign up here or share via WhatsApp with your friends.

*Figures correct as of May 18th 2023.

Past performance does not guarantee future results. Capital at risk when investing.

This content is for educational purposes only. Shares does not provide investment advice. If you are unsure about anything, please seek advice from an authorised financial advisor.