💡 If you want these updates delivered to your inbox every Friday, sign up here

US Steel surges 29% as rumours of a Musk takeover spreads 🔨

X marks the spot: This week, rumours have been circulating that Elon Musk may have submitted a bid to buy one of the largest steel manufacturers in the world. Why? Well, simply because its stock ticker symbol is ‘X’.

A possible IPO: Elon’s fascination with the letter X is no secret. With many believing he wants to take X Corp (the new Twitter) public, then why wouldn’t he splash a cool $5 bill to have the ticker symbol he wants? After all, he’s done crazier things…

Musk’s X factor: Although it’s unlikely Musk would spend that much just to acquire the letter X, it has thrust this story into the limelight with investors continuing to buy up shares.

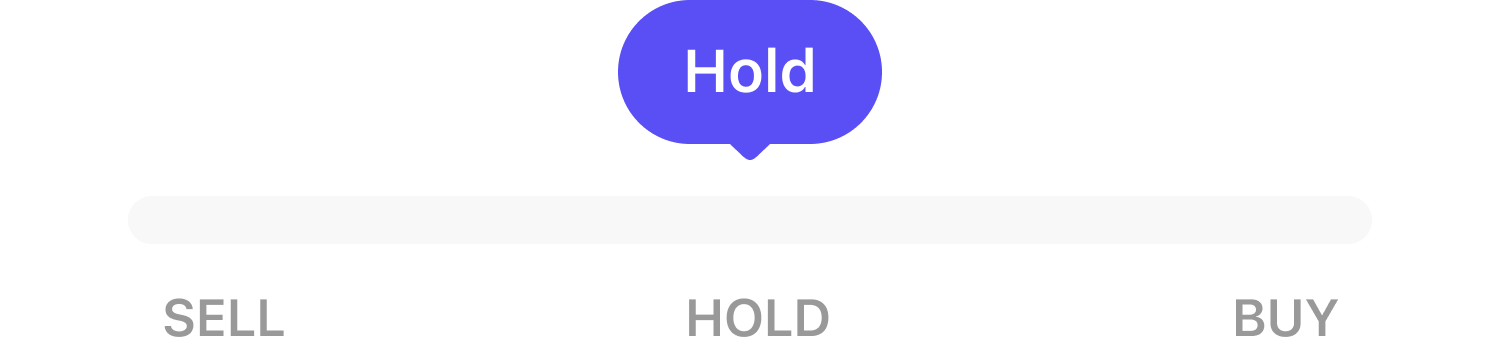

*Ratings are provided by analysts at Zacks, a leading investment research firm

Expedia dips 4% despite Michael Burry’s optimistic outlook ✈️

A complete 180: Michael Burry (yep, the guy from The Big Short), just sold his positions in Chinese e-commerce companies Alibaba and JD.com, months after buying $20 million worth of shares. This happened in the same week China announced disappointing economic growth.

Burry’s bearish bet: He’s also hedged against the S&P 500, shorting the index by $886 million. Does Burry know something about the US economy we don’t?

The very big short: 93% of Burry’s portfolio is now betting against the market. So, which stock is Burry bullish on? His largest long position is now Expedia, making up around 10% of his Scion Asset Management portfolio.

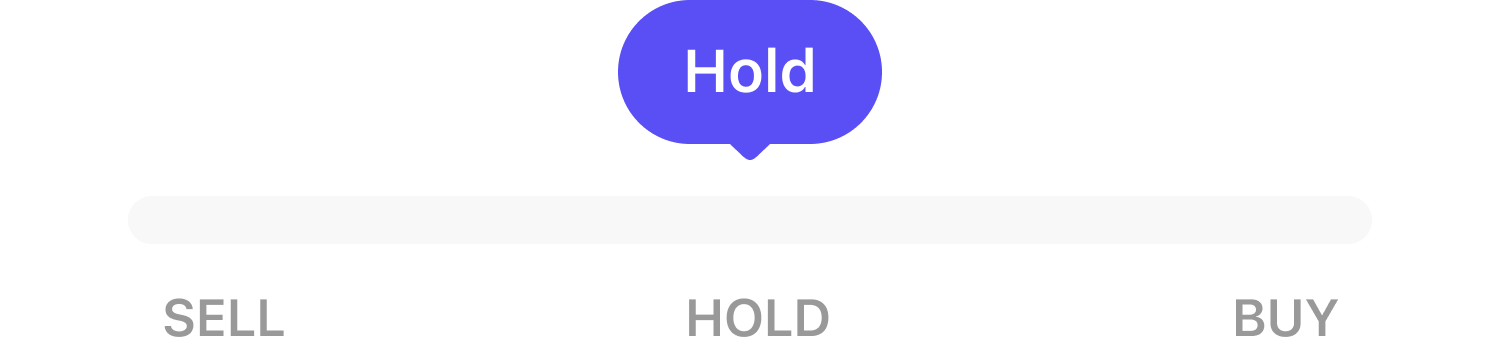

*Ratings are provided by analysts at Zacks, a leading investment research firm

Nvidia jumps 6% thanks to optimistic analysts 🤖

Looking ahead: Regular readers of The Weekly Scoop will know when a company reports its quarterly earnings, there’s a strong chance its share price will move. But this time, Nvidia has jumped one week before it announces its earnings. So, why is this?

The top dogs like what they see: Morgan Stanley, UBS, Wells Fargo and Baird are all leading financial services companies that raised their expectations on what Nvidia’s earnings could look like on 26th August. This has investors excited.

The Middle East wants in on AI: So, why are analysts feeling optimistic? Well, Saudi Arabia and the UAE are the latest nations to purchase thousands of Nvidia's H100 chips. Each chip is worth a whopping $40k and is vital for building AI. Analysts clearly feel Nvidia is hot in demand.

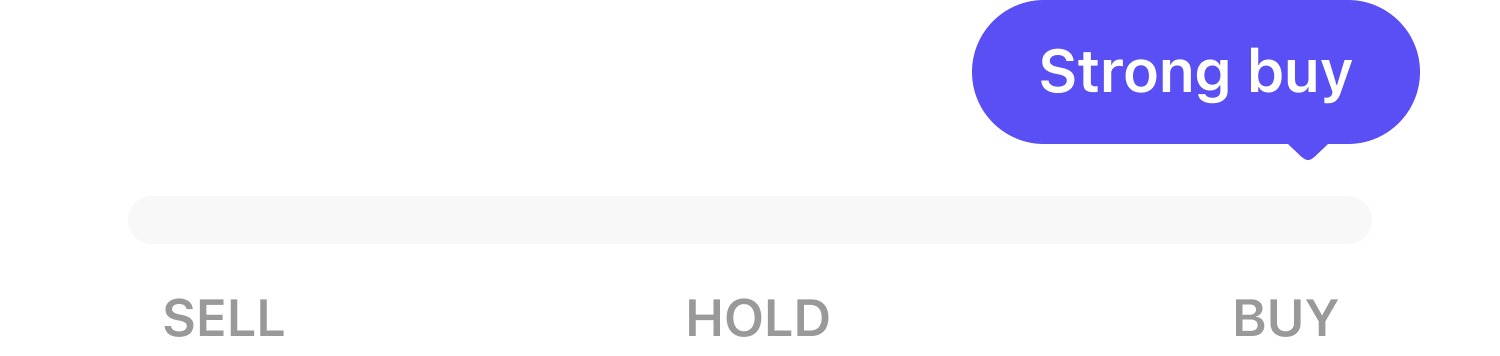

*Ratings are provided by analysts at Zacks, a leading investment research firm

What have we learned this week? 🤓

Rumours are market movers: It’s not always numbers and cold hard facts that affect a stock’s price. Sometimes, rumours can send the market into a frenzy and Musk’s association with US Steel is a prime example of this.

93% of Michael Burry’s portfolio is against the market: When you’ve predicted a financial crash as well as Burry did in 2008, many people start listening to you. He alone is very influential in altering the market’s sentiment.

Nvidia has counties as customers: When your customers are powerhouses such as Saudi Arabia, UAE and China, you know you’re doing something right. Perhaps that’s why it’s been the most successful stock in the S&P 500 this year.

Thanks for tucking in! Want to receive these updates every Friday? Sign up here or share via WhatsApp with your friends.

*Figures and ratings correct as of August 16th 2023.

Past performance does not guarantee future results. Capital at risk when investing. This content is for educational purposes only. Shares does not provide investment advice. If you are unsure about anything, please seek advice from an authorised financial advisor.