💡 If you want these updates delivered to your inbox every Friday, sign up here

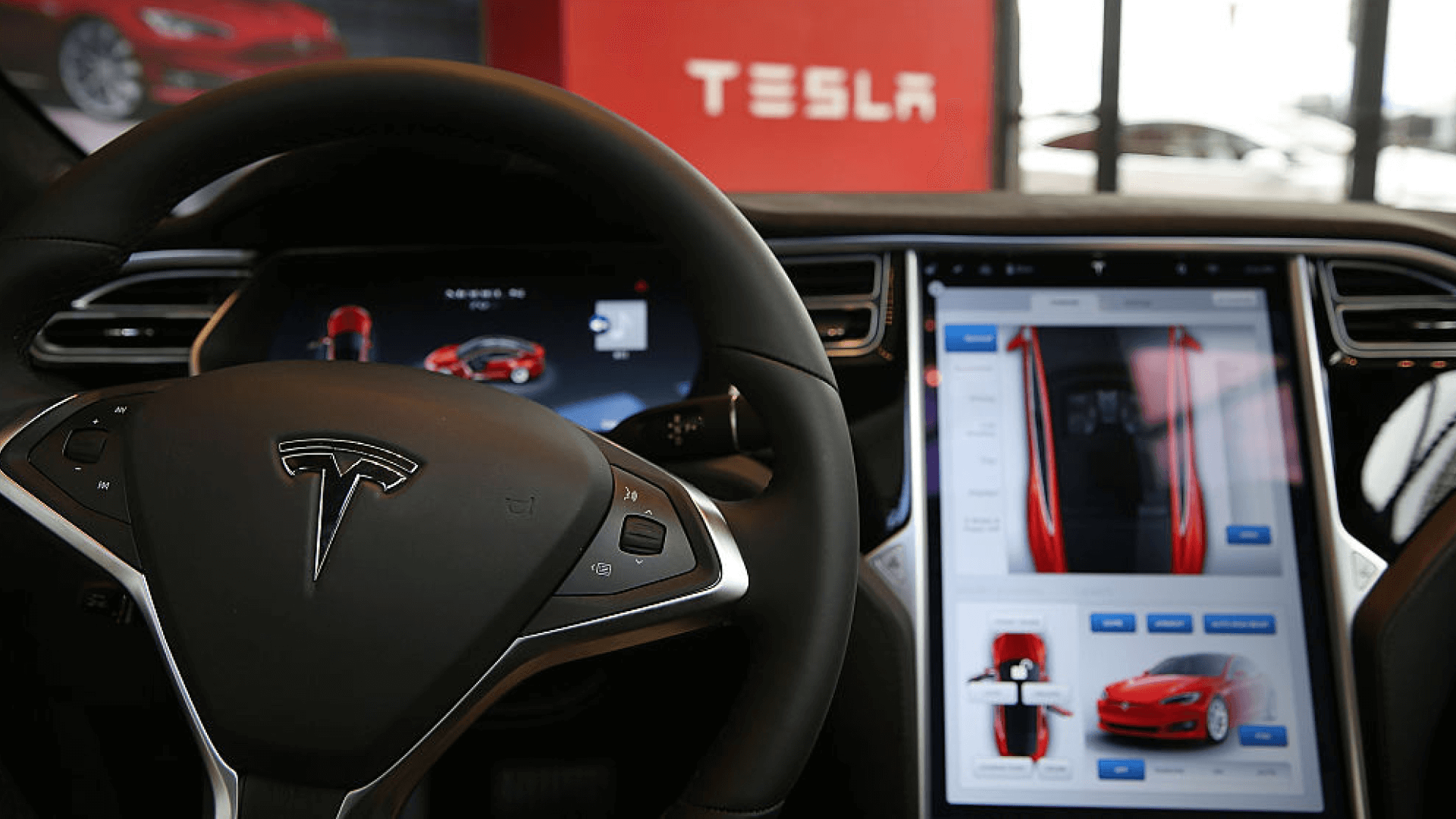

Tesla jumps 7% as Nvidia helps create self-driving tech 🏎️

A super boost thanks to a supercomputer: On Monday, Tesla launched its new supercomputer which is powered by 10,000 Nvidia H100 chips. Why’s this a big deal? It’s able to expedite Tesla’s self-driving technology, one of the company’s biggest USPs.

Fully self-driving cars are coming: Currently, Tesla’s autopilot possesses some autonomous features, but full self-driving capabilities haven’t yet hit the market. But thanks to a partnership with Nvidia, Tesla may have fully self-driving cars by the end of 2023. Scary or exciting? You decide.

A much-needed boost: VinFast, a Singapore-based E.V maker, floated on the stock market earlier this month and quickly became the 3rd most valuable automaker in the world, second only to Tesla and Toyota. Competition in the EV market is fierce, but thankfully for Tesla, its recent supercomputer is helping it maintain pole position.

*Ratings are provided by analysts at Zacks, a leading investment research firm

Disney slips 3% as traditional T.V. becomes less profitable 📺

The small screen’s small returns: Disney shares are trading at their lowest level in nearly a decade as its long-term stock performance dwindles compared to competitors. So, what’s going wrong?

Better late than never: The company has suffered from a broad decline in profitability in traditional television. Disney was late to the streaming party, but it’s a good job they showed up, as it’s this part of the business model that has investors excited.

Disney’s diversification: Disney is a very diversified company, but investors are waiting to see if it will sell part of its traditional T.V. business model. Apple and Amazon are both looking to grow their presence in sports broadcasting and could be after Disney’s ESPN channel, according to Forbes.

*Ratings are provided by analysts at Zacks, a leading investment research firm

3M jumps 7% after a $6 billion settlement with the US military 🪖

A noisy settlement: 3M has been in the headlines this week as it’s finally agreed to pay $6 billion to settle lawsuits made by U.S. military veterans who say they suffered hearing loss from using the company's earplugs.

Almost a quarter of a million people are eligible: This has become the largest mass tort (harming of people) litigation in U.S. history. Still, 3M hasn’t admitted to being liable and claims the earplugs "are safe and effective when used properly".

But, shares are up: It seems odd for shares to jump, right? Well, the market had priced in a heavier payout settlement for 3M, with many investors thinking it would be around $10 billion.

*Ratings are provided by analysts at Zacks, a leading investment research firm

What have we learned this week? 🤓

The EV market is volatile: VinFast, the unprofitable EV company founded less than 6 years ago has just become the 3rd most valuable automaker in the world. This is big news, but can it maintain this position in a highly volatile market?

Disney is very diversified: Disney shares may be at a low point, but let’s not forget it owns TV networks like Hulu, TV channels like ESPN, and global franchises like Star Wars. Oh, and it owns a few theme parks, too. Its main challenge is choosing what to focus on!

Lawsuits are market movers: Often, lawsuits can drag on for years. The market prices in updates along the way, but when something unexpected happens, share price can move quickly.

Stocks we’re watching 👀

DocuSign: Despite the company’s post pandemic lull, DocuSign shares rose during its last earnings call as it beat analyst expectations. Will the same happen again on September 7th?

Adobe: The software company is up a huge 60% since January, largely due to AI advancements. How will the share price respond to its Q3 earnings on September 14th?

Oracle: Cloud company Oracle is already up 3% this week due to its focus on AI. Will the stock move again during its upcoming earnings call on September 11th. It’s currently up 44% since January.

Thanks for tucking in! Want to receive these updates every Friday? Sign up here or share via WhatsApp with your friends.

*Figures and ratings correct as of August 30th 2023.

Past performance does not guarantee future results. Capital at risk when investing. This content is for educational purposes only. Shares does not provide investment advice. If you are unsure about anything, please seek advice from an authorised financial advisor.