💡 If you want these updates delivered to your inbox every Friday, sign up here

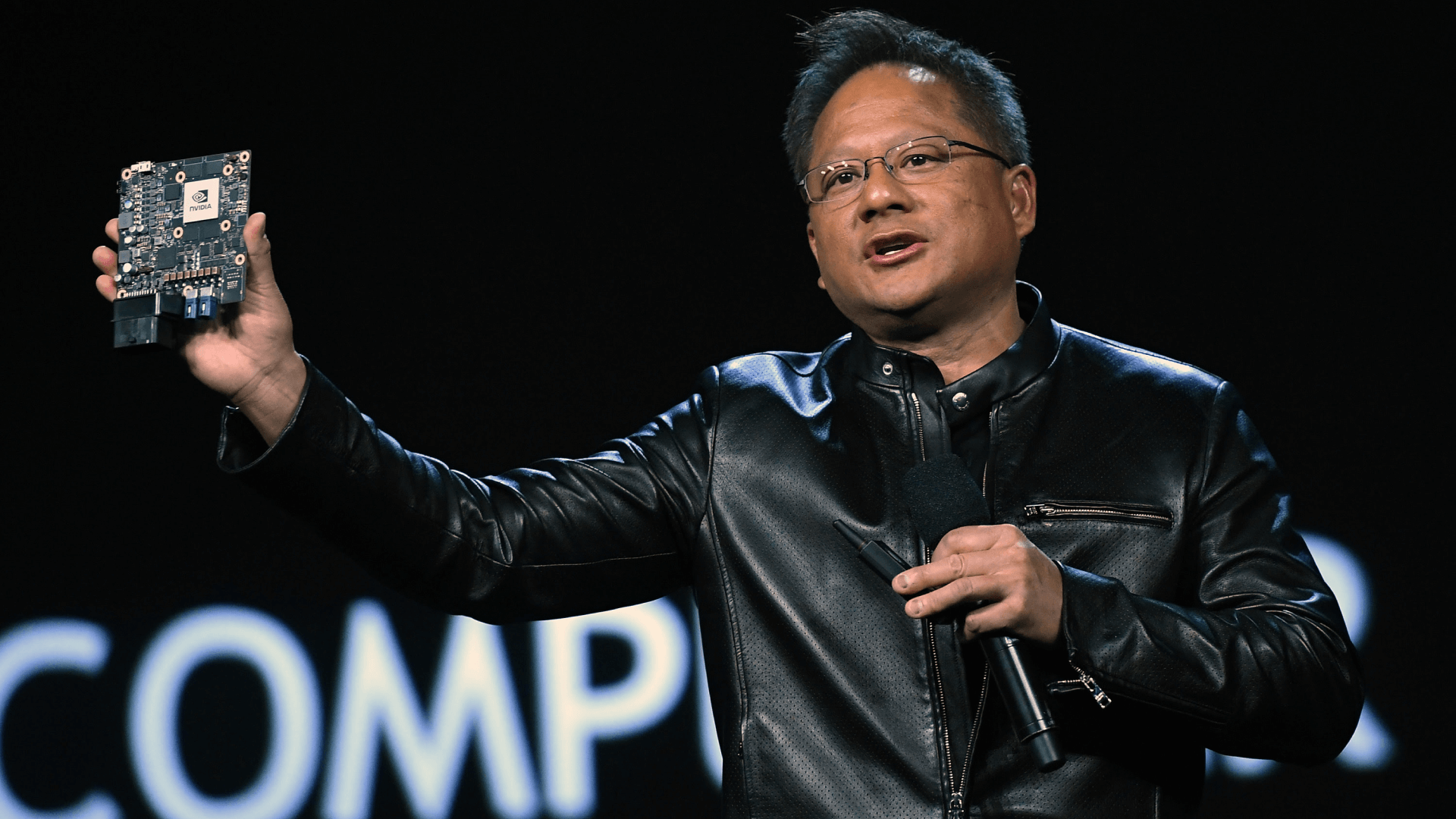

Nvidia stock soars 7% after bumper earnings report 💸

Soaring demand: Shares of US chipmaker Nvidia spiked 7% on Wednesday after they announced bumper quarterly earnings due to soaring demand for their computer chips, which are needed to train artificial intelligence models. Nvidia’s chips power nearly all the world’s major AI apps, including ChatGPT.

The big double: Nvidia’s revenue more than doubled in the latest quarter, coming in at $13.5bn, over $2bn more than the $11.2bn Wall Street analysts predicted.

The future is bright: Keeping up with such high demand has been Nvidia’s main growth constraint to date. But the company confirmed it’s overcoming these supply issues, and has projected higher revenue than expected for its current quarter.

*Ratings are provided by analysts at Zacks, a leading investment research firm

Cybersecurity leader Palo Alto Networks rallies 17% after ‘bizarre’ Friday earnings call 📆

Freaky Friday: When cybersecurity leader Palo Alto Networks scheduled their earnings call for a Friday afternoon, investors got spooked, thinking they were trying to bury bad news. People got so panicked, it sent the stock crashing 19%. So it was a huge relief to everyone when the company reported positive results, resulting in a 17% stock rally on Monday.

Beating expectations: The company delivered a fourth quarter revenue of $1.44 billion, above the $1.28 billion analysts expected, and has projected nearly 20% sales growth over the next three years.

AI-fuelled rally: Cybersecurity and AI are closely linked, as generative AI can be used to combat cyberattacks. Positive sentiment around the AI space led to similar stocks Zscaler and CrowdStrike also climbing more than 5% early Monday.

*Ratings are provided by analysts at Zacks, a leading investment research firm

Tesla rises 7% as analysts look forward to Cybertruck launch 🛻

Cybertruck excitement: Tesla stock rose 7% on Monday after investment firm Baird rated them a ‘buy’, highlighting exciting developments in the second half of the year, including the launch of the Cybertruck.

Losing streak: Tesla shares have been on a mostly downward trajectory after a disappointing second-quarter earnings in July, where they announced record revenue but lower margins due to price cuts.

Reasons to be hopeful: The reasoning behind the positive rating from Baird included the upcoming Cybertruck launch, a wider-scale adoption of self-driving, expanding into markets and a possible AI day. A Cybertruck was recently spotted in Iceland on the set of a promo film, hinting at a looming launch.

*Ratings are provided by analysts at Zacks, a leading investment research firm

What have we learned this week? 🤓

The AI gold rush isn’t slowing down anytime soon: AI stocks are still some of the hottest in town, and Nvidia are leading the pack, crushing earnings expectations once again. Questions about their ability to meet demand seem to be the only thing that can hold them back.

Timing is everything: Earnings calls are crucial opportunities for investors to assess their options, and the market is easily spooked when timings change. Investors were expecting the worst from Palo Alto Networks’ call, unusually scheduled for a Friday - and better than expected results led to a relief rally.

Tesla’s product offering sparks optimism: Despite price cuts that have led to lower margins and a dip in share price, hype around the long-awaited Cybertruck has reinvigorated market excitement for the world’s most valuable automaker.

Thanks for tucking in! Want to receive these updates every Friday? Sign up here or share via WhatsApp with your friends.

*Figures and ratings correct as of August 24th 2023.

Past performance does not guarantee future results. Capital at risk when investing. This content is for educational purposes only. Shares does not provide investment advice. If you are unsure about anything, please seek advice from an authorised financial advisor.