Fed Opts to Hold Rates Steady

Fed officials opted to hold interest rates at their 22 year high of 5.25 - 5.5% at their meeting at the end of September.

They did however indicate that they’re considering another rate increase towards the end of this year, but said that they’ll likely be fewer in 2024.

Since March 2022, the Fed has embarked on a mission to curb both consumer and business demand, in an attempt to mitigate persistent and higher than anticipated inflationary pressures.

The Fed also released updated economic projections, predicting an uptick in growth for this year and a more optimistic inflation scenario compared to the forecasts made in June.

These projections also hinted at a potential peak in interest rates of 5.5-5.75%, suggesting an additional quarter-point rate hike this year.

The majority of policymakers now anticipate the federal funds rate to stabilize at 5-5.25% by the close of 2024.

The Fed's commitment to further tightening is not assured and the repercussions of prolonged high interest rates are beginning to show, notably in the slowing US labor market.

New obstacles to economic growth are surfacing, including the recommencement of student loan repayments, ongoing auto worker strikes, and a potential government shutdown.

To add to this, recent constraints on oil supply have led to a spike in prices, raising concerns over long term costs for many goods and services.

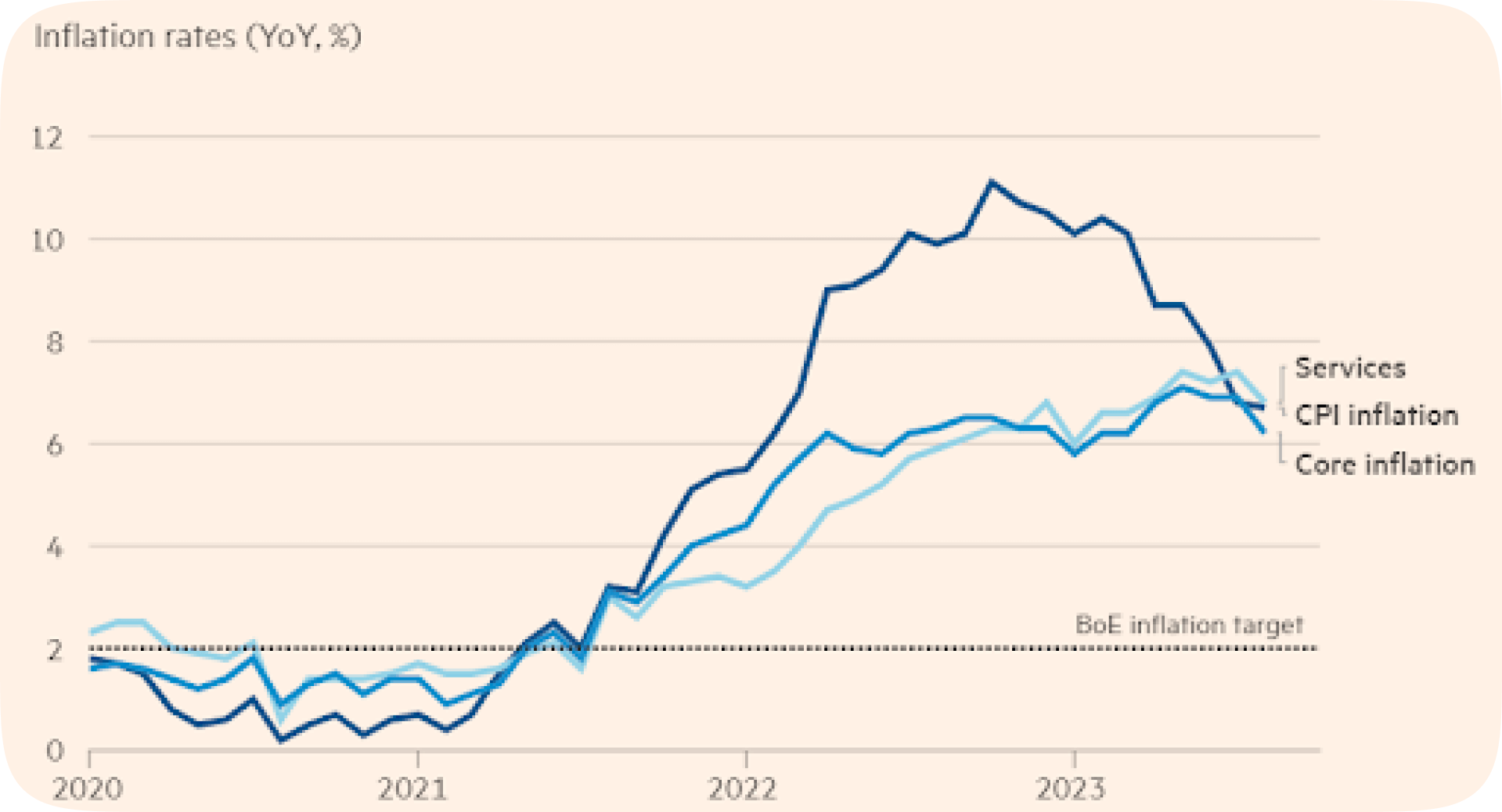

UK Inflation Falls to 6.7%

Data out in September showed that prices in the UK rose less than expected in August. Analysts had expected rates to rise by 7%, up from 6.8% in July.

However, prices actually rose by 6.7%, surprising given petrol and diesel prices both rose. The fall was mainly driven by slowing growth in the cost of eating out as well as petcare.

The big 3 measures of inflation all fell in August. Source: Financial Times.

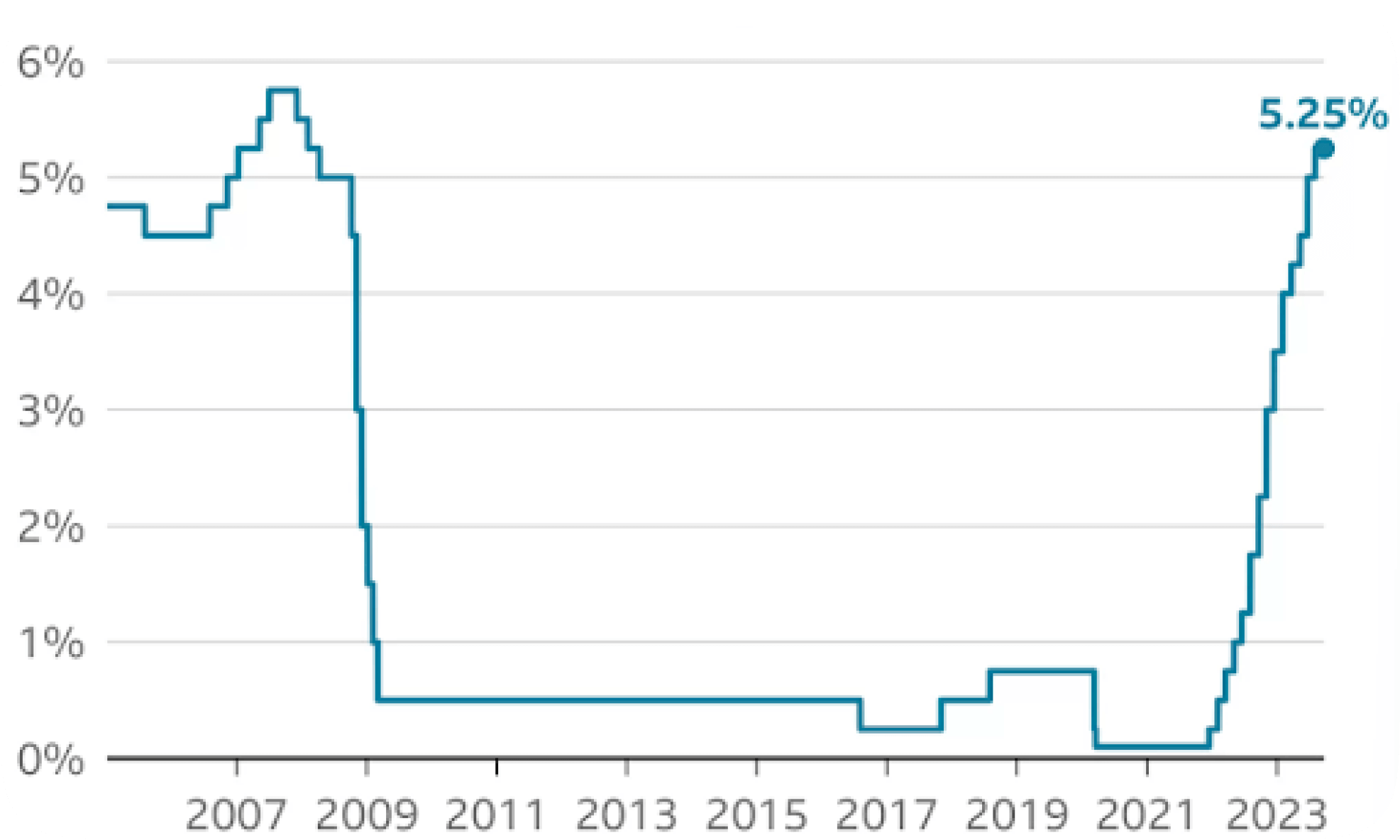

On the day after the announcement that inflation fell, the Bank of England announced that it would leave current interest rates unchanged at 5.25%, their highest for 15 years, but ending a run of 14 consecutive increases.

The Bank said there were signs that higher rates were starting to hurt the economy, through higher borrowing costs, and that they believe inflation will continue to soften regardless.

Most analysts had expected another rate increase, but the Bank's decision to leave it on hold raises the prospect that they view this as a turning point in the fight against inflation.

Andrew Bailey, head of the Bank of England, did say that there’s a long way to go to bring inflation back down to the Bank’s target of 2% and said that reducing rates would be “very, very premature”.

Interest rates are at their highest levels in over a decade but it’s unclear whether they’ll go any higher in the next 12 months. Source: BBC.

Chancellor Jeremy Hunt said “We are starting to see the tide turn against high inflation, but we will continue to do what we can to help households struggling with mortgage payments. Now is the time to see the job through. We are on track to halve inflation this year and sticking to our plan is the only way to bring interest and mortgage rates down."

Tech Companies Fall After Going Public

Shares of newly public tech companies Arm and Instacart have dropped over 10% from their peak values, suggesting that recent hopes of tech IPOs coming back may be misplaced.

There was initial excitement surrounding both of these IPOs, the first big ones in almost two years, but that’s now partly disappeared thanks to the poor performance of these two offerings.

Instacart's shares, after rising by 40% in early trading on their IPO on the 19th September, returned to their initial price the following day, closing at just $30.10, a mere 10 cents above the IPO rate.

Arm's stock, after an initial 25% surge, has seen a drop of 16% since its IPO.

The poor performance of these two offerings could hinder the hoped for IPO momentum. Some have questioned the value of buying at IPO when they could get a significant discount later.

Investors now seem to be prioritising profitability over rapid revenue growth for IPO candidates.

We’ll see over the next 12 months whether the performance of these newly public companies improves or whether their poor performance puts off other companies from going public.

Download the Shares app today!

Make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

This content is for educational purposes only. Shares does not provide investment advice. If you are unsure about anything, please seek advice from an authorised financial advisor. Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.