Tesla Earnings

Tesla's stock declined after its Q3 financial results and a problematic conference call with Elon Musk.

Revenue was $23.4 billion vs $24.06 expected and earnings per share were $0.66 vs $0.74 expected.

The company's results fell short of expectations, but the stock initially held steady. However, once the conference with Tesla’s management team began, it began to fall.

The call was marred by technical difficulties and miscommunications. Musk's opening statement was missed as he was inadvertently muted.

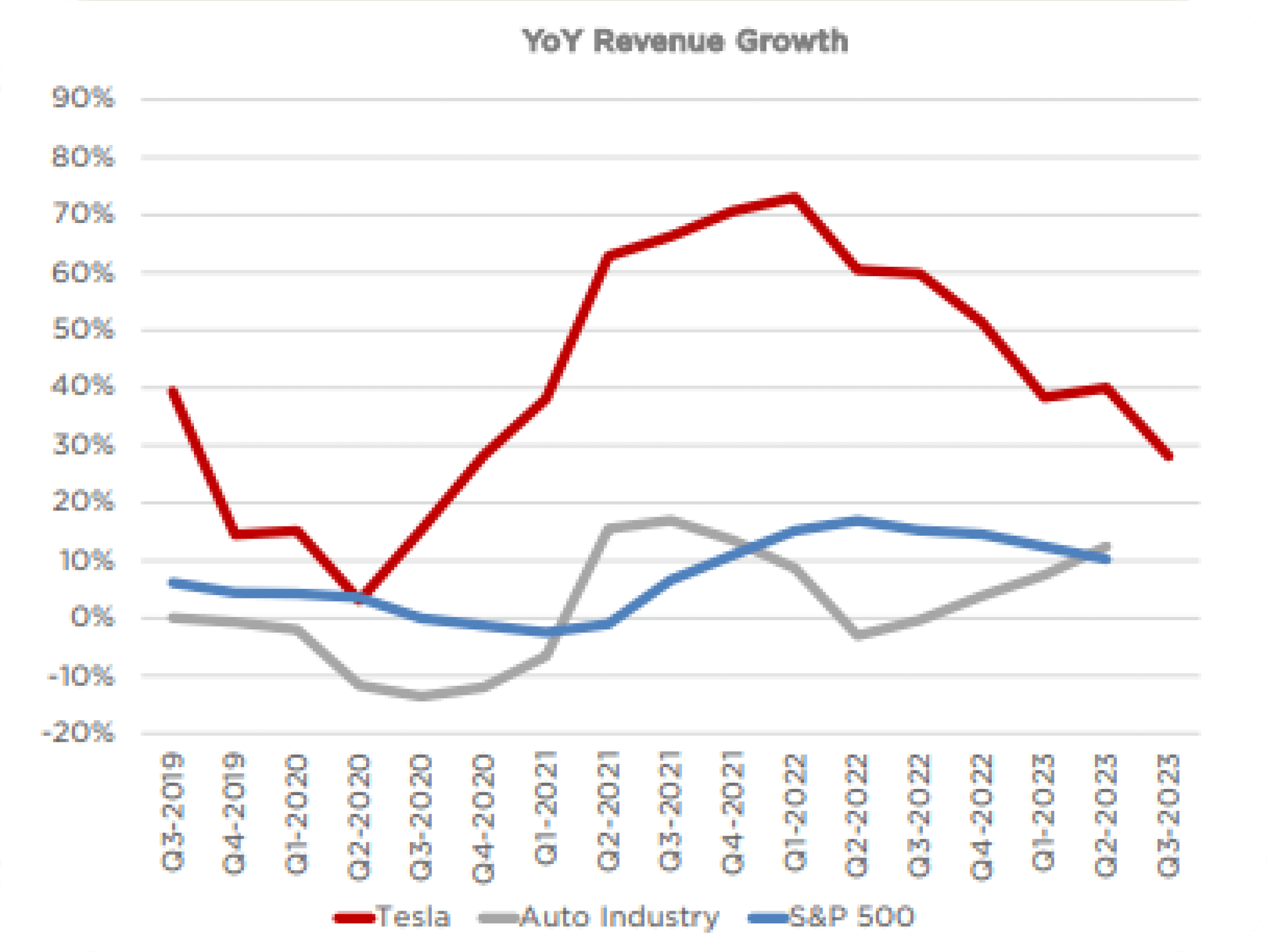

Although it was worse than expected, Tesla’s revenue growth continues to beat that of both the wider auto industry and the S&P 500. It’ll need to keep this up for a few years yet though if it’s to justify its valuation.

Analysts have expressed concerns about Musk's management style, suggesting he might be insulated from direct feedback and criticized him for evading pivotal questions, notably about Tesla's potential legal responsibility for their Full-Self Driving technology.

Instead of addressing this, Musk lamented external lawsuits and made unrelated remarks.

He also spent a significant portion of the call discussing macroeconomics and interest rates, topics outside Tesla's control, while avoiding pertinent questions about the company's internal decisions.

One of Tesla’s biggest bulls and Wedbush analyst, Dan Ives, even went as far to say “if you look up disaster in the dictionary, there’d be a video of [Tesla’s] conference call.”

It’s fair to say that the earnings, nor the call itself, were as good as many had hoped, but there were some positives to take away. Cybertruck deliveries are on track to begin at the end of November and the company still hopes to deliver 1.8 million vehicles this year.

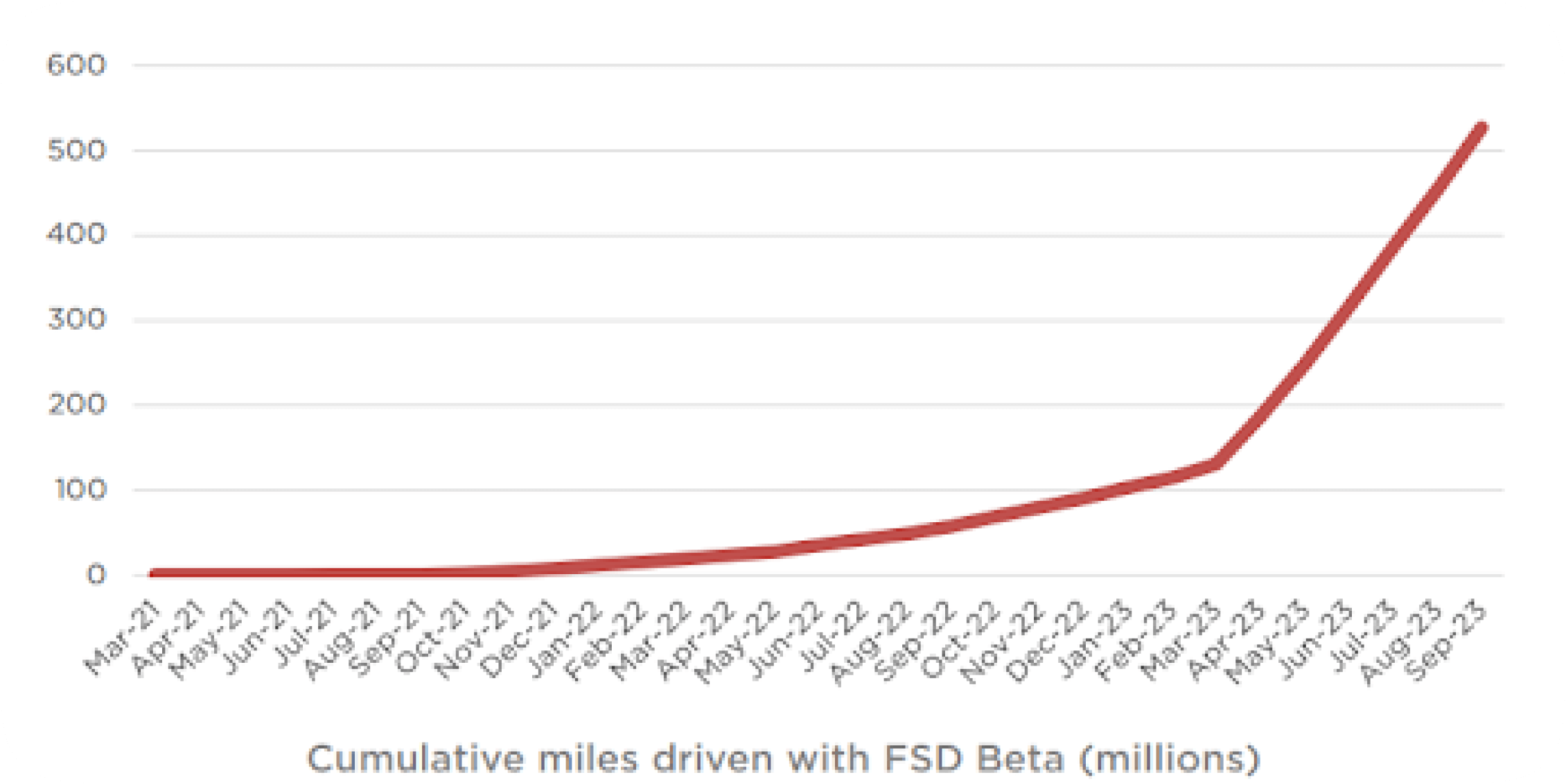

On a positive note, the number of miles driven using Tesla’s FSD beta technology is growing incredibly quickly. All of this data is being fed back into the system to improve it.

Tesla’s FSD technology also continues to improve, although it’s still uncertain if or when actual full self-driving technology will be available to everyone with a Tesla vehicle.

Hopefully for Tesla investors, Q4 will be better than Q3.

US Places More Restrictions on Chip Exports

The Biden administration announced it would be restricting shipments of advanced AI chips to China from the middle of November. The US wants to prevent the enhancement of China’s military through the use of US technology.

The regulations will also affect other countries such as Russia and Iran and blacklist some Chinese chipmakers from buying chip-making equipment.

Tensions between China and the US have risen dramatically over the last 10 years and these new restrictions are just the latest in the ongoing tit for tat trade war.

The restrictions are, thankfully, fairly simple. If a chip exceeds a certain performance threshold measured in flops per square millimeter, then its sale to China will be banned.

The new regulations also means that companies must notify the US government before selling any chips to China, even if they’re only for consumer devices.

US Department of Commerce Secretary, Gina Raimondo, said the new guidelines will probably be updated “at least annually” and said that the main goal is to limit China’s access to advanced semiconductors, specifically to those that could help them with the development of AI and military applications.

“The updates are specifically designed to control access to computing power, which will significantly slow [China’s] development of next-generation frontier model, and could be leveraged in ways that threaten the US and our allies, especially because they could be used for military uses and modernization.”

The new rules will affect the stock and strategy of major chipmakers like Nvidia, Intel, and AMD.

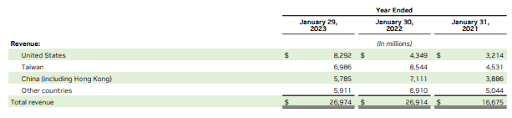

From Nvidia’s 2022 annual report

About 25% of Nvidia’s revenue comes from China and the country is the third largest contributor to revenue, behind the United States and Taiwan.

If you’re an investor in a chip-making company, it’s well worth keeping an eye on this fast moving space.

UK Consumer Confidence Falls

With households grappling with rising costs, including increased mortgage and rent expenses, along with higher fuel prices, it’s no wonder UK consumer confidence is falling.

The latest GfK Consumer Confidence Index saw the largest decrease since March 2020 during the onset of the Covid-19 lockdowns

Joe Staton from GfK attributed this decline to several factors: soaring costs of heating, filling petrol tanks, escalating mortgage and rental rates, a decelerating job market, and the prevailing uncertainties arising from Middle East tensions.

UK consumer confidence fell to its lowest level in nearly 3 years in October but will it be given a boost by the upcoming festive period?

Consumer confidence is a crucial indicator for investors and economists as it reflects household spending, which in turn influences economic growth.

The recent findings intensify concerns about the UK's economic wellbeing, given the near standstill in output for over a year, fewer job opportunities, and the highest interest rates since 2008 as the Bank of England attempts to control inflation.

The survey, conducted in early October, revealed participants felt less optimistic about their personal financial status and the wider economic situation than they did the previous month.

Despite wages outpacing prices for a few months, the benefits were nullified by the burden of higher mortgage expenses and an unprecedented surge in residential rental charges.

Fuel costs are also on the rise, with petrol prices reaching 156 pence per litre, a 10 pence increase since June.

Hopefully things will start picking up for the UK economy as we get closer to the end of the year where retail spending is bound to increase.

Download the Shares app today!

Make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

This content is for educational purposes only. Shares does not provide investment advice. If you are unsure about anything, please seek advice from an authorised financial advisor. Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.