Tesla Sam Altman Fired and Rehired as OpenAI CEO

The leadership situation at OpenAI was thrown into the air, with Sam Altman, the 38-year-old CEO and co-founder, being briefly removed as CEO before returning just 5 days later.

Altman was dismissed as CEO on Friday 17th. A statement from the OpenAI board said Altman was dismissed for not being "consistently candid" with them. Altman's dismissal led to internal conflict and mounting investor pressure especially from Microsoft.

By Monday 20th, Microsoft had hired Altman and OpenAI co-founder and president Greg Brockman, welcoming any OpenAI staff wishing to join them.

On the same day, it was revealed that more than 730 staff at OpenAI had signed a letter saying they would quit the company and join Microsoft unless Altman was reinstated as CEO.

By late Tuesday, OpenAI announced a tentative agreement for Altman's return as CEO under a board with new members including:

Bret Taylor, Shopify board member and former co-CEO of Salesforce.

Larry Summers, former treasury secretary and former president of Harvard.

Adam D’Angelo, CEO of Quora.

The new board seems to have more experience in tech and business, rather than the previous one that was made up of more academics and researchers.

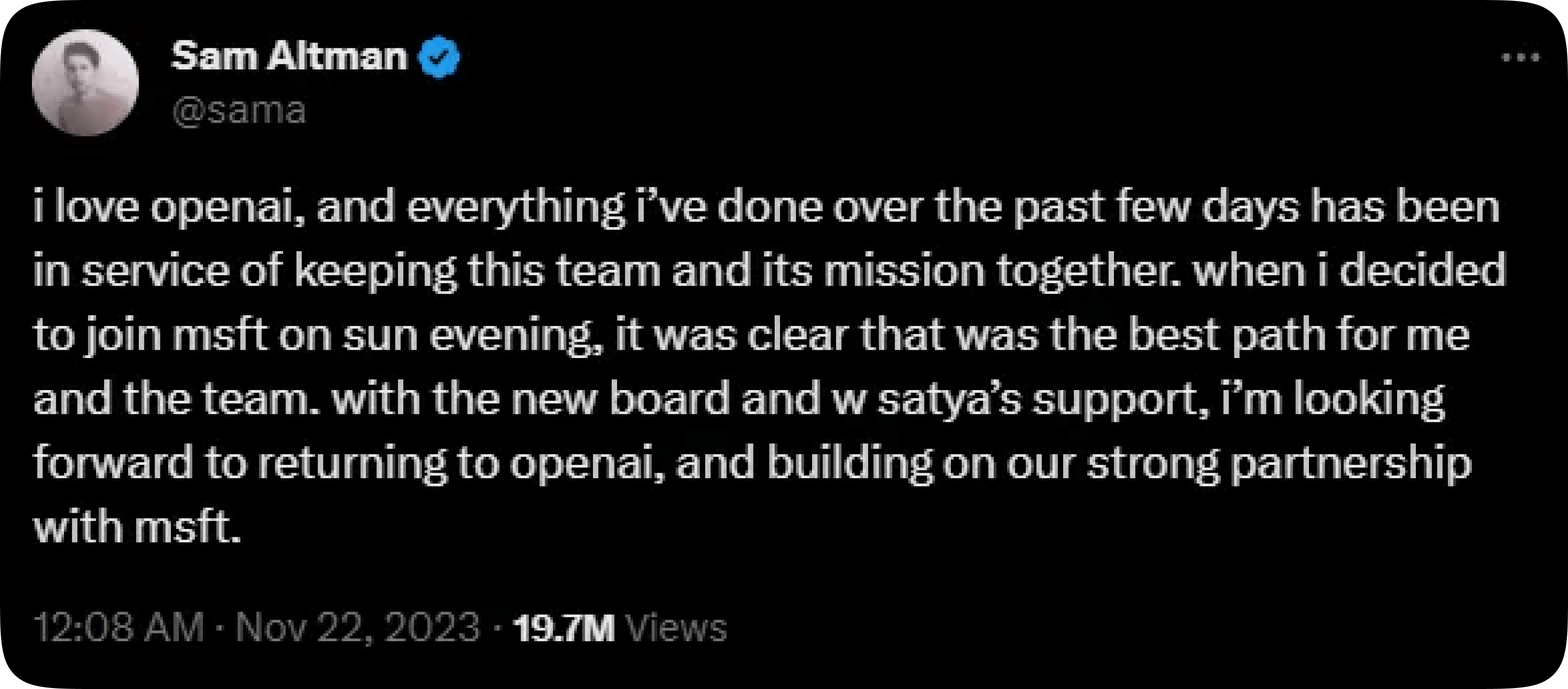

Altman shared his return to the company on X.

Media reports indicate that departed board members had disagreements with Altman over OpenAI's direction, although it’s still unclear exactly what the disagreement was.

There is speculation that it relates to a major breakthrough achieved at OpenAI a few months ago, known as Q*. Reuters reported that researchers sent a letter to the board citing concerns about a major advance, saying that they believed the breakthrough could threaten humanity.

For the moment however, the exact reason remains unknown.

Nvidia Beats Estimates Again

Nvidia beat earnings estimates by a large margin yet again but the company also said it expects a downturn next quarter due to chip export restrictions to China.

Despite this, the company foresees this decline being compensated by robust growth in other regions.

The company is also focusing on developing new data center products that align with government regulations and don’t need licenses. However, CFO and executive vice president Colette Kress, was skeptical that these products would significantly impact the fourth quarter.

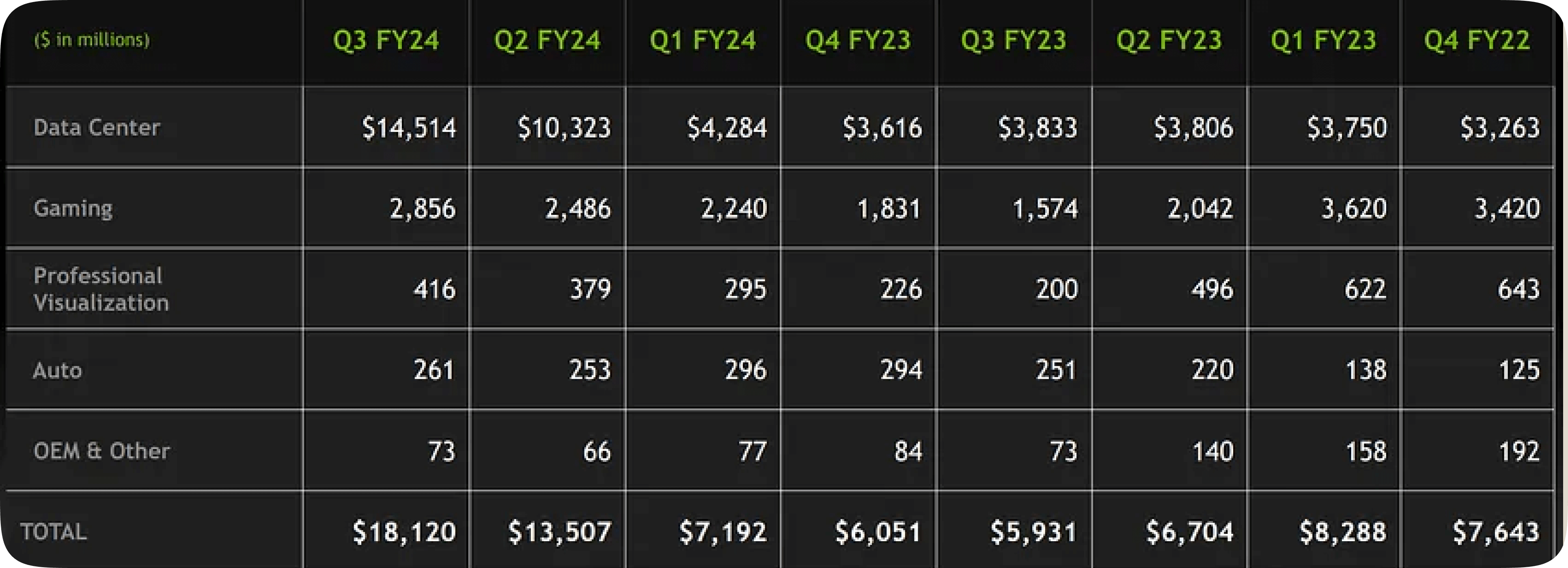

Nvidia's performance was as follows:

Total Revenue: $18.1 billion vs $16.2 billion expected, 206% up year on year.

Data Centre Revenue: $14.5 billion.

Gaming Revenue: $2.9 billion.

Earnings per share: $4.02 vs $3.37 expected.

Kress highlighted the strong demand from clouds specializing in GPU rentals during the call.

The gaming segment also saw growth, contributing $2.86 billion, an 81% increase, and surpassing the $2.68 billion estimates. Nvidia forecasts $20 billion in revenue for the fiscal fourth quarter, which would be roughly 230% revenue growth.

A few years ago, PC gaming GPUs were Nvidia's primary revenue source. Now, the company earns most of its revenue from server farm deployments.

Nvidia’s sources of revenue

The launch of ChatGPT this time last year, backed by Microsoft, spurred interest in generative AI, hugely boosting demand for Nvidia's GPUs.

Nvidia's stock has surged 188% this year, significantly outperforming the 18% rise in the S&P 500 index over the same period.

Holiday Shopping Season Kicks Off

An unprecedented number of people are expected to turn out for the festive shopping period in the United States.

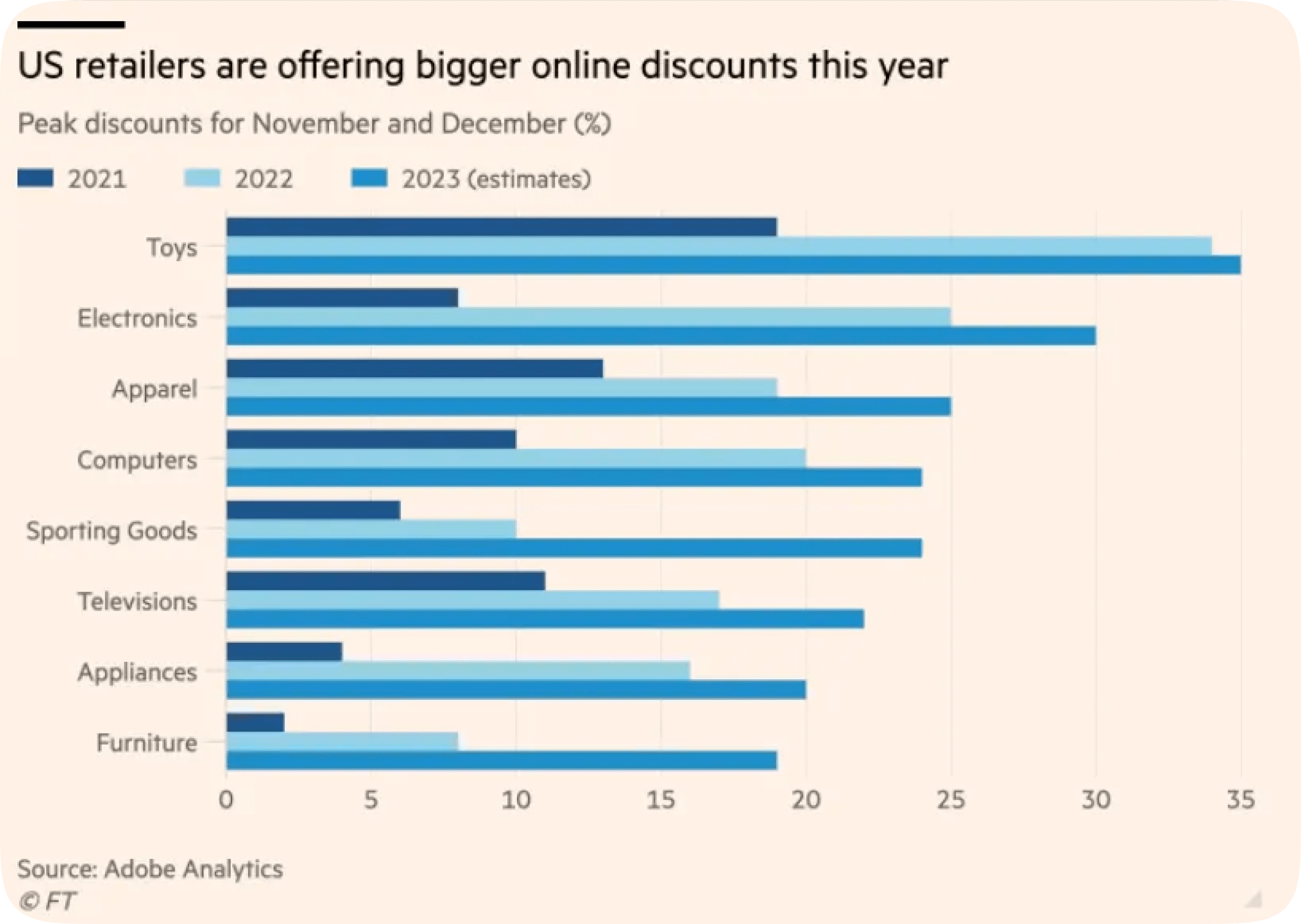

The start of the shopping season was marked by Black Friday on the 24th November where numerous retailers offered significantly larger discounts than usual.

The National Retail Federation (NRF) expects about 182 million shoppers to engage in both in-store and online shopping from Thanksgiving to Cyber Monday (November 23rd - 27th), an increase of 15.7 million from the previous year.

Deloitte's research indicates that the average spending per person will rise by 13% compared to last year, reaching $567.

In an effort to boost consumer spending, retailers have been presenting unusually high discounts. Additionally, a growing number of younger shoppers are expected to utilize buy now pay later (BNPL) services.

This surge in consumer spending follows a year where many analysts were taken aback by the consumers' robust response to rising prices and their continued willingness to spend despite higher inflation rates.

The forthcoming data on the festive period's sales will soon reveal the true extent of the US consumer's resilience.

Download the Shares app today!

Make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

This content is for educational purposes only. Shares does not provide investment advice. If you are unsure about anything, please seek advice from an authorised financial advisor. Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.