What is the US Debt Ceiling and Why Does it Matter?

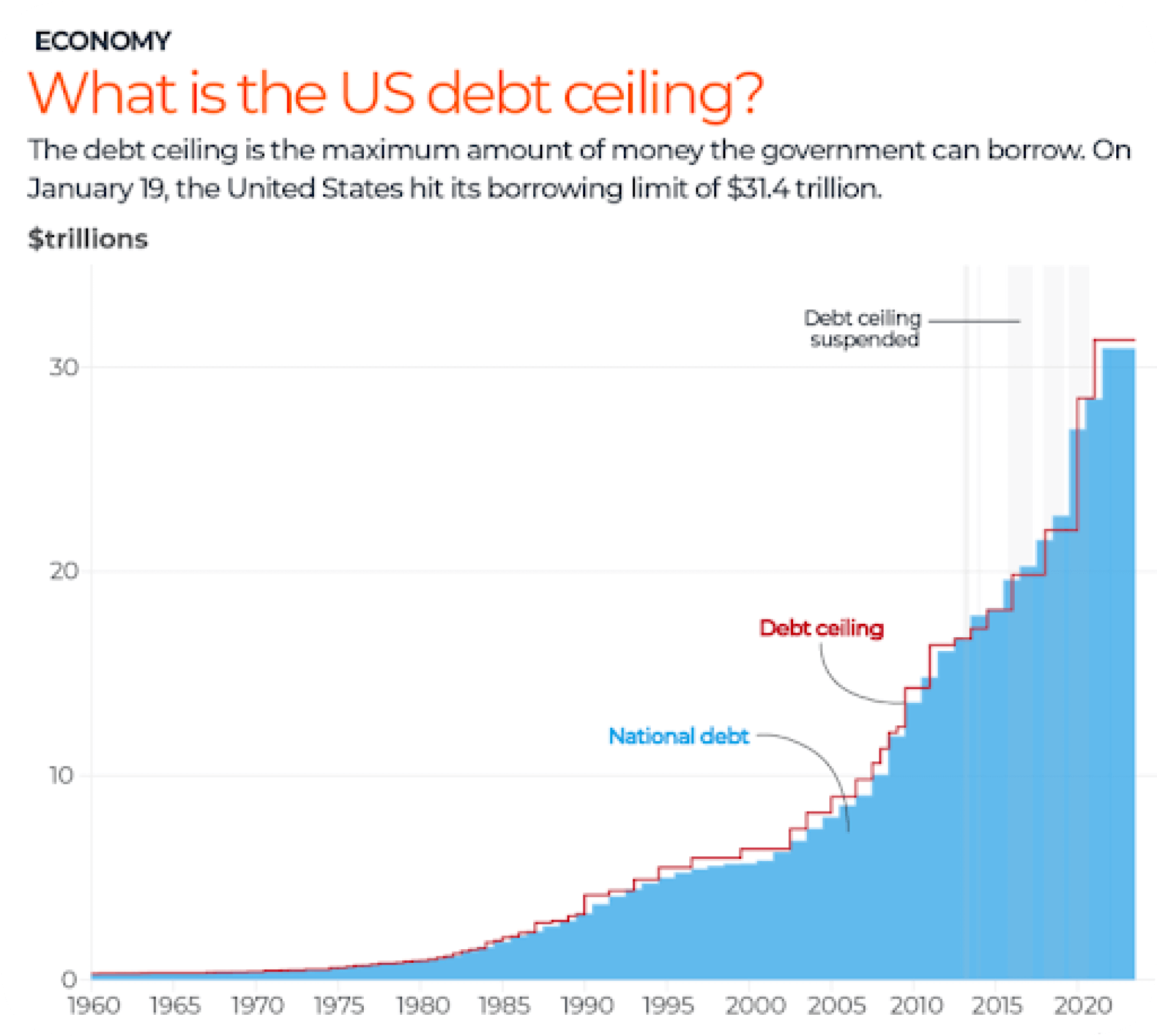

The US debt ceiling marks the maximum amount of money that the government can borrow. It was created in 1917 and has been raised multiple times since then to prevent the US from defaulting on its debt.

The ceiling was set at $31.4 trillion after a congressional vote on December 15th 2021. However, the new deal means there’s now no debt limit until January 2025. Basically, the US government can now borrow as much money as it wants to pay its bills.

Source: Al Jazeera.

Under the new legislation, the debt limit will be set at whatever level it has reached by the end date. The deal has basically just kicked the decision down the road until after the next presidential election which will take place in November 2024.

The new agreement reduces funding for nondefense programs, including domestic law enforcement, forest management, scientific research, and other areas.

The military spending budget will increase to $886 billion next year - in line with what Biden requested in his 2024 budget proposal, and rise to $895 billion in 2025. The bill will also put an end to the Biden administration’s freeze on student loan repayments.

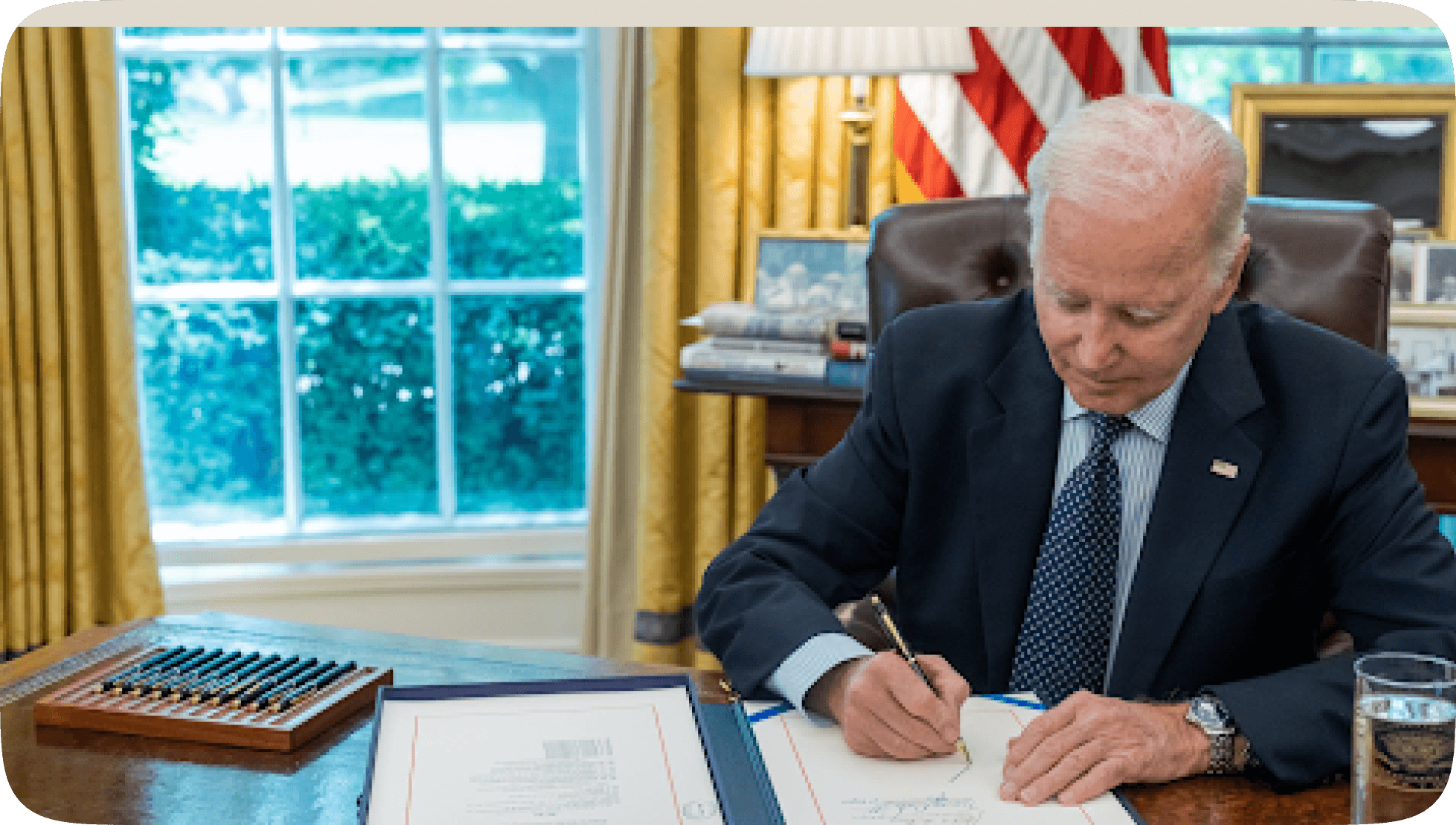

Joe Biden signed the “critical” deal to raise the debt ceiling on June 3rd after intense negotiations took place throughout May.

The final agreement will cover the next two years of government spending but includes far less reduction in future debt than either side initially proposed. In two years' time, the Democrats and Republicans will have to come to another agreement about how to spend taxpayer dollars.

Nasdaq 100 Gains

The banking crisis, which saw the collapse of Silicon Valley Bank and Credit Suisse earlier this year, has complicated the situation around inflation and interest rates. However, inflation in April was 4.9%, down from the June 2022 peak of 9%.

Slowing inflation and lower interest rates have made tech stocks, many of which won’t be profitable for a while yet (if at all), more attractive to own.

Federal Reserve Chairman, Jay Powell, has said the Fed might pause future rate hikes if inflation continues to slow - this could help tech stocks even more.

The Nasdaq has had one of its best starts to a year ever but can it keep it up for the rest of 2023?

The buzz around AI has also helped tech this year. AI and its growth dominated headlines across the financial news throughout May. Many tech companies are excited about its potential and are investing heavily in the space.

But as with most tech, it’s a double-edged sword. One report found that AI contributed to nearly 4,000 job losses in May alone. Businesses are wasting no time in adopting the technology to the detriment of many creative jobs including writers, software engineers, as well as admin and clerical work.

But looking at it purely from an investing standpoint, increasing use of AI will likely be one of the main drivers behind earnings growth over the next five years and could push the Nasdaq even higher this year.

UK Economy Had a Poor Start to the Year

The UK economy grew sluggishly in the first half of the year thanks to ongoing inflation headwinds, strikes, and weaker than expected retail sales weighing on the economy.

It’s still better than the shallow recession many economists once forecast for the UK but a sharp drop in output in March showed just how unsteady the recovery is.

Like much of the world, the UK economy is currently going through a rocky period but will it emerge from it stronger or remain permanently weakened by Covid and the cost of lying crisis?

GDP was up 0.1% in the first three months of this year, the same as the final three months of 2022, despite dropping 0.3% in March alone.

Inflation in March topped 10%, more than double the US and higher than the Eurozone’s 8%. The UK interest rate currently stands at 4.5%, its highest since 2008. The Bank of England (BoE) forecasts that the UK economy will grow just 0.25% in the whole of 2023, better than its initial prediction of a 0.5% contraction but still not great.

KPMG economist Yael Selfin said "While recession is probably no longer on the cards, vulnerabilities resulting from higher borrowing costs and tighter credit are likely to dampen business and household activity this year."

Rachel Reeves, Shadow Chancellor of the Exchequer, said that Prime Minister Rishi Sunak, was leading the country into a period of “managed decline”.

How quickly, if at all, the UK can fix its weakening economy remains to be seen.

Make sure to download the Shares app!

Follow us on our socials 👇

As with all investing, your capital is at risk.

This content is for educational purposes only. Shares does not provide investment advice. If you are unsure about anything, please seek advice from an authorised financial advisor. Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.