Big Problems for Banks

Silicon Valley Bank (SVB) and Credit Suisse both faced huge issues, with the former being taken over by regulators and the latter being bought by UBS for $3.25 billion.

SVB’s problems were caused by rising interest rates affecting the value of the US bonds they owned. Bonds are normally considered “safe-assets” but as interest rates in the US rose, their value declined, and SVB could only sell them at a loss.

At the start of March, the bank faced $42 billion of deposit withdrawal requests. Unfortunately, it wasn’t able to raise the cash it needed to cover the outflow, which prompted regulators to step in and close the bank.

Credit Suisse’s problems were ultimately caused by multi-billion dollar losses, scandals, and top-management changes. In 2022, Credit Suisse lost $7.9 billion, its biggest loss since the financial crisis in 2008. However, it was the announcement by Credit Suisse’s largest shareholder, the Saudi National Bank (SNB), that it couldn’t give more money to the bank due to regulatory hurdles, which finally brought things crashing down.

The deal between Credit Suisse and UBS has created a single bank twice the size of the Swiss economy.

The collapse of these 2 (there were other smaller banks affected as well) in such a short space of time has already caused concerns among those worried about another financial crisis. Politicians and central bankers say the situation is now stable, but it remains to be seen whether this is really the case - we’ll find out over the course of this year.

AI Advances

Every day in March seemed to herald huge advances in AI. Probably the biggest event was the release of GPT-4. ChatGPT, which was the quickest product ever to reach 100 million users in January, just 2 months after its release, runs on GPT-3.5; GPT-4 is a big step up from this. It can make websites from simple sketches, compose music, and get better results in academic tests than most humans!

Other notable AI events in March include massive improvements to image-generation AI, Google releasing its own chatbot, and Nvidia’s AI conference, where CEO Jensen Huang proclaimed this “the iPhone moment for AI”.

This photo was created by the image generation AI programme, Midjourney, in a few seconds. Will we soon see AI replacing graphic artists and designers and what else might it be capable of doing in the future?

AI has been used for years to make ad recommendations, help prevent fraud, and in image recognition. But the advancements in the past few months raise important questions for workers: How much of our work now requires humans? And will technology ever fully replace us or just augment us? The recent advances have led Bill Gates to conclude the age of AI has begun.

Bank of England Hikes Interest Rates

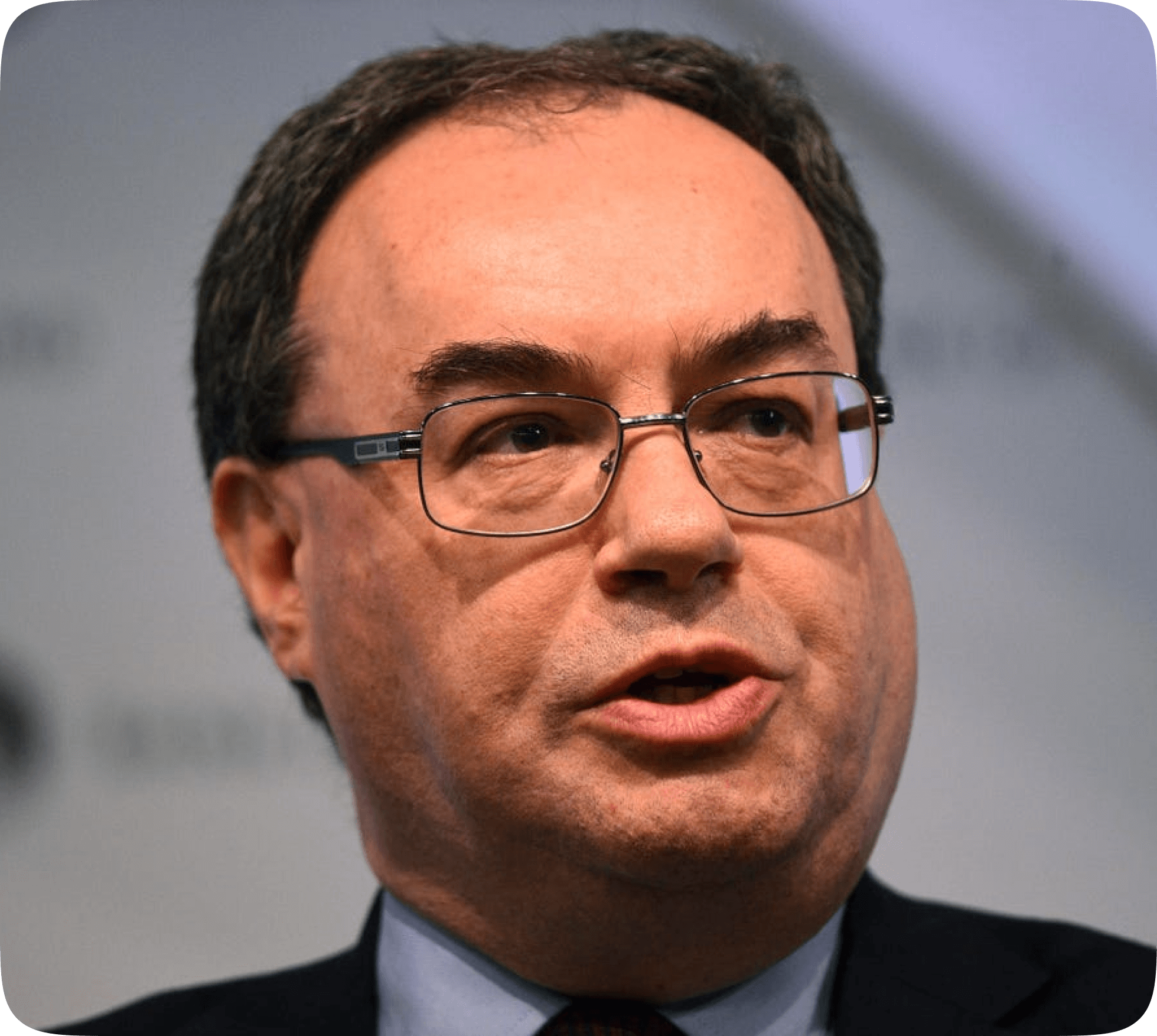

The Bank of England announced on the 23rd that it would hike interest rates by 0.25%, bringing the base rate to 4.25%. The news came after data showed that inflation unexpectedly accelerated in February to a year over year rate of 10.4%.

During the announcement, the BoE’s governor, Andrew Bailey, said he was more optimistic that the UK was no longer heading towards a recession, but also warned that the economy is expected to grow slowly in the coming months.

Andrew Bailey was named as head of the BoE on 16th March 2020, just as the pandemic was getting really bad. Since then he’s had to contend with that, and the highest inflation in decades caused by the after-effects of the pandemic and the Ukraine conflict.

The jump in interest rates will make it harder for those with a mortgage but means that savers will get better returns on their money in the bank. Despite the rate increases the bank also said it expects the cost of living to fall sharply over the rest of the year, largely due to the extended energy bill help offered by the government and falls in wholesale gas prices.

The BoE refused to say whether or not it thought the interest rates might go even higher, although many expect this to be the last rise for some time.

Good News

Let’s end on some more good news!

In the UK, the BoE said that banks are safe from any sort of fallout from the Credit Suisse debacle and welcomed UBS’s decision to buy the bank. In a statement the BoE said: "The UK banking system is well capitalised and funded, and remains safe and sound."

In the US the Federal Reserve raised rates by just 0.25% and said that despite the problems afflicting the banking sector, the US banking system is “sound and resilient”. The Fed also suggested they could end the monetary tightening campaign soon, a sign that they believe inflation will start to come down over the course of the year.

Hopefully, this will bring us closer to ending, or at least help fight, the cost of living crisis currently taking place across most of the world.

Subscribe to Harry and see all his trades in real time. Just make sure you have the Shares app downloaded!

Make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

This content is for educational purposes only. Shares does not provide investment advice. If you are unsure about anything, please seek advice from an authorised financial advisor. Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.