UK Inflation Remains High

UK inflation threw a curveball at economic forecasters by holding steady at 8.7% in May, bucking the expected drop to 8.4%. The persistent inflation rate not only pressured the Bank of England (BoE), but also cranked up the heat on Prime Minister Rishi Sunak, and potentially millions of homeowners.

The problems started back in 2021, when supply-chain bottlenecks due to the pandemic and Russia's invasion of Ukraine led to a surge in inflation. Although it was initially hoped this would be a temporary phenomenon, UK inflation is still higher than analysts had expected.

Food inflation remains particularly high. Although slowing, it came in at 14.6% year-on-year for June.

The BoE has been trying to bring it down with continuous rate interest hikes but it’s proving difficult.

Rising interest rates are having a major effect on mortgages. Around 800,000 are due to be refinanced in the second half of 2023 - this will likely result in higher monthly payments for homeowners, especially if rates continue to rise.

Inflation has also caused a stir in the political arena, with Labour accusing the Conservatives of triggering a "mortgage catastrophe".

Finance Minister, Jeremy Hunt, has reiterated the government's commitment to reducing inflation, turning the focus to mortgage lenders to see what more they can do to help homeowners.

However, it's not all doom and gloom. According to ING economist James Smith, falling petrol and energy prices could bring inflation below 7% by July.

That being said, the persistently high inflation rate and its impact on the mortgage landscape are certainly areas to keep an eye on. It's a complex dance between maintaining economic stability and managing the cost of living for UK residents.

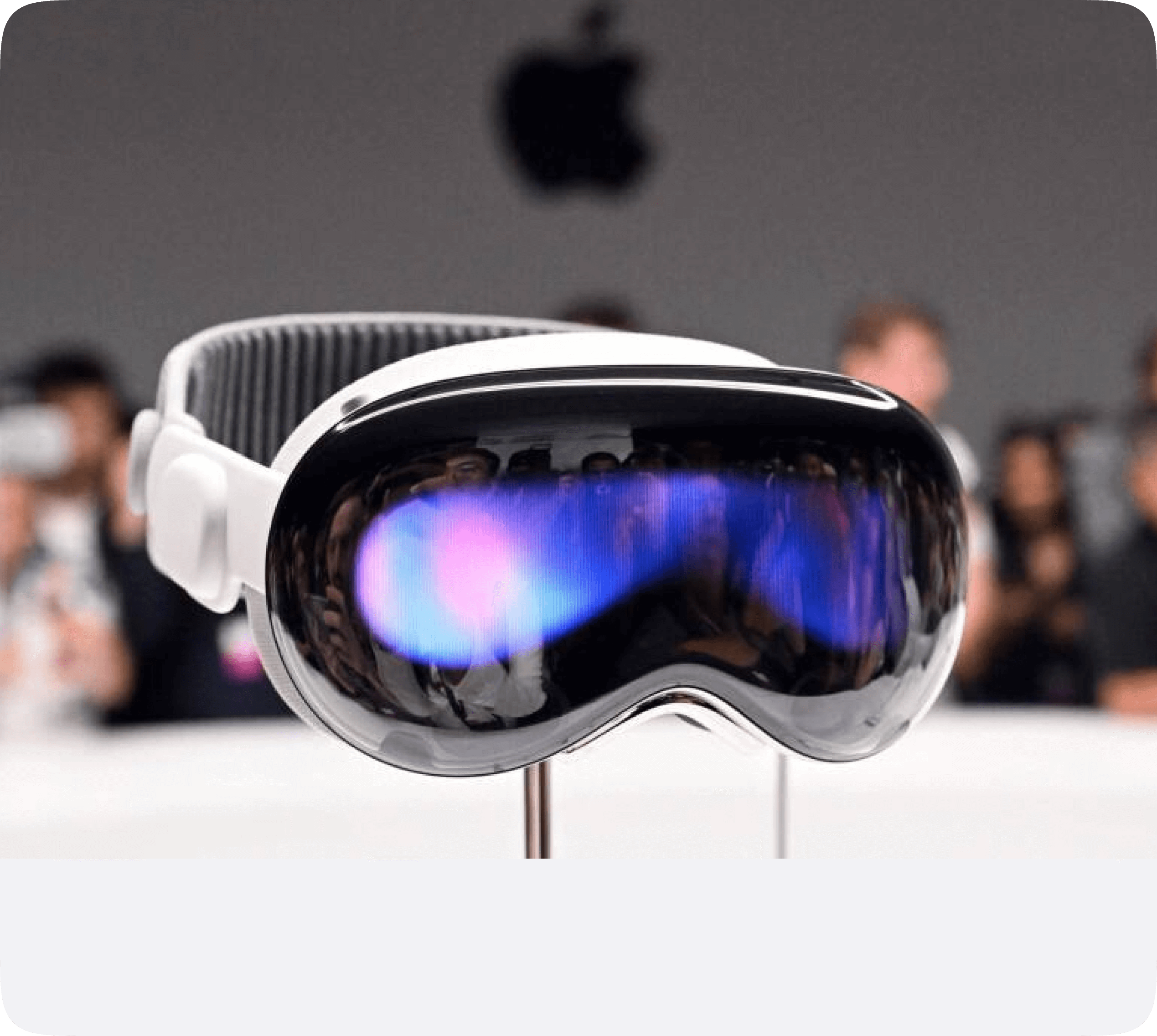

Apple’s New Headset

Apple has once again made headlines with its latest unveiling - a cutting-edge mixed-reality headset.

This innovative gadget represents Apple's strategic move into the vibrant and rapidly-evolving world of augmented and virtual reality (AR/VR), marking a significant step forward in their product line.

The new headset promises to offer a seamless blend of augmented and virtual reality experiences, enhancing users' interaction with the digital world like never before and leverage Apple's existing ecosystem and the capabilities of their mobile devices.

It will go on sale in the US in early 2024 for $3,499 with availability in other countries soon after that. The price is much higher than its main competitor, the Meta Quest 3, which was announced on June 1st and will go on sale for $499.99 this fall.

The MR battle is the latest in the Meta vs Apple saga. Apple’s privacy change to iOS in 2021 seriously hurt Meta’s targeted advertising capabilities and Mark Zuckerburg has been consistently vocal about what he sees as Apple’s unfair app store policies.

It remains to be seen who will come out on top this time or if there’s space for two huge companies in the AR/VR world, but the fight promises to be one of the most interesting and entertaining rivalries in tech over the next 5 years.

Crypto Prices

Cryptocurrency markets had a great June for many reasons.

Bitcoin reached its highest level since early May with the rise largely attributed to the engagement of major traditional financial sector players in cryptocurrency initiatives.

The launch of a digital-asset exchange, EDX Markets, which is backed by reputable firms including Citadel Securities and Charles Schwab, has been a major boost to investor confidence.

Bitcoin Cash more than doubled in the week after EDX Markets was launched on 20th June. The new exchange aims to be a trusted marketplace for crypto trading and has backing from some big names.

On top of this, BlackRock has also applied to launch Bitcoin ETFs. These developments have been widely seen as a validation of the cryptocurrency sector by traditional finance.

The regulatory environment in Asia has also seen developments that may have contributed to the rise in cryptocurrency prices. Beijing has released a whitepaper that outlines China’s plan for Web3 innovation and development, indicating a potential openness towards blockchain technologies.

Hong Kong announced that it will begin accepting applications from digital asset exchanges to allow retail trading of cryptocurrencies. This news suggests a more welcoming regulatory environment for cryptocurrencies in Asia, a hugely important market if crypto is to gain further acceptance.

On the altcoin front, Ripple's XRP had a great June. This performance boost can be attributed to its expansion efforts, which include the launch of a new platform enabling central banks, governments, and financial institutions to issue their own digital currencies2.

Despite the market's overall bullish trend, Dogecoin and Shiba Inu experienced declines in value. Although the introduction of "DRC-20 tokens" led to record daily transaction volumes for Dogecoin, both meme coins fell in June.

The cryptocurrency market has seen notable price increases in June, largely driven by developments in traditional finance and regulatory changes, but the performance has not been uniform across all cryptocurrencies. The crypto market is full of volatility and unpredictability and as the year progresses, it will be interesting to monitor how these trends evolve!

Make to download the Shares app!

Follow us on our socials 👇

As with all investing, your capital is at risk.

This content is for educational purposes only. Shares does not provide investment advice. If you are unsure about anything, please seek advice from an authorised financial advisor. Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.