Global Inflation

UK inflation is finally falling

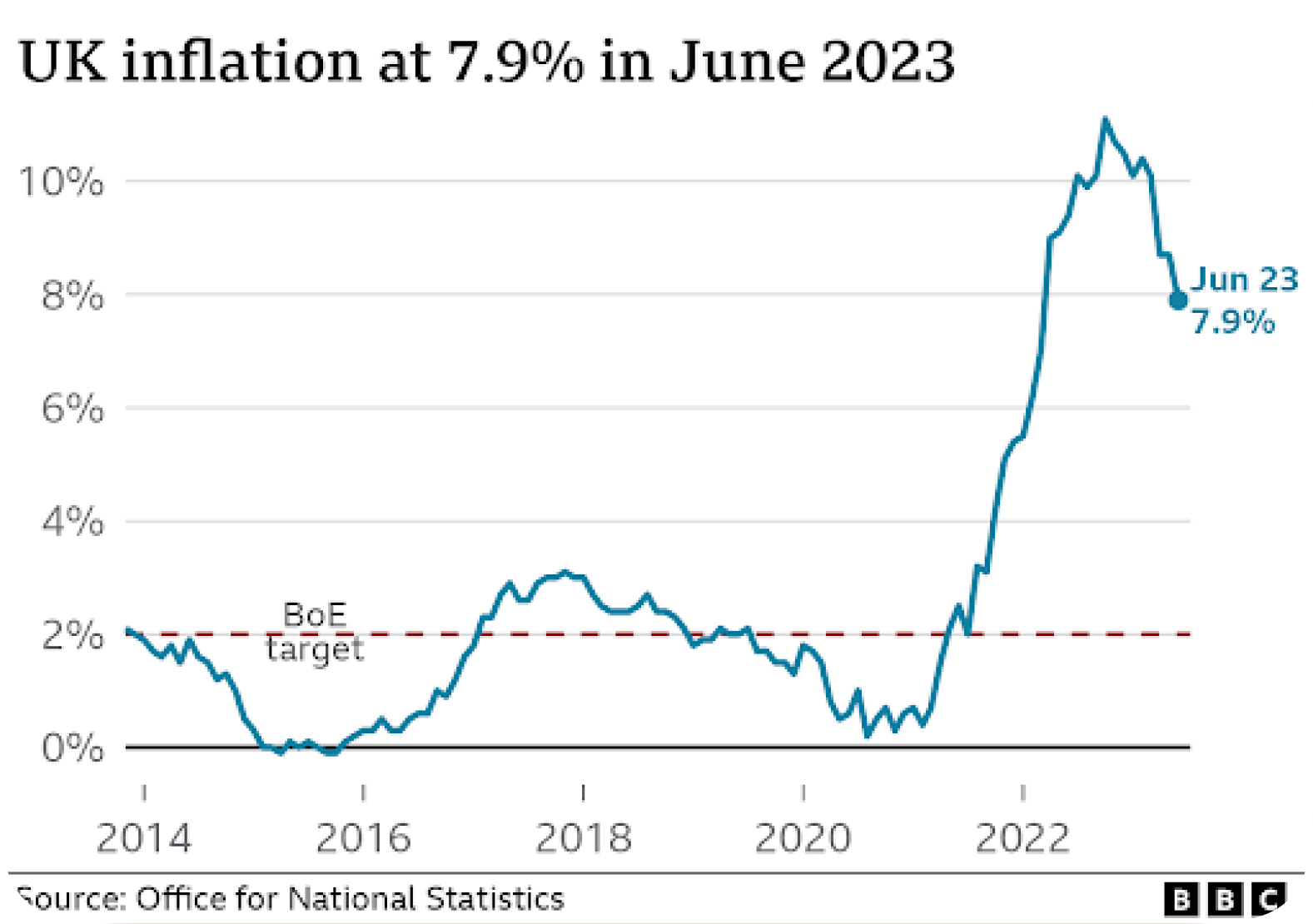

UK inflation finally seems to be falling. Data released in July showed it was 7.9% in June, much lower than the 8.7% in May. The development was unexpected - economists polled by Reuters had projected an annual rise in the Consumer Price Index (CPI) of 8.2%.

Despite this decrease, annualized inflation continues to exceed the Bank of England's 2% target.

The largest downward contributions to the monthly change in the CPI annual rate were made by the falling price of fuel, according to the Office for National Statistics. Food prices also increased in June, but at a slower pace than the same period last year.

UK inflation, despite coming down, remains close to its all time high over the last decade.

The fall in inflation means that an interest rate rise of 0.25% rather than 0.5% is more likely at the Bank of England’s next meeting on August 3rd. Although inflation remains much higher than the BoE’s target of 2%.

European Central Bank raises interest rates

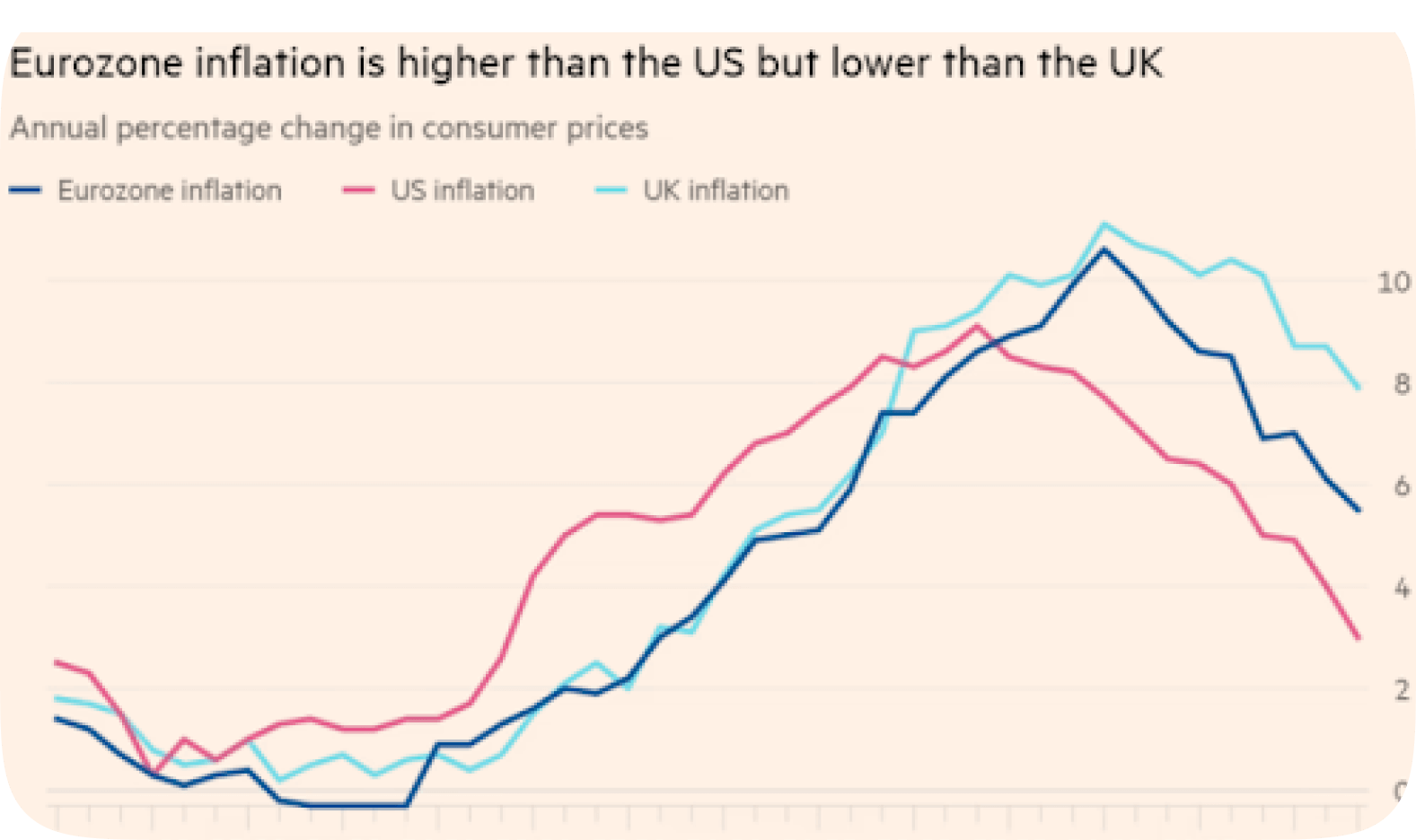

The European Central Bank (ECB) raised interest rates to a record high in an effort to tame inflation despite it falling faster than expected in the Eurozone.

The European interest rate now stands at 3.75% as of 27th July, equal to its record high in 2001 when it was trying to boost the value of the newly launched Euro.

In a policy statement in May, the ECB committed to adjusting interest rates to a "sufficiently restrictive" level to control inflation and align it with the 2% target set by rate decision-makers.

US is no longer forecasting a recession

The Federal Reserve raised the US interest rate by 0.25% on 26th July to 5.5%, its highest level in 22 years and said rates could rise even further this year as it also battles to bring down inflation.

So far, it seems to be winning the fight. Inflation in June fell sharply to 3%. Despite higher interest rates the US labour market and economy remain strong and many analysts now believe the Fed will be able to pull off a “soft landing” for the economy and avoid a recession.

The Fed’s own economists said their forecasts show a “noticeable slowdown in growth starting later this year”, but given the resilience of the economy recently they are no longer forecasting a recession.

UK inflation remains higher than that of the Eurozone and the US. Source: FT.

Big tech earnings

A few of the big tech companies have already reported their earnings for the most recent quarter with Apple and Amazon due to report theirs on 3rd August.

Netflix

Netflix lost 8.4% after missing revenue estimates and posting lower than expected guidance for the third quarter. It was the stock’s biggest single day drop since last December. Netflix gained 5.9 million subscribers in the quarter, meaning it now has 238 million subscribers worldwide.

Tesla

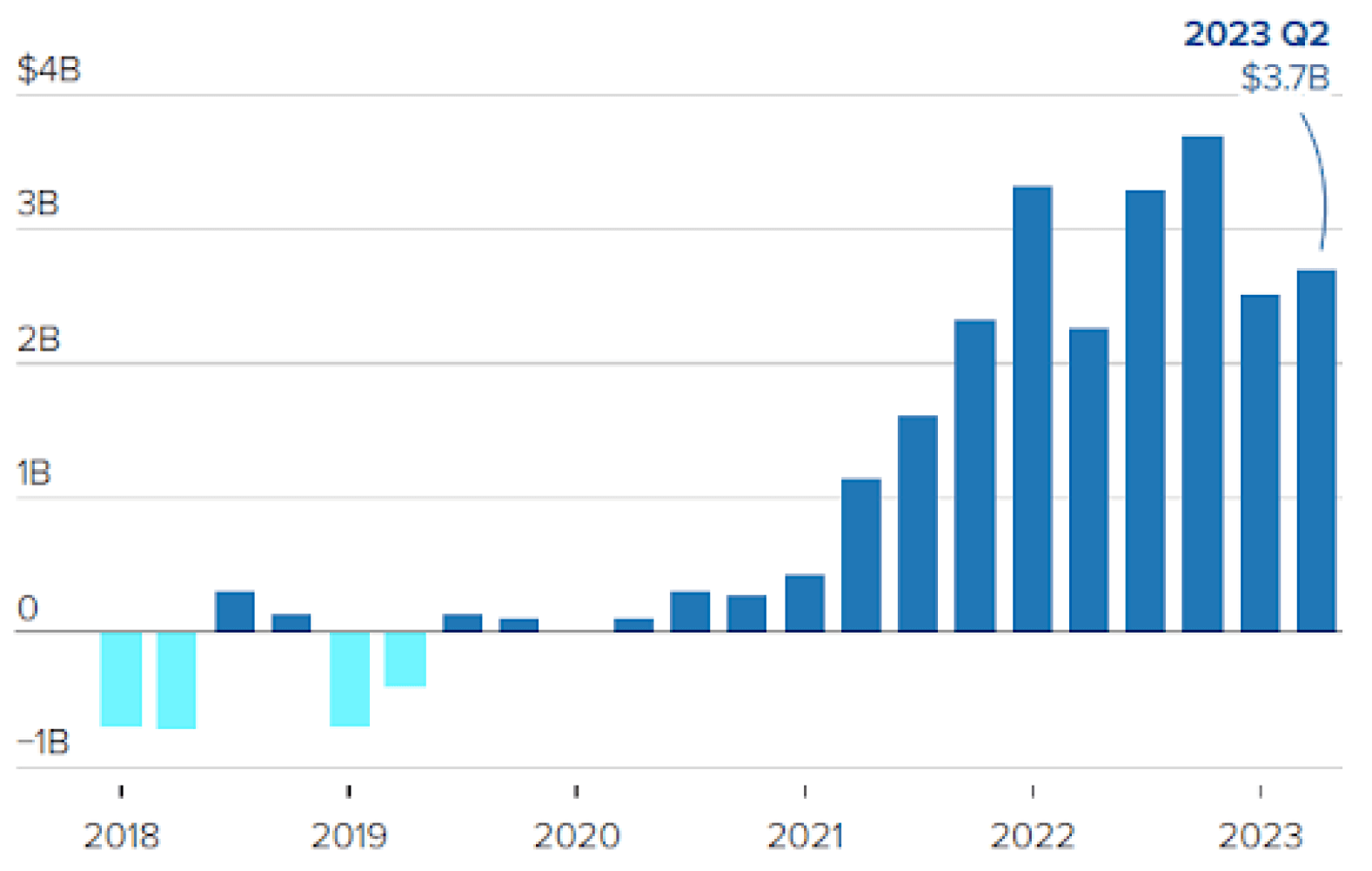

Tesla shares fell 9.7% after it announced its latest earnings report on the 19th July, its biggest drop since early January. Despite reporting a record revenue for the quarter of $24.9 billion, the electric car maker announced profit margins had slipped after it cut the price of its vehicles to boost sales. Its revenue is soaring but profits are lagging behind.

Tesla’s quarterly net income. Source: CNBC.

Microsoft

Microsoft announced worse than expected revenue for the quarter and said that extra spending on AI product development will likely harm gross margins in the future. The company seems focused on the long term potential of AI however and most analysts still seem to see Microsoft as an AI powerhouse over the next decade. Many believe that the short term cost of its development is well worth the long term gain.

Alphabet

Alphabet, Google’s parent company, reported better than expected Q2 earnings. I beat analyst expectations for both revenue and earnings per share. This was largely driven by cloud computing growth and search and advertising.

Revenue from Google Ads, YouTube, and Google Cloud all beat forecasts. Google also said investments in AI development are likely to be “elevated” for the rest of 2023 and all of 2024.

Meta

Meta’s earnings also topped analyst estimates and the company issued better than expected guidance for the next quarter. Revenue was up 11% from Q2 2022, the first time the company has recorded double-digit growth since the end of 2021.

The company also expects revenue to grow 15% in Q3 of this year compared to Q3 2022.

We continue to see strong engagement across our apps and we have the most exciting roadmap I’ve seen in a while with Llama 2, Threads, Reels, new AI products in the pipeline, and the launch of Quest 3 this fall.

Meta’s Llama 2 is perhaps the world’s leading open-source large language model and is now one of the company’s leading products and the main competitor to OpenAI’s GPT and Google’s Bard.

Conclusion

So far it’s been a mixed earnings season for the big tech companies. Those focussing on cloud and AI development seem to have fared well.

Tesla’s falling margins were expected given its price cuts but there were no major announcements around full self-driving which is where a lot of the company’s current value is based on. Netflix performed worse than expected and it's unclear how the current actor and writer strike will affect the streaming company.

It will be interesting to see how Amazon and Apple performed in Q2 on August 3rd.

Make sure to download the Shares app!

Make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

This content is for educational purposes only. Shares does not provide investment advice. If you are unsure about anything, please seek advice from an authorised financial advisor. Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.