2023 - A Great Year for US Stocks

2023 will be remembered as a landmark year for the stock market, with the technology sector at the forefront of the resurgence.

The big story of the year is undoubtedly the AI breakthroughs which have seen improvements in products like ChatGPT and a rush to release similar chatbot services from a whole host of tech companies including Google, Meta and Amazon.

The resurgence of the tech sector ignited investor enthusiasm, drawing both seasoned and new investors to the promise of high returns. This influx of investment was driven not just by the potential for short-term gains but also by a belief in the long-term transformative impact of these companies and technologies.

Despite facing challenges like regulatory scrutiny and privacy concerns, the tech sector shone through, further cementing its appeal to investors. The positive sentiment spilled over into other sectors, creating a domino effect that buoyed the entire stock market.

Central banks, especially the Federal Reserve in the US, played a pivotal role in shaping the stock market through its monetary policies. The decision to reduce interest rates, aimed at controlling inflation while supporting economic growth, had a big impact on investor sentiment and stock valuations. As rates were cut, the stock market rose.

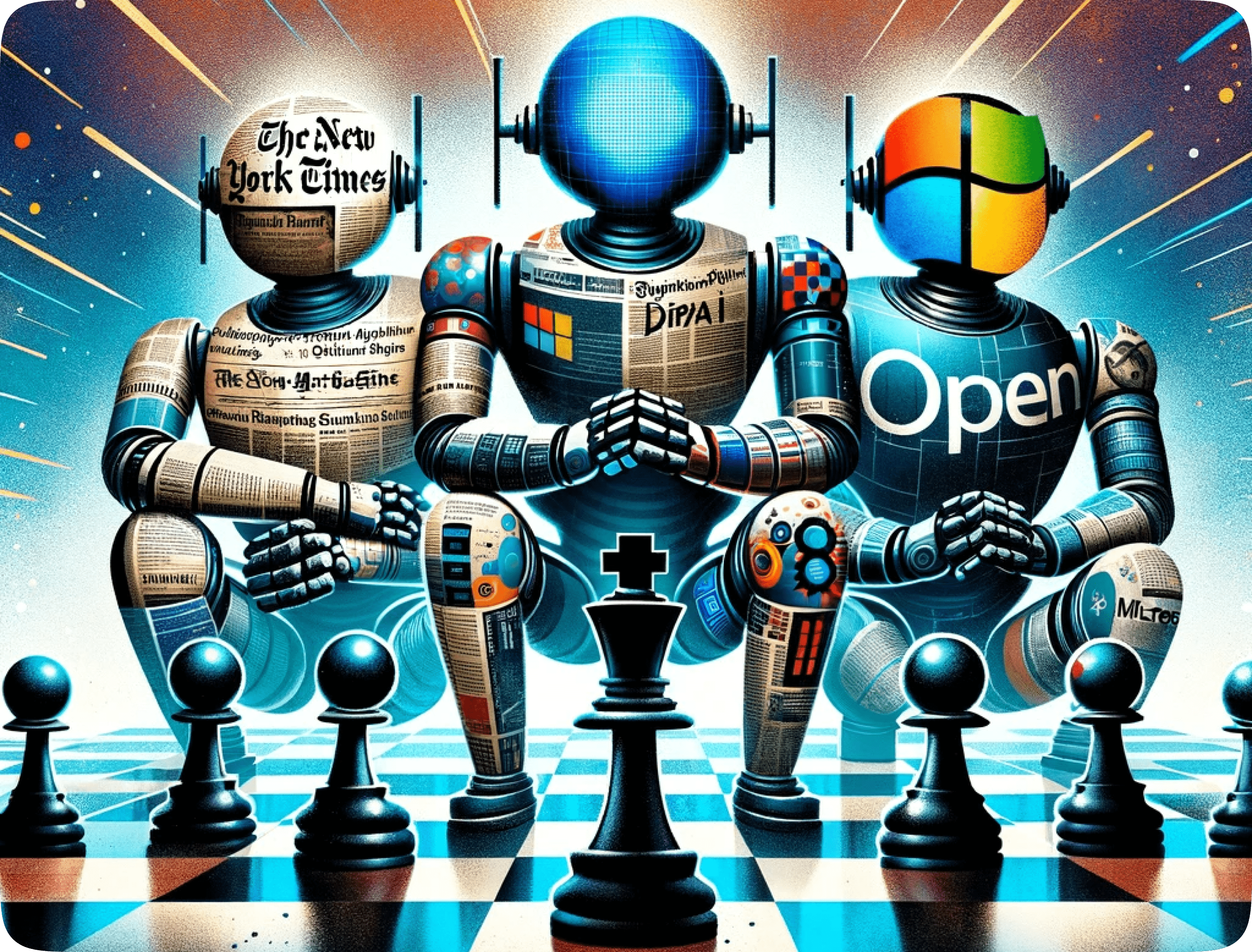

OpenAI and Microsoft in Hot Water with The New York Times

The New York Times opened a lawsuit against OpenAI and Microsoft on 27th December in a move that has sent shockwaves through the tech world.

This legal battle is not just about a dispute between a media giant and tech behemoths; it's a case that could have far-reaching implications for the future of AI and its role in our society.

At the heart of this lawsuit are complex issues surrounding intellectual property, ethics, and the responsible use of AI technology. The New York Times alleges that OpenAI, with Microsoft's backing, has misused its content, potentially infringing on copyright laws and raising serious ethical concerns about AI-generated content.

This lawsuit could be a watershed moment for the AI industry, with several potential outcomes:

We could see a push for more stringent regulations governing AI development and usage. This could mean new laws and guidelines that dictate how AI can be used, especially in relation to content creation and intellectual property.

The case could force AI developers and companies to take a more cautious approach, ensuring that their innovations do not overstep legal or ethical boundaries.

The case will likely influence public opinion on AI. A ruling against OpenAI and Microsoft might lead to increased skepticism and concern about AI technologies.

The image above was, ironically, created by ChatGPT, but will the New York Time’s lawsuit put an end to the use of some types of content in AI generated images.

The battle is a pivotal moment that could define the trajectory of AI development and its integration into society. The outcome of the case will likely shape how AI is perceived, regulated, and utilized in the coming years.

Looking Ahead to 2024

As we enter 2024, investors around the globe are poised to navigate a year that promises both challenges and opportunities. With the global economy in a state of flux, technological advancements continuing at a rapid pace, and significant political events on the horizon, 2024 promises to be an interesting and pivotal year, both in the stock market and further afield.

The global economic landscape in 2024 is expected to be shaped by several factors:

Declining inflation and interest rates: Central banks' responses to inflationary pressures will be a critical factor. Interest rate policies will significantly impact bond markets, real estate investments, and stock valuations.

Technological Innovations: Breakthroughs in AI, clean energy, and biotechnology are likely to drive growth in specific sectors. Investors should stay informed about emerging technologies and their potential market impacts.

Geopolitics and Global Elections: 2024 is set to be a year of significant political events, including key global elections in the UK and the US. Political shifts can lead to changes in fiscal policy, international trade agreements, and regulatory environments, all of which will likely affect the stock market this year.

2024 will be a complex tapestry of investment opportunities and challenges. As always, diversification remains a key tenet, helping investors navigate uncertainties and capitalize on emerging opportunities in a dynamic global market.

Download the Shares app today!

Make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

This content is for educational purposes only. Shares does not provide investment advice. If you are unsure about anything, please seek advice from an authorised financial advisor. Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.