Nvidia’s Blowout Earnings

Nvidia's latest Q2 financial results underscored the grand potential of generative AI.

The semiconductor giant is spearheading AI advancement with its A100 and H100 AI chips playing a pivotal role in driving AI tools like ChatGPT and Midjourney.

In recent times, the appetite for such sophisticated applications has surged, prompting infrastructural changes to support them.

At the end of the month, the Biden administration even banned sales of Nvidia’s most advanced chips to the Middle East to prevent them from being sold on to China.

Numerous cloud service vendors are currently embedding Nvidia's H100 AI technology into their data centres. As Nvidia CEO, Jensen Huang, remarked, "Generative AI is the next frontier."

Established in 1993, Nvidia has ascended to the pinnacle of chip design, fuelling today's digital age.

Their Q2 financial performance was impressive, recording revenues of $13.51 billion, which not only outpaced Wall Street's projections but also marked a twofold increase from Q2 in the previous fiscal year.

Their net profit also shot up, totalling $6.18 billion, marking a significant jump from the prior year's figure of $656 million.

Though Nvidia's gaming division continues its growth trajectory, it's the company's data centre operations that are grabbing headlines, raking in an impressive $10.32 billion during Q2.

Earlier this quarter, Huang looked back at Nvidia's pivot in 2018 toward AI-driven image processing. This strategic direction has borne fruit, with forthcoming quarters expected to showcase further growth - the company forecasts Q3 revenues to hover around $16 billion.

US Job Market Cools

The US job market showed signs of slowing in August, leading many to believe that the Federal Reserve is successfully managing the smooth transition of the world's leading economy.

Investors are optimistic about a balanced situation where inflation is tamed without triggering a recession. Recent data showed a rise in unemployment, modest job growth, and salaries returning to levels seen before the pandemic.

Andrew Hollenhorst, an economist at Citibank, remarked, “If the Fed could have put together their ideal employment report, it would look something like today,” However, he cautioned against over-relying on a single month's figures.

Can the Fed finally fix the inflation jigsaw and lead the US economy to a soft landing?

Most investors anticipate the central bank will maintain current rates during its upcoming late September session.

The job market's performance is under scrutiny by investors and policymakers since it has a big impact on inflation.

US President Joe Biden, dismissed experts who believed drastic measures were necessary to stabilize prices. He highlighted consistent efforts to control inflation alongside job creation and wage growth and said they were having the desired effect.

Data from the Bureau of Labor Statistics revealed that unemployment rose to 3.8% last month, against expectations of staying steady at 3.5%.

Monthly wage growth was slightly below forecasts, yet the annual growth rate of 4.3% still surpasses the Fed's 2% inflation goal.

Recent data has also indicated a dip in job vacancies, suggesting a decrease in demand for labor.

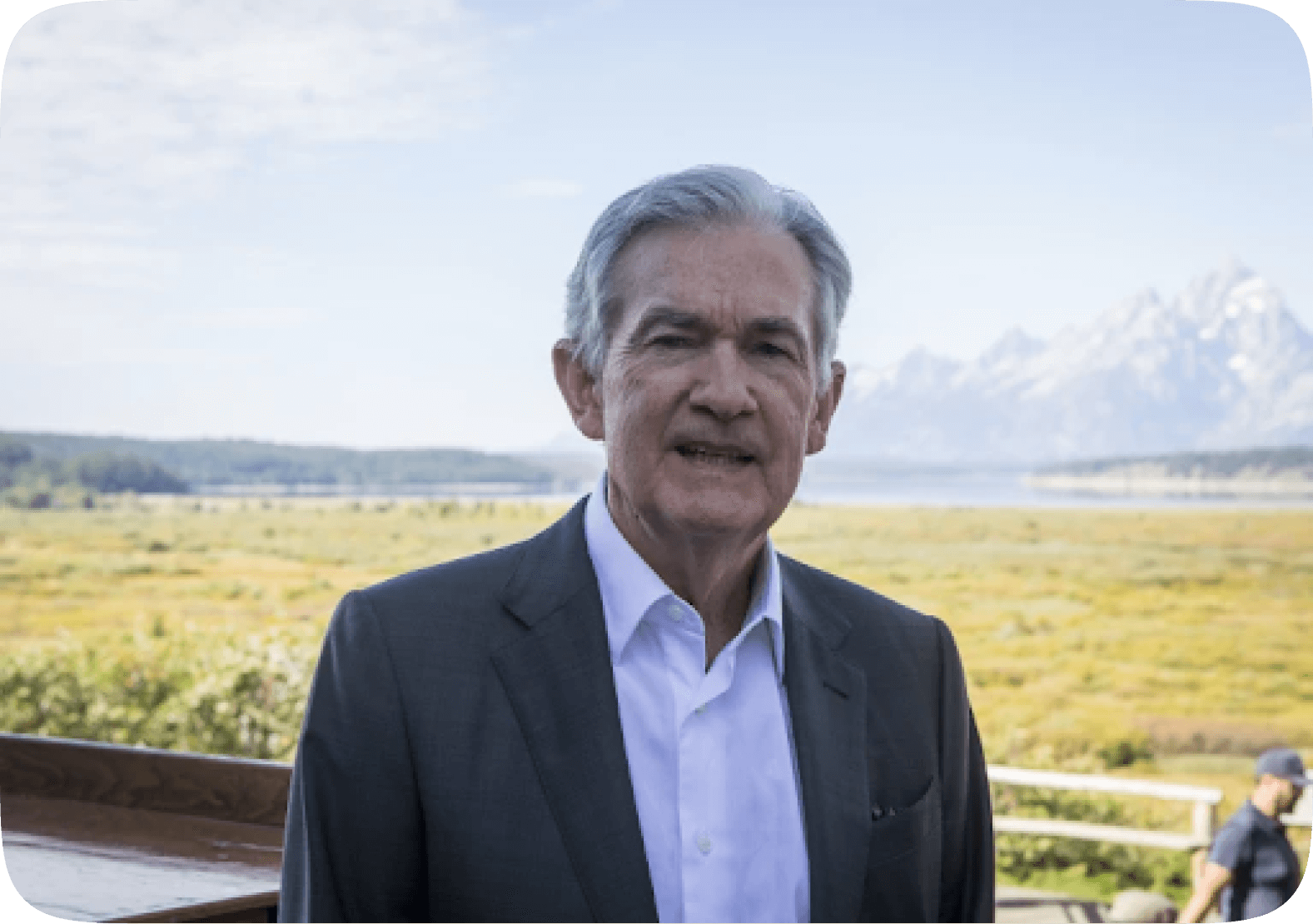

Chair of the Federal Reserve, Jerome Powell, has said that he’s not afraid to increase rates even further if it’s needed to lower inflation.

Last week, Fed chair Jay Powell said at an economic symposium in Jackson Hole, Wyoming, that the bank remains open to further rate hikes if needed but will exercise caution to ensure the broader economy's well-being.

UK House Prices Fall at Fastest Rate since 2009

UK house prices saw a decline of 5.3% in August 2023 compared to their peak in August 2022. This marks the quickest yearly dip since the financial crisis of July 2009 according to Nationwide Building Society.

This sharp fall is largely attributable to skyrocketing mortgage costs discouraging potential buyers.

In a month-on-month comparison, prices decreased by 0.8% in August from July, bringing the average cost of a UK home down to £259,153.

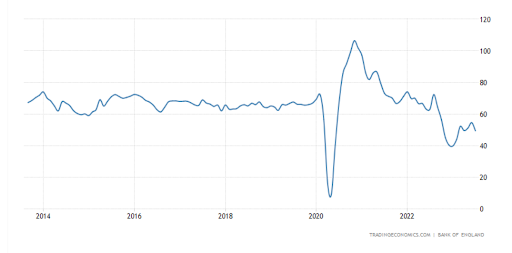

UK mortgage approvals have risen slightly from their lows in the past year but remain far lower than they were for most of the 2010s.

The average house price now stands at over £14,600 less than last year, with mortgage approvals declining by 20% compared to levels before the pandemic.

Mortgage rates have surged following numerous interventions by the Bank of England, which has upped its interest rates 14 times since December 2021 from 0.1% to 5.25%.

The first half of the year saw a 20% decrease in completed house sales compared to 2019. This is a 40% drop from 2021 when the UK underwent a housing sales surge due to low interest rates and the government's stamp duty holiday.

In a recent assessment, property portal Zoopla projected that 2023 would witness the fewest UK home sales in over a decade, attributing this to the escalating cost of mortgages deterring buyers.

House sales for 2023 are projected to decrease by 21% annually, amounting to around 1 million — a number not seen since 2012.

Download the Shares app today!

Make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

This content is for educational purposes only. Shares does not provide investment advice. If you are unsure about anything, please seek advice from an authorised financial advisor. Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.