US inflation falls

Data released in April showed that inflation in the US fell to its lowest level in two years driven by falling energy prices. Oil and gas prices are now about 6.4% lower than they were this time last year, although housing costs are still 8% higher.

Prices rose just 0.1% month over month. Food prices remained unchanged from the previous month and house prices rose very slightly but this was offset by energy prices falling by 3.5%.

Falling oil and gas prices are the main reasons global inflation is starting to slow, good news for consumers!

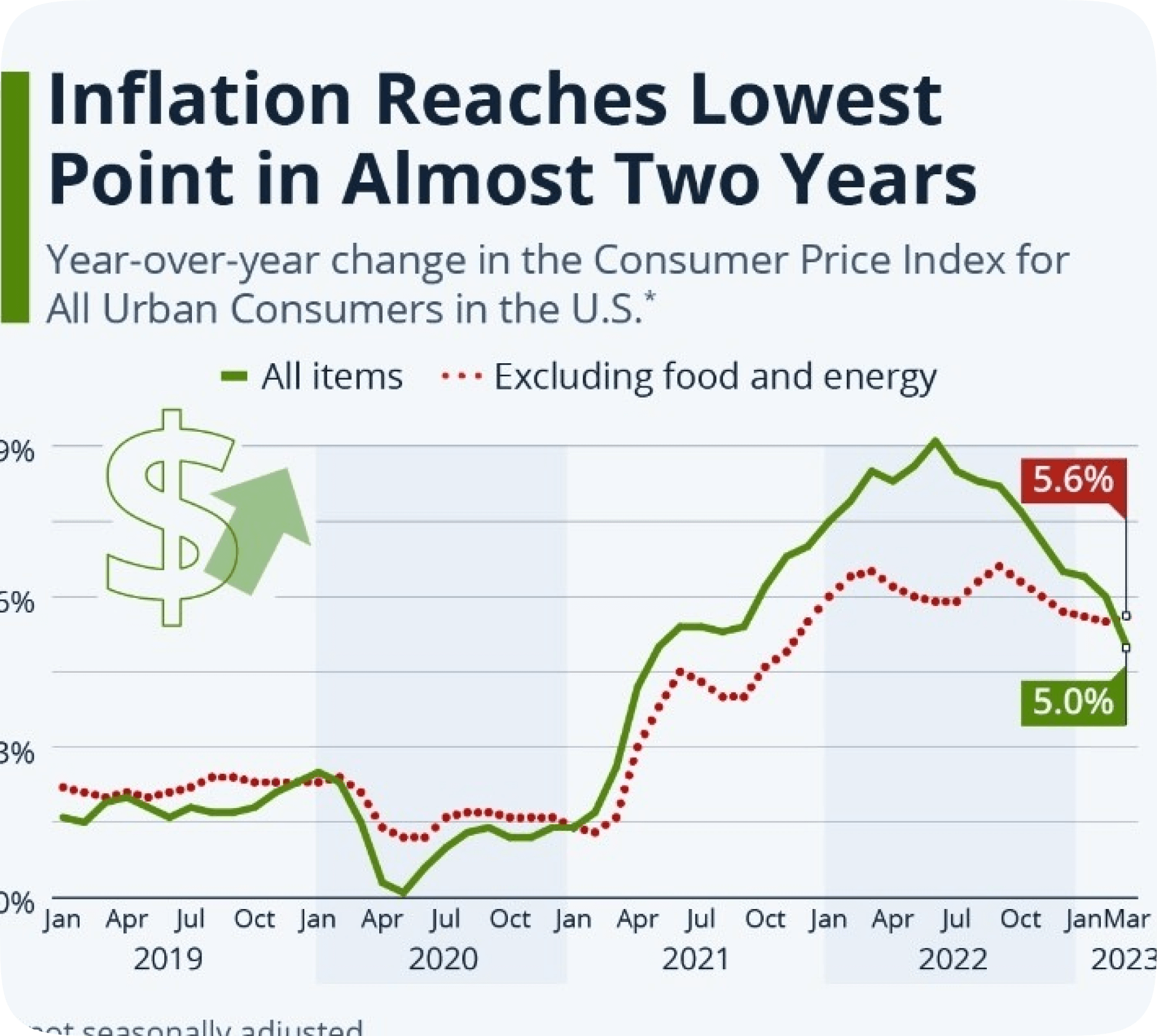

In early 2021, inflation spiked due to a reversal of the pandemic’s cooling effect on prices a year earlier. At the onset of the pandemic, prices fell due to a sudden drop in spending, before slowly climbing back to their pre-pandemic level over the second half of the year.

Going forward, inflation rates will appear lower as they’re now being compared to prices that spiked after the war in Ukraine began.

Year over year inflation is still at 5%, significantly higher than the Federal Reserve’s 2% target, but thankfully much lower than the 11.2% of last June (Source: Statista)

It seems that the Federal Reserve’s interest rate hikes are having their desired effect of reducing inflation. The last time inflation was this low was in May 2021. Analysts expect at least one more rate hike in May but interest rate increases may soon be over, although the road back to 2% will be bumpy and there is a chance inflation will remain stubbornly high.

Ethereum’s Shanghai upgrade completed

Ethereum’s Shanghai upgrade was completed on April 12th. Staking, the process of locking up ETH to receive income from it, helps to secure and validate transactions on the blockchain, and had meant that about 18 million ($36 billion) of ETH was locked into the network.

The upgrade means people can now un-stake their ETH and sell it. You might have thought this would cause a fall in the price, but the price spiked, rising 5% in the 24 hours after the upgrade.

Data from CryptoQuant, showed that in the 4 days after the upgrade 1.1 million Eth ($2.3 billion) was deposited within exchanges whilst only 923,000 ($1.95 billion) was removed.

Coinbase was one of the first exchanges to let users immediately unlock and withdraw their staked ETH via its platform. Binance, the world’s largest crypto exchange by volume, followed suit on April 19th.

Before the upgrade, analysts disagreed on the impact the split would have. Some were worried the upgrade would flood the market with millions of unlocked ETH and crash the price. Others thought there would be little impact or that the price would actually rise.

News of a seamless implementation pushed ETH’s price above $2,100 the following day, outperforming Bitcoin and marking its highest level since May 2022. As of 27th April, Eth was trading at $1,887, up 1.10% in the last 24 hours.

More good news

Strong wage growth in the UK

Strong wage growth in the UK is good news for most but gives the Bank of England a hard decision on whether to raise interest rates or not when it meets on 11th May. The labour shortages that have fuelled wage rises are slowly starting to ease, but the fact they remain stronger than expected will add to fears of more persistent inflation.

China’s better than expected GDP

Data out of China showed that its GDP grew by 4.5% in Q1 of this year, much more than analysts expected and significantly higher than the 2.9% in Q1 of 2022. The main reason was stronger retail sales which were up by a whopping 10.6%.

Tesla’s new manufacturing process

Tesla’s earnings report on April 19th wasn’t great (net income fell 24% from Q1 of 2022 and margins dipped below 20% to 19.3%) but it did announce it’s found a way to reduce production costs of electric vehicles by 50%. During a four-hour presentation, the company discussed the global economy's potential transition from combustion engines to electric power and presented its strategy to significantly increase the production of electric vehicles.

With all the positive economic news out in April, let’s hope May is just as good!

Make sure to download the Shares app!

Make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

This content is for educational purposes only. Shares does not provide investment advice. If you are unsure about anything, please seek advice from an authorised financial advisor. Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.