💡 If you want these updates delivered to your inbox every Friday, sign up here

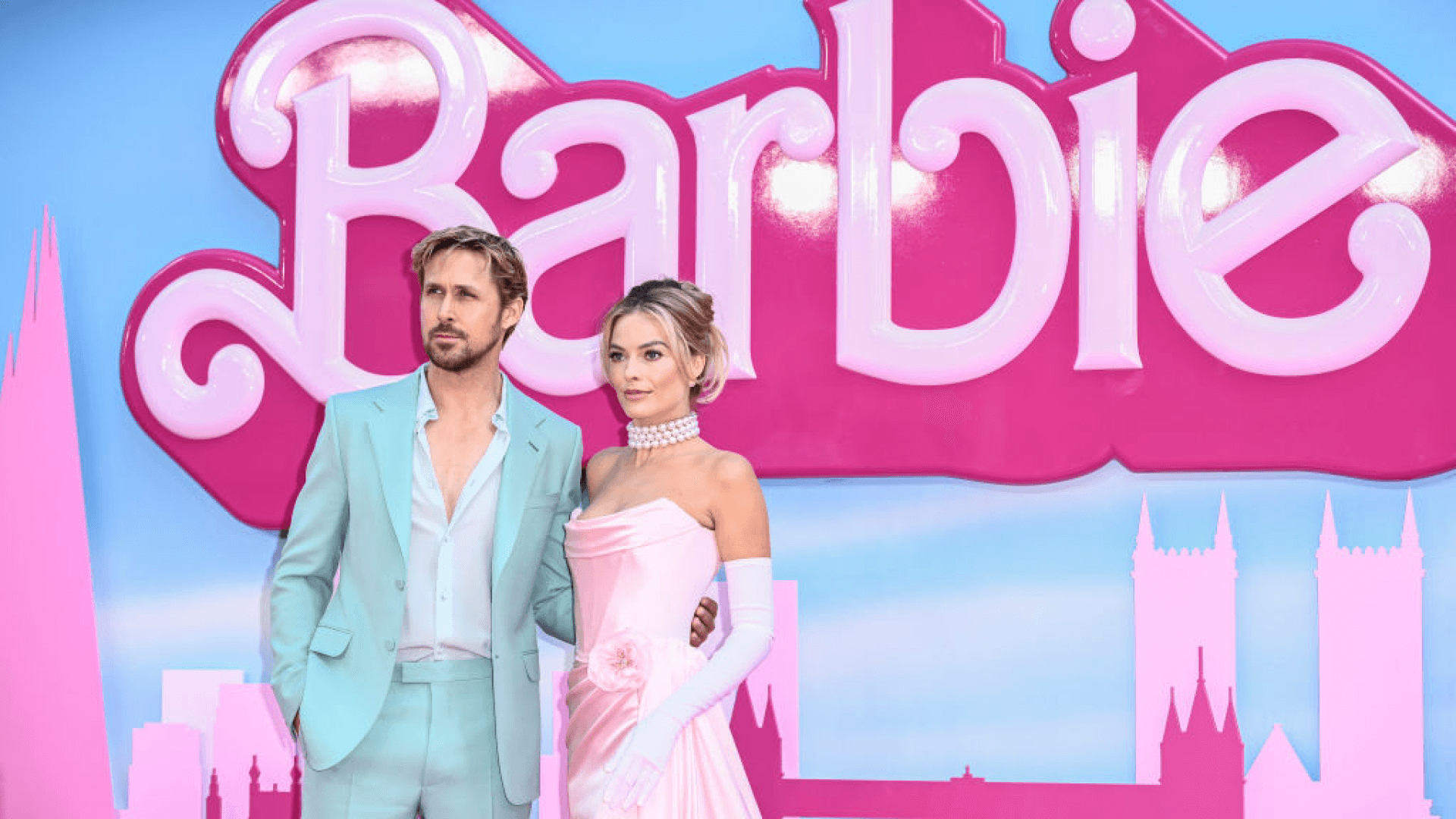

Mattel shares jump 6% ahead of Barbie’s release 👚

Life’s fantastic: Mattel, the global toy manufacturer who makes Barbie dolls, is capitalising on the huge buzz surrounding the upcoming Barbie film. With a significant 27% of its revenue tied to the iconic doll, the film's release is bound to impact Mattel’s performance this quarter. Certain investors have been buying shares ahead of the film's release on July 21st.

Anything is possible: Right now, investors are looking ahead and predicting what could happen. A popular film may mean more toy sales, and ultimately, profit.

A much-needed boost: From senior execs cooking the books to losing its position as the number one toymaker in the world, Mattel has had a difficult few years. Is Barbie Mattel’s

knight in shining armourprincess in bright pink?

Zoom climbs 5% thanks to AI and mobile growth 🖥️

Post pandemic doom could be over for Zoom: Zoom shares have fallen a staggering 87% since the COVID-19 pandemic, but since January, the stock is up 5%. Investors are now excited with its upcoming AI plans and mobile division growth.

Zoom IQ: Zoom plans to expand Zoom IQ, its AI feature that can summarise your calls with chat threads and whiteboard sessions. It’s also invested in Anthropic, a start-up founded by members of the OpenAI team who are specialising in using AI responsibility.

Zoom on mobile: Zoom’s phone solution now makes up 10% of its revenue, offering services like unlimited domestic calls, text messaging and call recording. The division has grown over 100% year over year, and it seems investors have taken note.

Activision Blizzard soars 11% as Microsoft takeover edges closer 🎮

The takeover that’s taking forever: Microsoft has been wanting to acquire video game company Activision Blizzard for 18 months. But regulators have been blocking what would be the biggest tech deal in history over worries that it would stifle competition in the fast-growing gaming market.

Things are looking up: This week, a federal judge announced they will not block the $69 billion deal. This is good news for Activision Blizzard investors as when a company is being bought, a premium is often paid on shares meaning the stock rises in value.

Looking ahead: The deal would also see Microsoft take control of the Call of Duty and World of Warcraft franchises. How would the Microsoft stock react to that news? We might just find out.

What have we learned this week? 🤓

Pop culture affects the stock market: We saw it with The Flash, and now we’re seeing it with Barbie. Films often have a knock on effect, and in this case, it’s merchandise. If demand for Barbie dolls rises, it’s realistic to think the stock will too.

Balance sheets are an investor’s secret weapon: If you think of Zoom, you probably picture a video call taking place on a desktop, right? Savvy investors have cottoned on to the fact that it’s Zoom’s mobile division that is growing quickly.

Gaming is a booming market: When the second largest company in the world wants to buy another business for almost $70 billion, you know it’s a fast-growing market. Microsoft appears to be going full steam ahead with its focus into gaming.

Thanks for tucking in! Want to receive these updates every Friday? Sign up here or share via WhatsApp with your friends.

*Figures correct as of July 12th 2023.

Past performance does not guarantee future results. Capital at risk when investing. This content is for educational purposes only. Shares does not provide investment advice. If you are unsure about anything, please seek advice from an authorised financial advisor.