It’s been a pretty ‘sporting’ week for the stock market. Man Utd’s takeover talks have ramped up, On has been given the advantage by Roger Federer, and Nike really did ‘just do it’ when it came to last quarter’s revenue. Grab a spoon folks, you know what time it is.

💡 If you want these updates delivered to your inbox every Friday, sign up here

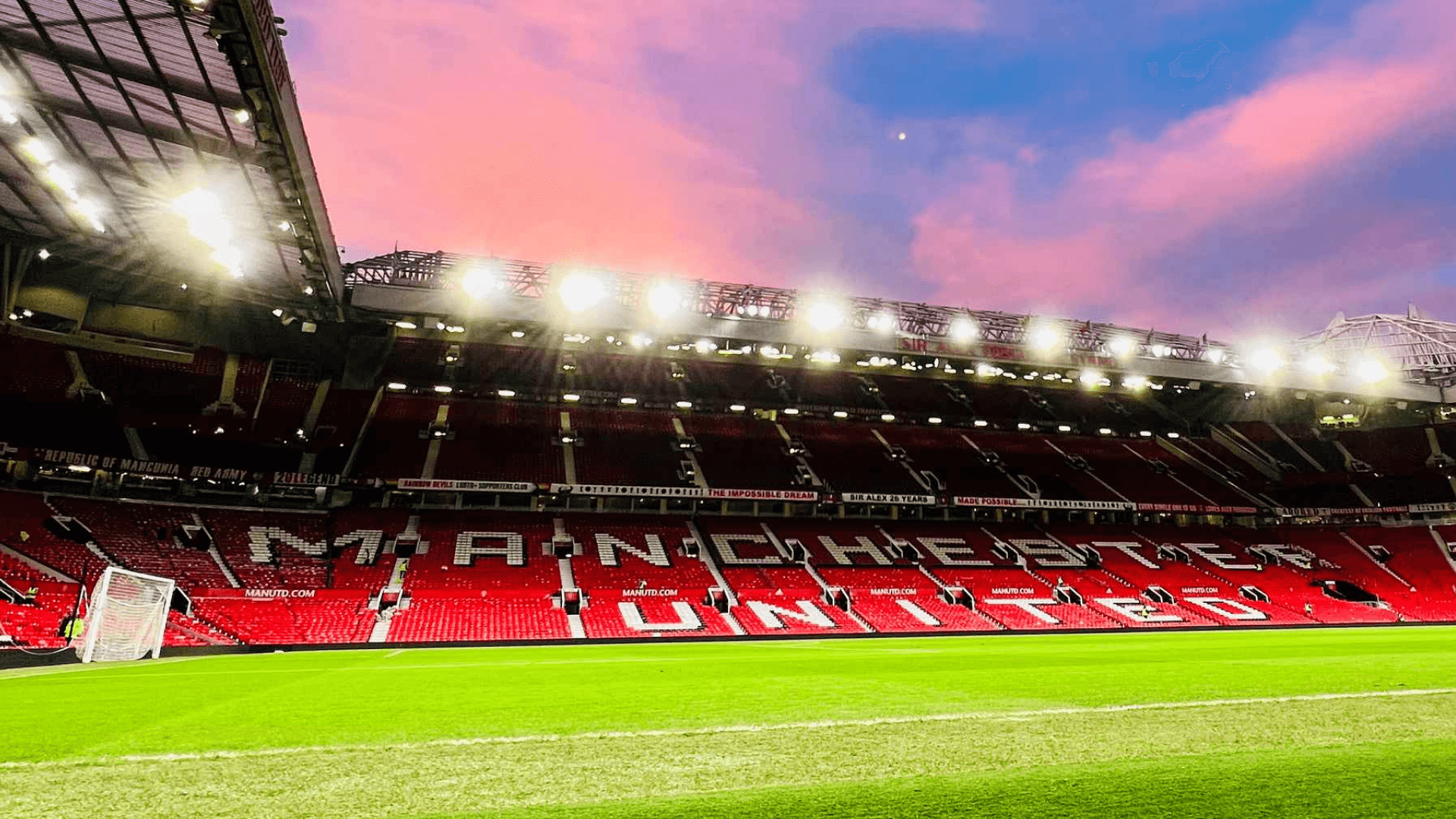

Manchester United stock scores as it climbs 14% ⚽️

Glory, glory Man Utd: According to Sky Sports, the Qatari banker Sheikh Jassim is willing to overpay for the Premier League club because he’s so eager to take charge.

A clean sheet of debt: Man Utd is in over half a billion’s worth of debt, but thankfully for shareholders (and fans), the Premier League’s liberal set of laws has made buying British football clubs something of a fashion for foreign investors. Sheikh Jassim has even said he’s willing to wipe off all existing debt.

Sheikh Jassim 1, Sir Jim Ratcliffe 0: Britain’s richest man, Sir Jim Ratcliffe, is Jassim’s main competition. But this week, Ratcliffe said he refuses to pay a ‘stupid’ price for the club. His opening offer was reportedly £4bn, whilst the current owners (the Glazers) are supposedly holding out for an offer around £6 billion.

Swiss sportswear brand, On, surges 27% 👟

The new kid on the block: In case you haven’t heard, On is a Swiss-based sportswear company that holds 40% market share in Switzerland and is now looking to enter new markets.

A swing towards profitability: Whilst only being public for a year, it significantly cut its losses in its fourth quarter results. Sales entered the billions at $1.29 billion, causing the stock to surge.

The Federer effect: On signed the world’s number 1 ranked women’s tennis player, Iga Swiatek, and rising American star Ben Shelton as ambassadors. How? It might help that the legendary tennis player Roger Federer is a major investor in the company!

Nike stock ticks up 8% ✅

Positive earnings: Nike shares jumped 8% this week, thanks to its Q3 earnings report released on Tuesday.

Up $900 million in revenue: Nike outperformed analysts’ expectations by almost $1 billion, as sales were up 27% in North America and 17% across EMEA. Nike’s attention will now turn to China, where sales slipped 8% due to sweeping lockdowns and rising infections.

Ambassadors were a slam dunk: Nike experienced strong demand for its sneakers, including the Jordan Retro and LeBron 20, which both helped grow its market share. This is in contrast to adidas, who still can’t decide what to do with excess Yeezy stock.

What have we learnt this week? 🤓

Foreign investors love football in Britain: Ever wondered why British football clubs receive so much foreign investment? Liberal laws favour buyers, so much so, they’re often prepared to overpay for a club.

Ambassadors are key drivers in the sportswear industry: On and Nike have both benefited from their work with ambassadors in the last quarter. On has been able to enter the tennis market, whilst Nike has leveraged sales using global basketball icons LeBron James and Michael Jordan.

Most public companies in sport are apparel based: For investors interested in the sports industry, the money often lies with apparel companies.

Thanks for tucking in! Want to receive these updates every Friday? Sign up here or share via WhatsApp with your friends.

*Figures correct as of March 22nd 2023.

Past performance does not guarantee future results. Capital at risk when investing.

This content is for educational purposes only. Shares does not provide investment advice. If you are unsure about anything, please seek advice from an authorised financial advisor.