💡 If you want these updates delivered to your inbox every Friday, sign up here

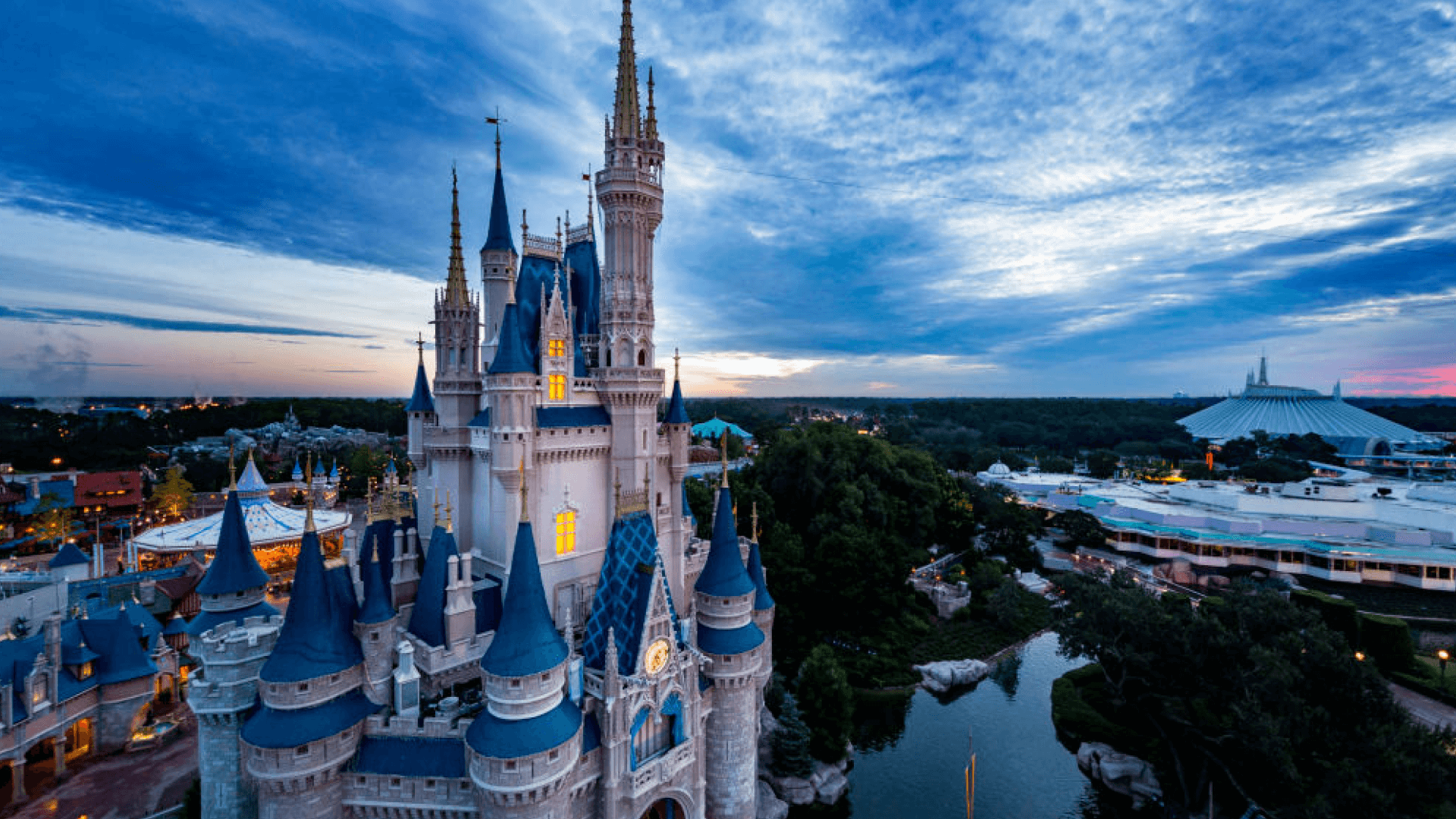

Disney drops 3% as it invests $60bn into theme parks and cruises 🎢

Disney’s adrenaline rush: When you think of Disney, franchises like Star Wars, Marvel and The Simpsons probably come to mind. But last quarter, it was the experiences division that made up over a third of sales, growing 13%. The media division? Declined 18%.

A roller coaster of emotions: Disney parks had a rough time during the Covid-19 pandemic, laying off 28,000 workers. But now, it’s up 42% from 2019. It seems roller coasters, fancy dress and salty snacks are driving Disney’s growth.

So, why are shares down? Disney’s TV business (ABC, ESPN and other major channels) is declining due to the popularity of streaming services. That’s why it’s focusing its growth on theme parks and cruises. But in true Disney fashion, it’s still keeping itself diversified by investing $9bn into its own streaming platform, Disney+.

*Ratings are provided by analysts at Zacks, a leading investment research firm

Pinterest jumps 5% thanks to its Amazon partnership 📍

Pinterest’s gaining interest: On Tuesday, Pinterest held its first investor day. The event was deemed a success, largely because management expect compound growth over the next three to five years, somewhere between 15 to 20%. This compared to growth of 9% last year is music to investors’ ears.

A slow couple of years: Pinterest boomed during Covid-19, but later experienced a slowdown in growth. It made lay-offs, and even its co-founder and former CEO, Ben Silbermann, stepped down. Google’s commerce executive Bill Ready took the reins.

Ready and waiting: As the new CEO, Ready enforced a new strategy of working with other retailers to help consumers buy products outside its own platform. Early results from test ads with Amazon suggest they are performing much better than its current ads.

*Ratings are provided by analysts at Zacks, a leading investment research firm

NIO tumbles 13% as it increases its debt 📝

A bump in the road: On Tuesday, NIO announced it will issue around $1 billion in new debt. Why? Because the company still isn’t making a profit.

NIO’s negative numbers: Last year, NIO reported a staggering loss of $1.6 billion in free cash flow. As a hugely ambitious company, its growth can be rapid which investors like. But this can also make for big losses if it can’t turn a profit.

Buying the dip or steering clear? For some investors, it provides a low point to buy into the stock. For others, it’s a warning that NIO may be profitable one day, but that day could be quite some time away. Check out how NIO could one day steal Tesla’s crown.

*Ratings are provided by analysts at Zacks, a leading investment research firm

What have we learned this week? 🤓

Savvy investors follow the money: Disney has assessed which parts of its business model has the most potential, but savvy investors recognise its number one division is declining.

There’s power in partnerships: Whilst Pinterest and Amazon are competitors, Pinterest knows that’s a battle it isn’t likely to win. Teaming up with Amazon was a smart play, and it’s paying off.

Investors hate the D word: We’re of course talking about debt. Investors often worry when companies take on new debt because it shows they’re running out of cash.

Stocks we're watching 👀

Microsoft: A leak revealed that the next Xbox could feature AI and machine learning. Will Microsoft comment on this next week?

Costco: Shares are up 5% this month. Are investors silently anticipating positive earnings for the retail giant when they’re announced on September 26?

Warner Bros: Max, a streaming service owned by Warner Bros, is adding a live-sports tier to rival YouTube, Amazon and Apple. Will it help or hinder the entertainment giant?

Thanks for tucking in! Want to receive these updates every Friday? Sign up here or share via WhatsApp with your friends.

*Figures and ratings correct as of September 21st 2023.

Past performance does not guarantee future results. Capital at risk when investing. This content is for educational purposes only. Shares does not provide investment advice. If you are unsure about anything, please seek advice from an authorised financial advisor.