💡 If you want these updates delivered to your inbox every Friday, sign up here

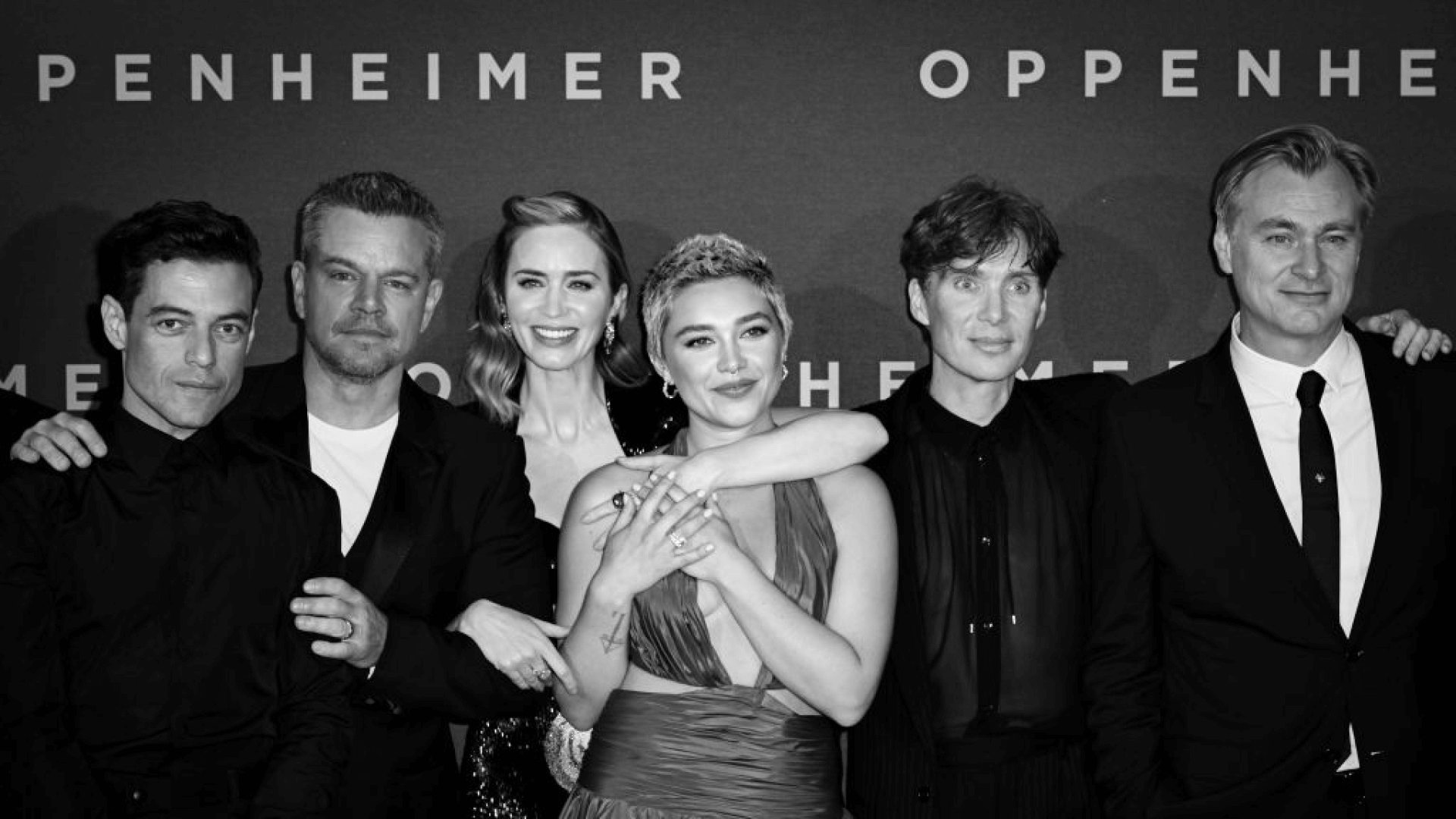

Comcast jumps 4% thanks to Oppenheimer’s success 📽️

And the Oscar goes to… Comcast. The owner of Universal Pictures is up 4% this week as Oppenheimer has been dubbed ‘Oscar worthy’ by numerous critics. Some have even called it the ‘film of the decade’.

Nolan does it again: Christopher Nolan, the director behind The Dark Knight, Interstellar and Inception, has produced yet another box office smash hit. Oppenheimer raked in a tidy $174m during its opening weekend, much to investors’ delight.

A half a billion dollar weekend: Combined, Barbie and Oppenheimer brought in $511m, yet Barbie’s impressive $337m didn’t cause shares in its distributor, Warner Bros Discovery, to move. Although savvy investors will know Mattel shares have been on the up thanks to the iconic fashion doll.

Spotify’s stock slips 10% thanks to its sneaky £1 strategy 🎧

The same old song and dance: On Monday, Spotify became the latest subscription service to announce it’s raising its prices. UK subscriptions will rise by £1 per month for an individual plan and by £3 for a family plan.

Small changes, big results: £1 is nothing, right? Well, Spotify has 210 million premium subscribers. With every customer paying at least £1 more, it leaves Spotify with an extra cash flow of £210m per month.

Unimpressed investors: So why is the stock down? During Tuesday’s earnings call Spotify said they expect the price hike to have ‘minimal impact’ on Q3 earnings. It’s expecting to generate $100m less revenue than analysts projected, which left investors feeling underwhelmed. Can Spotify’s new “supremium” tier raise investor excitement?

Domino’s Pizza climbs 3% thanks to positive earnings 🍕

Tasty earnings: On Monday, Domino’s proved why it’s the world's largest pizza company after announcing strong growth and impressive Q2 earnings.

Smashing Wall Street: Domino’s managed to outperform earnings thanks to… cheese. Yep, you read that right. As well as easing supply chain pressures, Domino’s lowered how much it pays for ingredients like cheese, resulting in a profit.

Domino’s is on the (Uber) menu: Believe it or not, Domino’s has only just partnered with Uber Eats. Starting in September, US residents will be able to order a Domino’s via the popular delivery app. The pro? Domino’s will likely see a surge in orders. The con? Uber Eats will be taking a slice (or two) of the profit!

What have we learned this week? 🤓

A smaller stock is more susceptible: Barbie doubled Oppenheimer’s earnings last weekend, but Universal Pictures is five times smaller than Warner Bros Discovery. The smaller a stock, the more susceptible it is to individual price movements.

Subscription services are in a battle: Subscription-model companies can scale quickly, but they can be risky. In a cost of living crisis, they’re often the first expense a person cuts. Companies are being forced to find new ways of monetising their users.

If you can’t beat them, join them: Domino’s has clearly avoided joining Uber Eats so it can utilise its own delivery network, resulting in better margins. But clearly, Domino’s executives believe it’s a partnership worth exploring. Is its delivery business flagging?

Thanks for tucking in! Want to receive these updates every Friday? Sign up here or share via WhatsApp with your friends.

*Figures correct as of July 25th 2023.

Past performance does not guarantee future results. Capital at risk when investing. This content is for educational purposes only. Shares does not provide investment advice. If you are unsure about anything, please seek advice from an authorised financial advisor.