💡 If you want these updates delivered to your inbox every Friday, sign up here

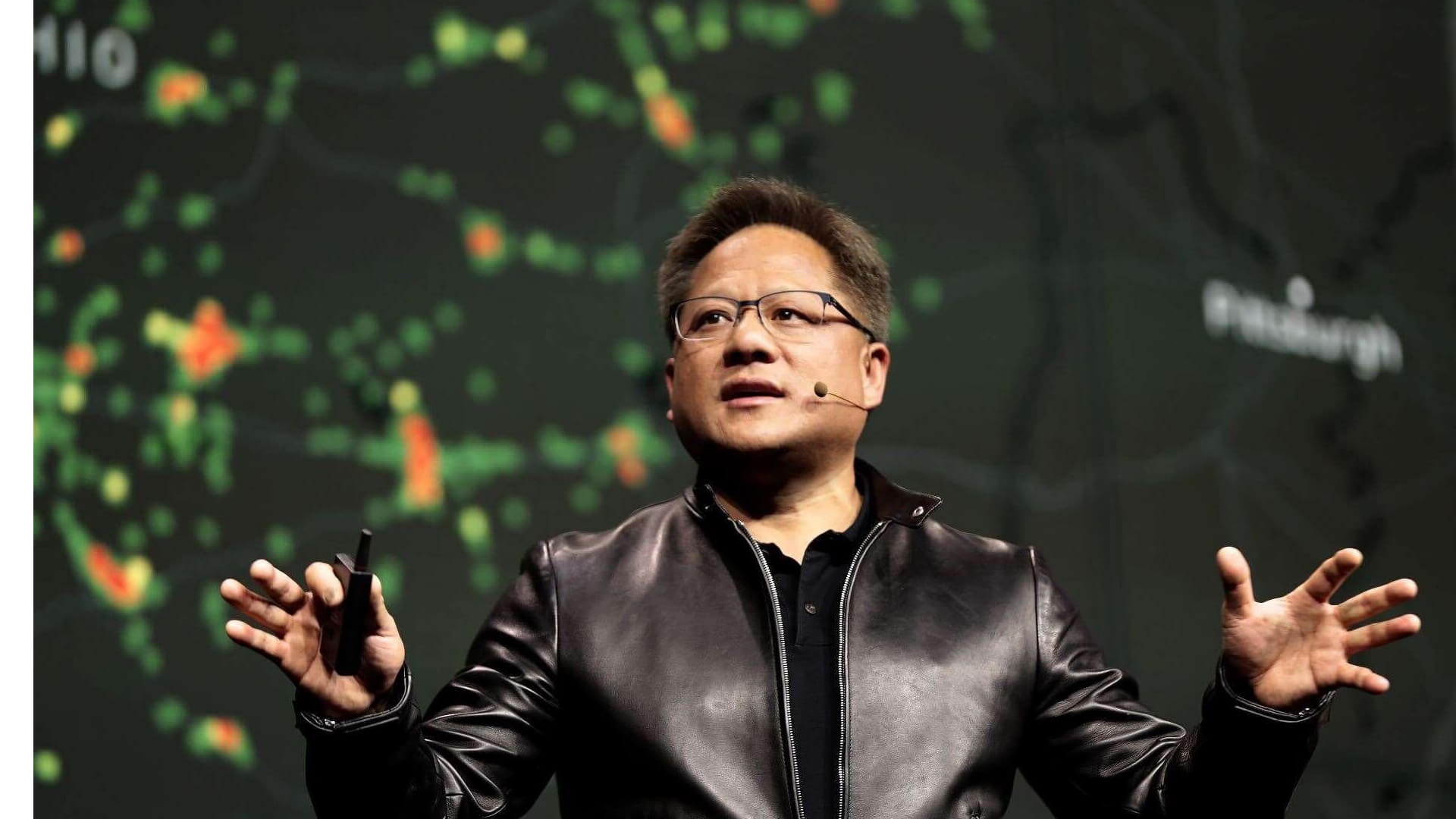

1. Nvidia climbs 250% in 2023 thanks to AI 🤖

Talk of the town: Since ChatGPT was released in November 2022, Nvidia stock has risen at rapid rates as AI has been the topic on everyone’s lips.

Selling shovels in a gold rush: Amazon, Microsoft, Google, and its largest customer, Tesla, are just some of many companies that rely on Nvidia to supply GPUs (Graphic Processing Units). Without GPUs, building AI wouldn’t be possible.

What should investors know for 2024? The US government has banned Nvidia from selling its flagship GPU to China, as it's wary of the country’s potential use of AI. Nvidia is exploring compliant ways of selling to China, given it's the largest GPU buyer in the world.

*Ratings are provided by analysts at Zacks, a leading investment research firm

2. Meta rallies 178% in 2023 as it focuses on efficiency 📝

The “year of efficiency”: In 2022, Meta shares plunged 64%. Mark Zuckerberg then declared 2023 would be Meta’s “year of efficiency”. He wasn’t lying, as Meta closes in on its best ever year.

20,000 job cuts: Meta’s first method of reducing operational costs was to cut over 20k roles. Unfortunately, a businesses’ largest expense is often its workforce, which is why shares jumped off the back of the news.

Advertising boomed: At heart, Meta is an advertising business. After declining sales in 2022, growth returned this year as Zuckerberg acknowledged this is Meta’s best way to fund ambitious ventures like the Metaverse, AI and even Threads.

*Ratings are provided by analysts at Zacks, a leading investment research firm

3. Royal Caribbean soars 117% in 2023 due to big demand ⛴️

Riding a new wave: Cruise stocks had been dead in the water during the Covid pandemic. But now, pent-up demand has helped Royal Caribbean Cruises double its share price in 2023.

Crunching numbers: Revenue for the last year stands at $13.1bn, a staggering 759% increase since 2021 and 82% increase since 2022. To put this into context, the company earned just $1.5bn in 2021.

Setting sail for 2024: The company stated momentum will continue in 2024, with bookings surpassing those of all previous years. As of Sep 30, it had $5bn in customer deposits, $800m more than this point last year.

*Ratings are provided by analysts at Zacks, a leading investment research firm

What have we learned this week? 🤓

2023 has been the year of AI: Amid rising global inflation, interest rates and geopolitical tensions, investors remained excited to invest in stocks, much of which is down to AI.

Meta loves new markets: Investors know Meta is a company that enters new markets, and whilst some plans fail, investors don’t seem to mind as long as it nails advertising.

Covid still moves markets: This time, for the better. The pandemic harmed experience-based companies, but those that survived are welcoming the demand.

Stock announcements 👀

Adobe: The Photoshop maker announced it’s scrapping the $20B takeover of rival platform Figma. It comes after persistent antitrust scrutiny from EU, UK & US regulators.

Apple: The tech giant will stop selling Series 9 and Ultra 2 watches in the US, following a ruling that they violated a patent owned by health tech company Masimo.

Coinbase: The 2022 “crypto winter” thawed in 2023, with Bitcoin up 145%. In 2024, the market could see the first spot Bitcoin ETF, leading to increased crypto exposure.

Thanks for tucking in! Want to receive these updates every Friday? Sign up here or share via WhatsApp with your friends.

*Figures and ratings correct as of December 19th 2023.

Past performance does not guarantee future results. Capital at risk when investing. This content is for educational purposes only. Shares does not provide investment advice. If you are unsure about anything, please seek advice from an authorised financial advisor.