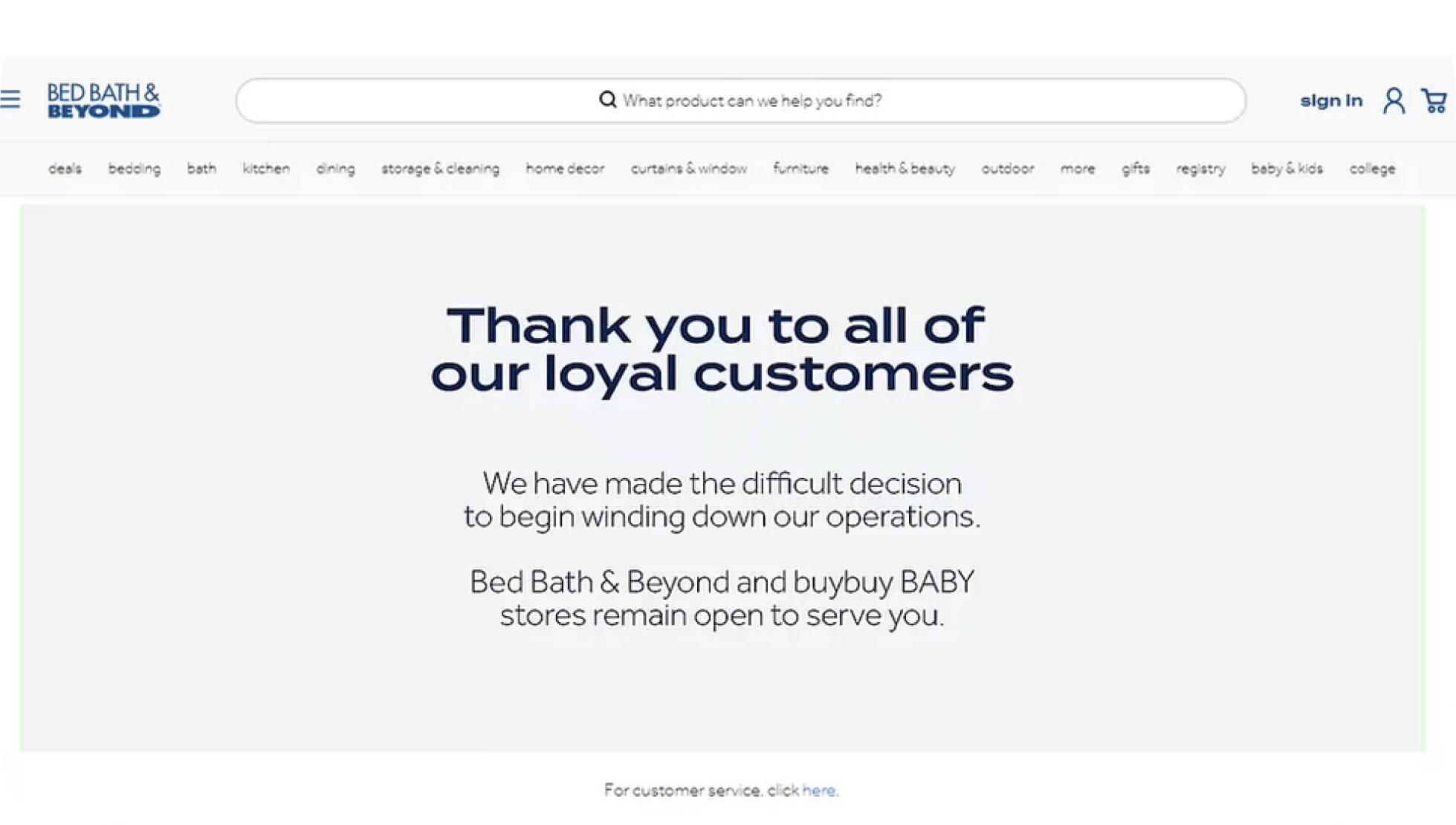

The company will be “winding down” its business by closing all 475 stores and stopping operations on its Buy Buy Baby brand by the end of June 2023.

The chain has faced financial troubles for some years now, and last month, the company announced that it would sell £241m worth of its shares. But, it warned shareholders that it might have to file for bankruptcy if the funds were not secured. Unfortunately, it failed to secure the funds it needed.

The Bed Bath & Beyond website thanks its loyal customers and states that its stores remain open to serve them.

Why did Bed Bath & Beyond file for bankruptcy?

The retail giant has struggled for years to keep up with the rise of competitors, particularly online stores such as Amazon.

Forbes breaks down three key reasons why it struggled:

The company was short on cash - the price of running stores and paying salaries exceeded the amount of revenue it was bringing in

It wrongly introduced private label goods - private label goods are more profitable for retailers than branded goods, because they’re cheaper. The problem? Customers didn’t want them and BBBY struggled with sales.

Poor senior management - the BBBY board hired Mark Tritton, former Target CEO. Tritton had successfully implemented a private label goods strategy into Target, but not all retailers face the same issues. Unfortunately, this strategy wasn’t fit for BBBY customers.

What will happen to Bed, Bath & Beyond shares?

If you owned BBBY stock, it’s likely you’ll have experienced a loss. Naturally, shares are down 55% in the last week (at the time of writing according to Google Finance), due to the news.

The company did state it was seeking buyers for some or all of its assets. As such, the company is still tradable on the stock market, so it’s worth checking with your investing platform what you’re able to do with the stock. For Shares app users, BBBY shares are still in your portfolio meaning you can sell them, should you wish.

Whilst BBBY’s financial struggles were well-known, retail investors showed support towards the company by buying up shares, just like they did with GameStop and AMC. BBBY had become a “meme stock”, but it seems it was a temporary solution to a permanent problem.

Download the Shares app to chat with like-minded investors!

Make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

Shares does not provide investment advice. If you are unsure about anything, please seek advice from an authorised financial advisor. Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.