💡 If you want these updates delivered to your inbox every Friday, sign up here

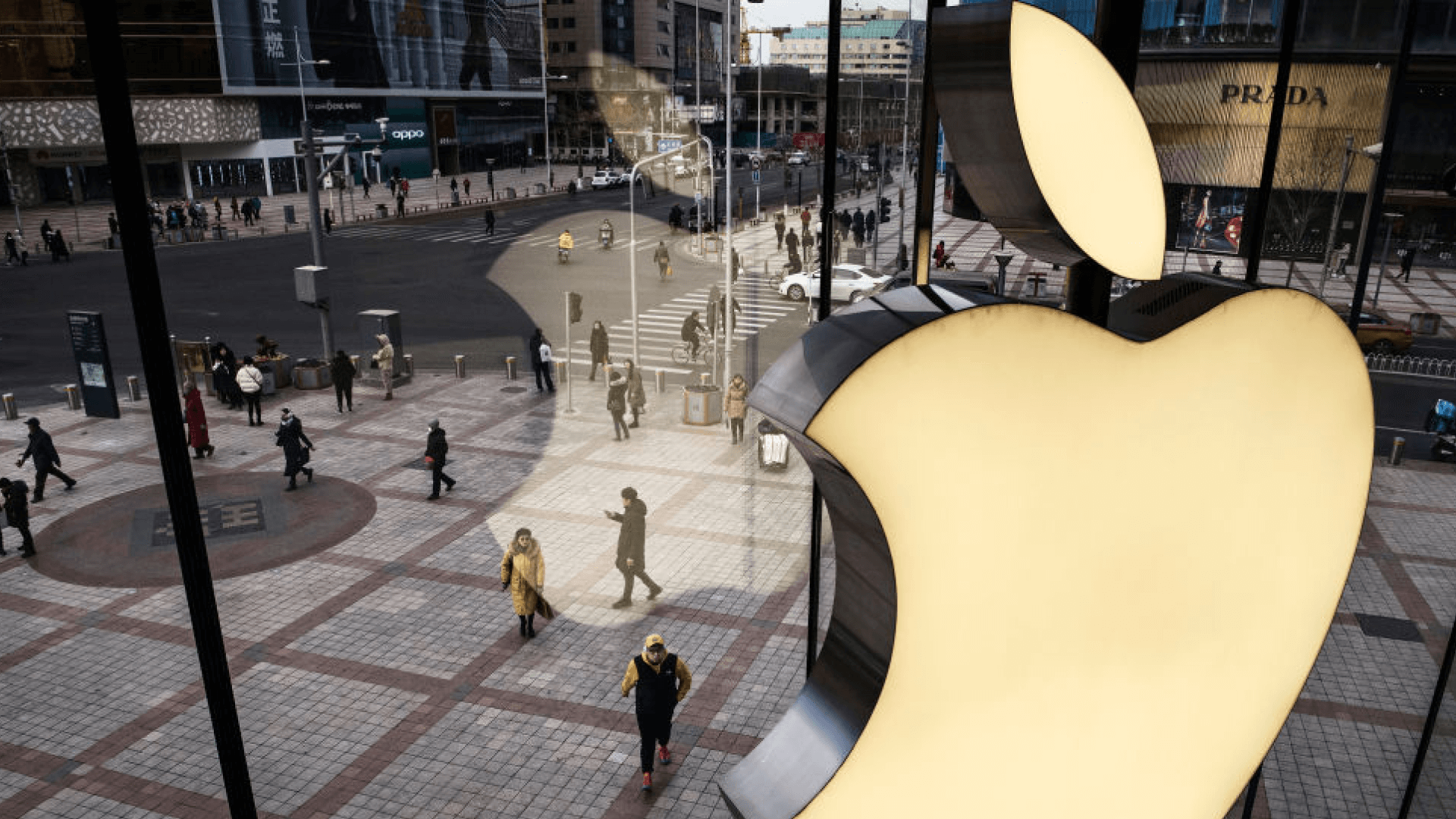

Apple dips 8% as iPhone revenue falls short 📱

Sour earnings: Last week, Apple posted a lacklustre earnings report. Ever since, shares have been on the decline. In the last five days, its market cap has fallen by $200bn, its worst five-day performance since November 2022. So, what’s going on?

Rotten revenues: iPhone revenue fell short of Wall Street’s estimates for this quarter, leading to the company's overall revenues dropping 1%. The iPhone makes up 50% of Apple’s total revenue, so when it underperforms, investors become spooked.

Upsetting the apple cart: Unfortunately for Apple, Mac and iPad revenues are also down 7% and 20% respectively. But Apple is still up 43% since January, so will investors buy the dip? Time will tell.

*Ratings are provided by analysts at Zacks, a leading investment research firm

PayPal jumps 3% as it launches its own crypto stablecoin 🪙

A stablecoin for a turbulent stock: Last week, PayPal stock experienced a three-month low. But on Monday, shares climbed 3% as it became the first online payment giant to enter the cryptocurrency arena by rolling out a stablecoin pegged to the U.S. dollar.

A $126bn market: PayPal USD (PYUSD), is designed to maintain a value of exactly $1, as the company looks to make crypto ‘part of the overall payments infrastructure’. Stablecoins are a $126 billion dollar market, so if it gets it right, it could be

quids incrypto in.Fee free for friends: PayPal USD can be sent to friends without any fees, which is big news for crypto lovers. Although the stablecoin terraUSD did collapse last year, it lacked backing from real assets unlike PayPal USD which is backed by real cash holdings. Could this be the kickstart PayPal needs?

*Ratings are provided by analysts at Zacks, a leading investment research firm

Beyond Meat dives 21% as shoppers cut back due to inflation 🌱

Out of the frying pan, into the fire: Last year, vegan food firm Beyond Meat cut a fifth of its workforce to save around $40m worth of costs, thinking the worst was behind them. But on Tuesday, it said sales plunged by almost a third as the rising cost of living squeezes shoppers.

Concerns over the vegan diet: Ethan Brown, CEO, said demand has also been hit by an increased scrutiny of the health benefits of vegan products. Many people have “succeeded in seeding doubt and fear around the ingredients used to create plant-based meats”.

All sizzle and definitely no steak: Beyond Meat expects annual revenue of between $360m to $380m which sounds impressive, right? But before Tuesday, estimates were around $415m. This could leave the company $55m short, hence why investors have been selling their shares.

*Ratings are provided by analysts at Zacks, a leading investment research firm

What have we learned this week? 🤓

Apple is very reliant on the iPhone: It’s hard to criticise the world’s most valuable company, but a slight red flag for investors is half its revenue comes from one single product. Apple is trying to diversify with Apple TV, Apple Music and Apple Pay.

Crypto remains a huge market: Many think crypto’s had its day. But clearly PayPal, one of the largest payment companies in the world, sees potential in the $126 billion dollar stablecoin market.

Inflation is a market mover: Retail stocks will always be hit hard during times of inflation. Naturally, customers look to reduce their spending and this time, plant-based alternatives have been hit the hardest.

Thanks for tucking in! Want to receive these updates every Friday? Sign up here or share via WhatsApp with your friends.

*Figures and ratings correct as of August 9th 2023.

Past performance does not guarantee future results. Capital at risk when investing. This content is for educational purposes only. Shares does not provide investment advice. If you are unsure about anything, please seek advice from an authorised financial advisor.