💡 If you want these updates delivered to your inbox every Friday, sign up here

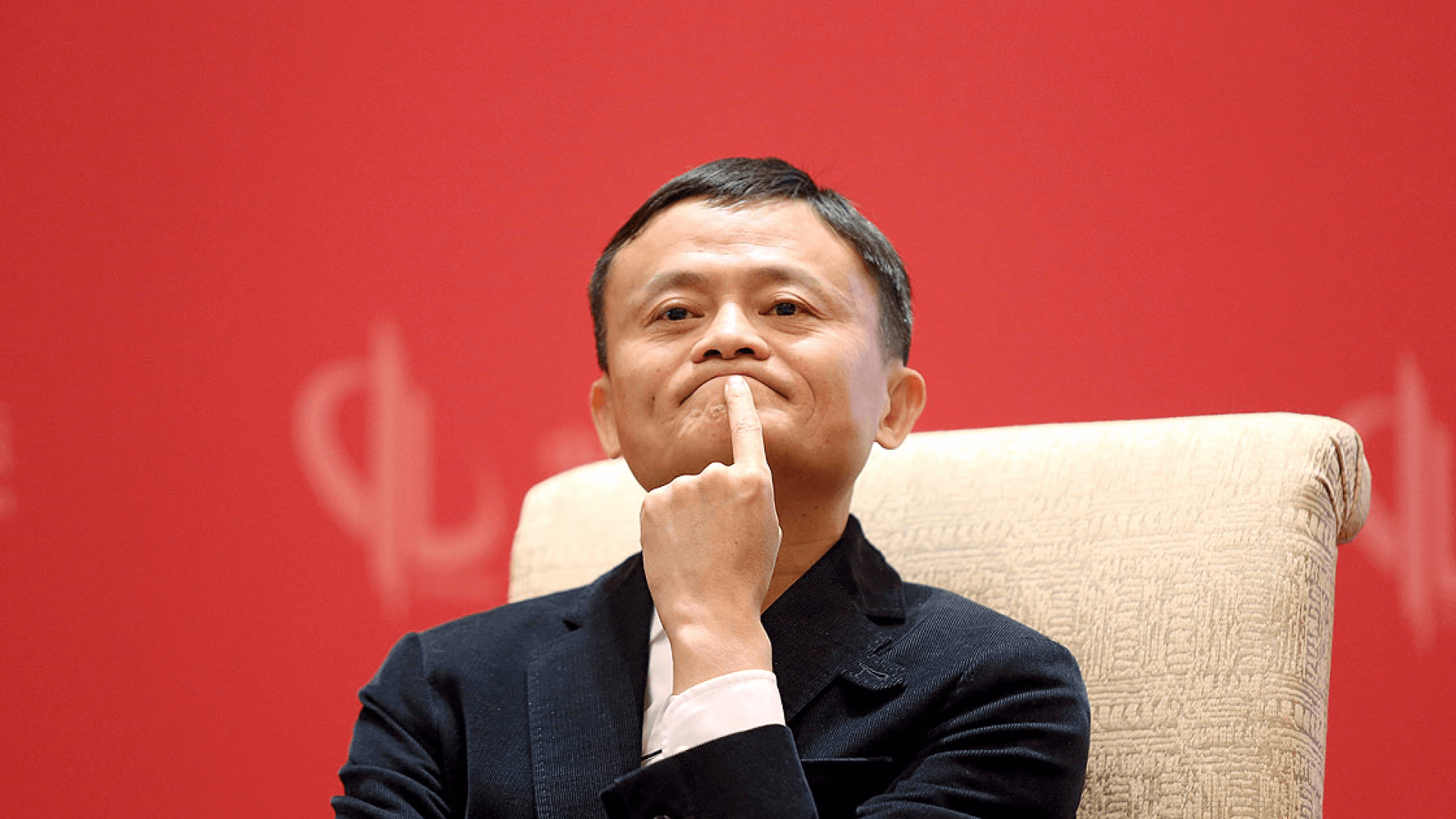

Alibaba up 12% as it plans to break up its business ➗

Divide and conquer: Alibaba, aka the Amazon of China, is splitting its business into individual ‘units’. E-commerce, cloud services, logistics and other divisions will all become their own businesses, in a bid to bolster a falling share price.

Investor confidence is up: Alibaba is becoming a holding group, and that means having a new corporate structure where it becomes more diversified by controlling numerous sub companies. Each sub company will be able to IPO separately.

Regulatory concerns: Alibaba has suffered a difficult past two years, contending with a record $2.8bn fine by Beijing regulators for monopolistic behaviour. By breaking itself up into smaller companies, it should pose less of a threat. Could this be a fresh start?

Lyft gains 6% on CEO step-down 🚖

Change of the guard: Lyft, Uber’s main rival, is overhauling its management. Co-founders Logan Green (CEO) and John Zimmer (President) are moving into non-executive roles on the board amid fierce competition in the ride-hailing market. Shares of Lyft lost nearly ¾ of their value in 2022 and are down about 13% this year. Uber has gained 24%.

Super new CEO: Lyft’s new CEO, David Risher, has an impressive resume of helping lead Amazon's growth from a small online bookshop to a major retailer, getting shareholders excited about Lyft's future outlook

A potential sale is on the cards: Uber dominated sales in 2022, accounting for ¾ of ride-share sales at the end of December. With Lyft continuing to be marginalised, it seems selling the company may be in everyone’s best interest, including shareholders.

Intra-Cellular surges 17% after promising drug results 💊

Potential drug breakthrough: Pharma company Intra-Cellular focuses on therapies to treat central nervous system disorders. On Tuesday, it released positive results for its depression therapy, Caplyta.

Reduction in symptoms: Caplyta is the company’s leading drug, and it has performed well on patients with depression, bipolar and schizophrenia in a phase 3 trial. On the MADRS, (a scale for assessing the severity of depressive symptoms), patients saw a 5.7-point reduction with depressive disorders. This is big news in the pharmaceutical world.

FDA approval: Caplyta is already FDA approved, which is great news as the overall process can take around 10 years. With 3 more drugs in the pipeline seeking approval, investors seem confident the company will be in strong demand.

What have we learnt this week? 🤓

Holding groups can excite investors: If there are two things investors love, it’s diversification and IPOs. When a company becomes a holding group, it can offer both these advantages.

Investor confidence continues to be a major market mover: Lyft’s new CEO has a proven track record at both Amazon and Microsoft. When the market prices this in, we see a change in stock price.

Medical breakthroughs are a win-win-win: Patients receive better treatment, the medical company can continue to grow, and investors are rewarded.

Thanks for tucking in! Want to receive these updates every Friday? Sign up here or share via WhatsApp with your friends.

*Figures correct as of March 29th 2023.

Past performance does not guarantee future results. Capital at risk when investing.

This content is for educational purposes only. Shares does not provide investment advice. If you are unsure about anything, please seek advice from an authorised financial advisor.