Well, imposter syndrome is often associated with school or work, but it can also impact our finances, according to a study conducted by Virgin Money.

Perhaps you've never considered investing because it's too complicated, full of jargon and only for crypto bros or men in suits. Or if you’ve started buying shares, you might feel like you’re trying to impersonate someone you're not, acting a bit like a fraud.

If this sounds familiar, then stick around because we're going to be breaking down:

What imposter syndrome is

How imposter syndrome and finances are connected

How to overcome imposter syndrome

What is imposter syndrome?

It's defined as “an internal experience of believing that you are not as competent as others perceive you to be.” Or in simple terms, you feel you’re in over your head, or that you don’t deserve to be in the position you’re in.

As humans, we’re obsessed with achievement. Whether it was an award in your year 7 school assembly, receiving A-Level results, or even that next job promotion, we typically crave success. Not only that, but we often want recognition of our success, too. Yet when receiving it, we can feel like we don't deserve it or that others feel we cheated our way there.

Ah, the double-edged sword of being a human. You can’t win, can you 😅.

Imposter syndrome and finances

According to Virgin Money, imposter syndrome can also affect your finances. For example, you might not consider investing because you feel it's too confusing, complicated or requires a lot of money.

Imposter syndrome can impact other areas of your financial life, too. For example, you might be put off asking for a promotion or pay rise, or feel you don’t know enough to start your own business.

It's difficult to grow financially when internalising these kinds of thoughts, but step one is recognising that you are experiencing them.

Symptoms of financial imposter syndrome

Not asking for a promotion or pay rise at work, even when you deserve it

Avoiding looking into steps you can take to improve your finances, like learning about investing, or researching frugal money tips

Not setting ambitious financial goals

Feeling like you have to know everything about a financial topic (e.g. budgeting, investing) before you can start

Excessively spending money on items such as clothing to try to ‘look the part’

Downplay your successes, meaning you might miss out on potential opportunities

How to overcome imposter syndrome

So, what are some steps to overcome feeling like a phoney fraud? Well, here’s five:

1. Understand the spotlight effect

This is one of my favourite things to think about.

The spotlight effect is when a person thinks they’re being noticed more than they really are. As we're all in the centre of our own world, we assume we're at the centre of everyone else's. But how can you be at the centre of someone else’s, when they’re at the centre of their own?

When the penny drops that others think the same way you do, it becomes easier to talk openly about your achievements without fear of judgment.

2. Remind yourself of your hard work

Focusing too much on your achievements may heighten imposter syndrome.

Instead, try thinking about the hours of hard work you’ve put in to earn your proudest achievements.

Open up a notes page on your phone and write down the hard work that you’ve put into each of your successes. If that’s not for you, try journaling with pen and paper instead. You'd be surprised how much doing this helps during those nasty moments of self-doubt.

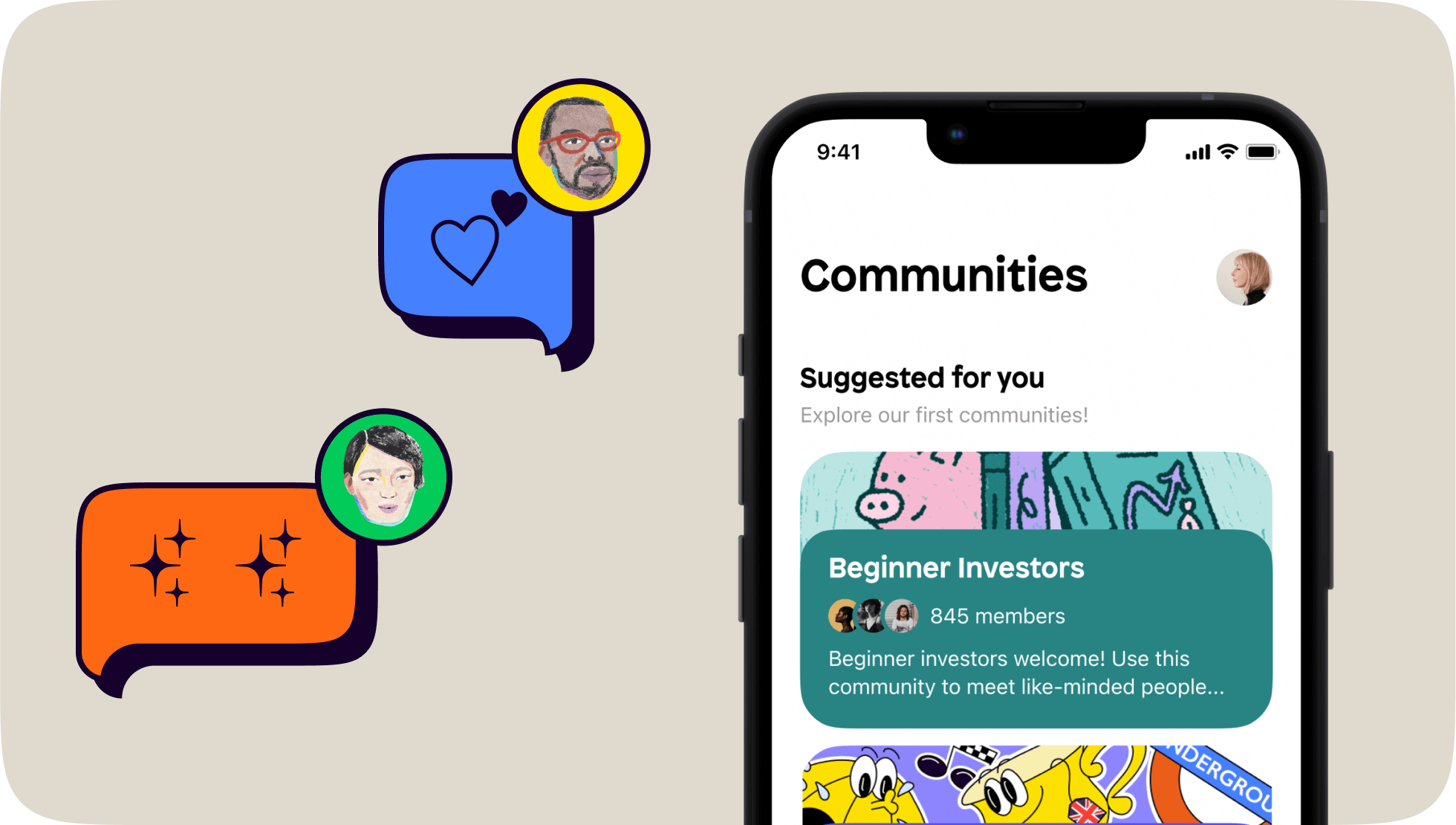

3. Talk to someone, or even a community

Investing has always been a lonely craft, and we're raised not to talk about finances in public.

Well, not any more. Shares exists to help connect you with like-minded people. You might find someone can help explain something to you, and find comfort that other people feel the same way you do.

Talking to someone doesn't have to be an unloading of your own thoughts, either. Perhaps someone else is struggling and you have the experience to help them through it. Nothing beats that warm fuzzy feeling knowing you’ve just helped someone during a difficult time. Talking is great. Listening and talking can be even better.

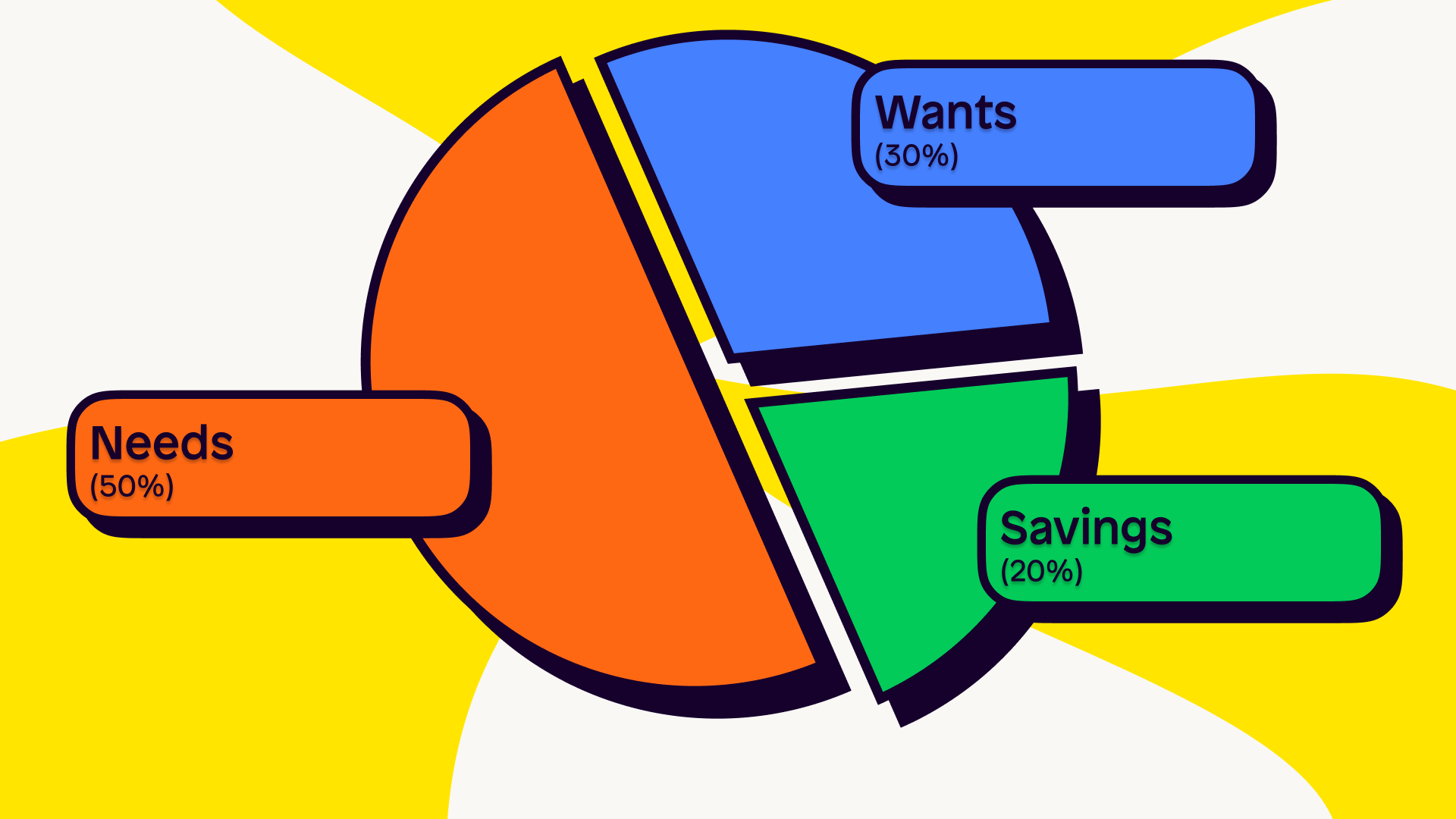

4. Build healthy (financial) habits

Achieving financial success isn't always connected to how many 0s you have in the bank.

Doing the simple things like:

Creating (and sticking) to a monthly budget

Building an emergency fund – transfer a set amount each month to a separate account for emergencies. It's amazing what this can do for your peace of mind.

Saving and investing in your own retirement. Read more in our investing section to get started

Creating a plan to pay off any debt – just like ripping a bandage off, it's the thought that hurts more than actually doing it

Building your way to a healthy credit score

5. Finally, understand the myths of managing finances

Here are some myths we’re always trying to debunk:

Regardless of the size of your incomings and outgoings, managing finances properly is something that can give everyone peace of mind

You don't need to be wealthy to start, you can start with £1 on the Shares app and buy some fractional shares (just remember to keep aware of the risks associated with investing, your capital is at risk)

Investing isn’t as complicated as you think. Think everyone who invests is sitting reading charts and conducting technical analysis? Wrong! Most people I know don't use these methods to invest!

For more lifestyle oriented content, make sure to check out:

Want to chat more on imposter syndrome? It's a topic that fascinates me and I'd love to talk to you about it. Head over to the Shares app, add me as a friend (@ashoo) and let's get sharing!

Make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.