It's true though, it’s easy to lose track of why you started investing. But, keeping your end goal in mind will help keep your decision-making justified.

The idea of lying on a beach sipping margaritas after an early retirement might be the fairytale we tell our future selves to aim for, but for many of us, the idea goes beyond white sand and blue water.

And that idea is time. When we free up time, we're truly free to do what we please. I remember the days when passive income was a term thrown about by people posing next to Lamborghinis promising you to 'get rich quick'. Can you get rich quickly? It could be possible – we've all seen the headlines of 12-year-olds earning hundreds of thousands designing NFTs, but that's not what we're talking about today.

Today I'd like to break down long-term investing into two stages; building and generating.

Building our investment

This is when we contribute part of our income into an investment. Typically, any income earned from investments such as capital gains or dividend payments is reinvested back into our portfolio. The primary ambition of the building stage is to grow the portfolio as much as possible; compound interest helps achieve this.

It's likely the building stage will last from the first day you make an investment, to the day you wish to live off the investment via passive income.

Generating from our investment

Generating is the long-term investor's end goal, their north star if you will. It involves putting your investment to work. Think of it like a team of workers you’ve been building your entire career. You've invested training into them, and now it's finally time for them to work for you. Welcome to the generating stage.

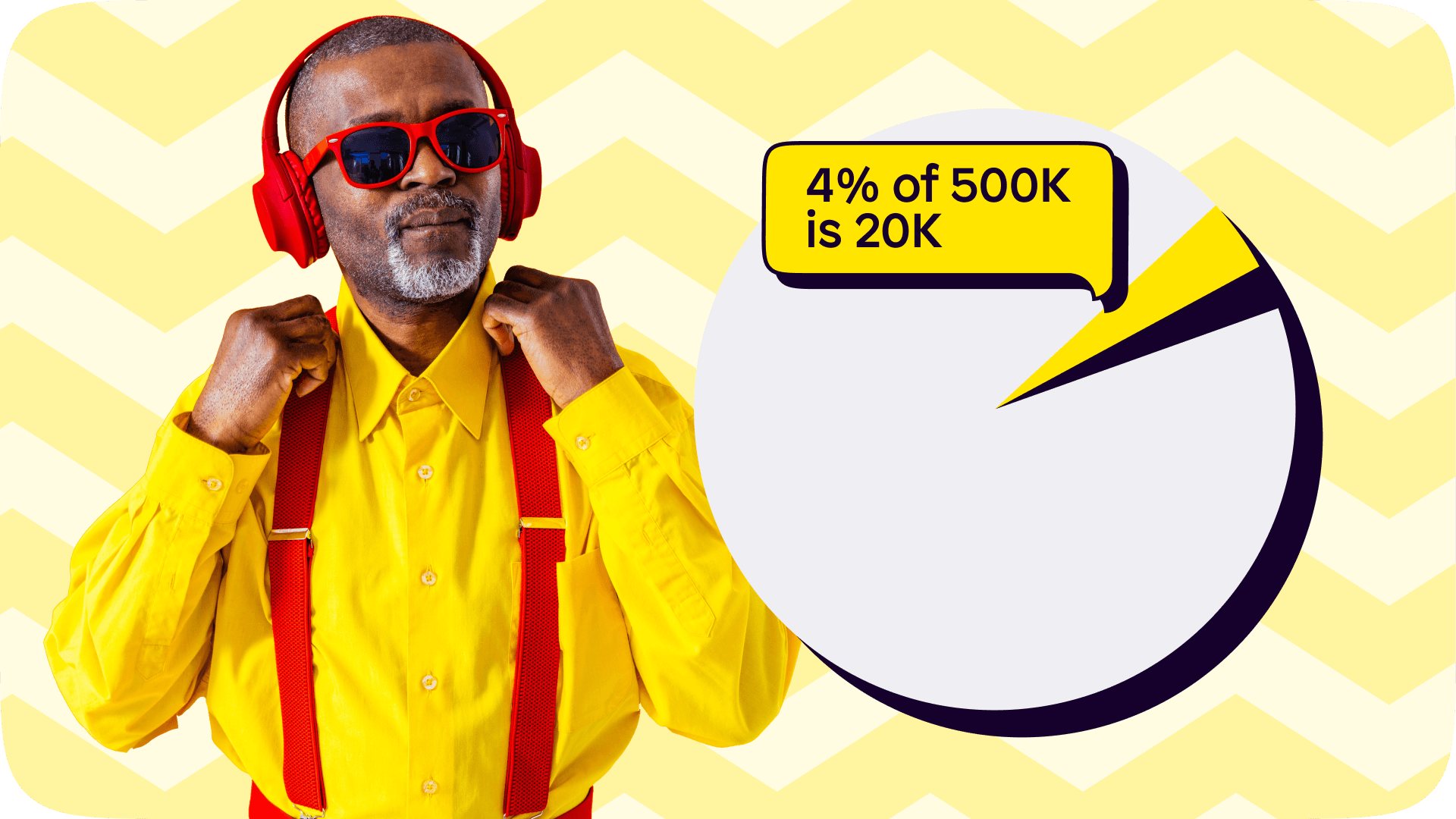

Let’s say Sam has managed to build a stock portfolio worth £500,000 throughout his career. Sam now decides he wants to earn passive income from his portfolio, instead of contributing to it. Investing into dividend stocks can achieve this and a realistic return would be around 4%.

4% of £500,000 is £20,000. This means Sam is able to keep his £500,000 invested (with the potential to keep growing at a steady rate) and is still earning £20,000 passively. The only difference between the generating stage is Sam’s not reinvesting that £20,000. Instead, it's his to do as he pleases.

If Sam’s dividend stocks are spread across dividend kings and aristocrats, then it's considered a relatively safe investment as their stock prices are stable and dividend payments have been consecutively increasing for 25 years or more.

The same logic can be applied to investing in property, or anything where the total investment sum is held and continues to make income. Instead of dividend stocks, someone might become a landlord and spend the £500,000 across five properties and rent them out. The landlord still has £500,000 worth of assets, but also earns a rental income.

Passive income in Crypto and NFTs

Stocks and property are considered two of the safer ways to earn passive income, but it is possible through staking cryptocurrency, and to some extent, owning NFTs.

Crypto

First, know that staking in crypto comes with added risk due to the volatility of the market. Staking works by locking up your cryptocurrency for a time frame such as 6 months. The % you can earn passively dramatically increases from the 3-5% we mentioned earlier, but you have no access to your investment during the staking period and are subject to a few other risks. Check out our piece on staking in crypto if you'd like to learn more.

NFTs

The stock, property and crypto market is much more established than the NFT market, but it's worth keeping one eye on how projects in this space are incentivising passive income. We've already seen some exciting projects, one example being CyberKongs where owners of a Genesis NFT receive 10 $BANANA tokens per day, for 10 years. As the NFT industry continues to grow, it's likely more of these types of projects will emerge.

Who knows, perhaps NFTs could become a reliable source of passive income one day in the future.

Join us!

What are some of your favourite ways of earning passive income? Join the Shares community and let us know! Download the Shares app now and make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.