✏️ Scoop tip - before we start, sticking to a budget can be hard. But, it has been found to be a major factor for helping maintain healthy spending habits. To help, we've built a free budget planner to help you manage your expenses. Sign up to The Weekly Scoop and there will be a free budget planner waiting for you on the confirmation page!

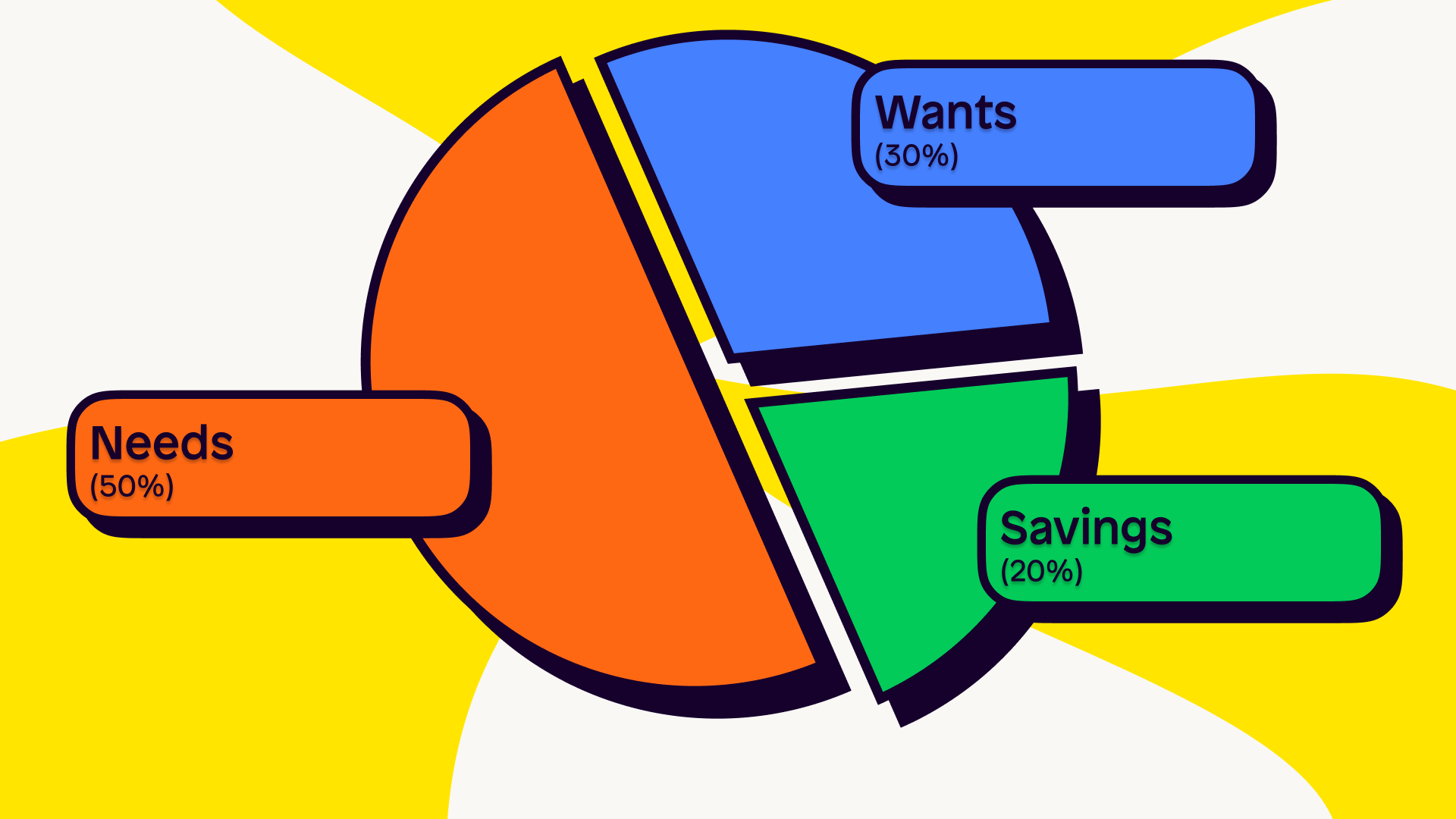

The 50/30/20 rule

Budgeting is an important skill that helps us manage our finances and plan for the future. But, many of us struggle to budget (guilty!) and find it challenging to allocate our income effectively. The 50/30/20 rule is an approach that can help you allocate your income effectively and achieve your financial goals.

It recommends separating your income into three categories:

Needs (50%)

Wants (30%)

Savings (20%)

Needs: 50% of income

Needs are the essential expenses in your life. These fundamentals are what keep us alive and in good health, hence why half of our income is dedicated towards them.

It's important to be realistic about your needs. I hate to burst any bubbles, but an Amazon Prime subscription isn't a need, however much you love next day delivery. Here are some examples of needs:

Accommodation - whether it's a mortgage or rent payment, ensuring you're in some form of living accommodation is essential for your health

Utilities - paying bills for electricity, heating and water are essential

Transportation - drive to work? That's a fuel cost. Have public transport expenses? Don't forget them either!

Insurances - life, car and house insurances

Food & drink - keep this based on your supermarket spending. Unfortunately, justifying a Nandos as a need isn't gonna cut it. Nice try!

Wants: 30% of income

What's life without a bit of enjoyment? We're not so frugal around here that we're going to tell you to live off rice and beans for the rest of your life.

Your ‘wants’ aren't essential for your living standards, but may improve your quality of life. It's probably most people's favourite category, so be careful not to overspend here! Some examples include:

Entertainment - socialising with friends, attending events, going to the pub

Hobbies - gym memberships, weekly 5-a-side fees or tennis club membership

Eating out - a meal that is more expensive than cooking at home

Holidays - although some deem essential, this is a want, not a need

Other non-essentials - things like subscriptions that you don't need, but enjoy having (think Netflix, Spotify, Prime!)

Savings: 20% of income

So, we've had the essential wants and needs. Last, we have the category which is commonly forgotten about - savings!

With over a third of Brits saying they have no savings, they are often neglected. But, it remains important as this category helps us prepare for our future and any potential emergencies. Examples include:

Retirement

Emergency pot

Other investment assets, like stocks, bonds, ETFs and mutual funds

So, that's the 50/30/20 rule explained. Let's take a look how to implement it by creating a proper budget.

Create a budget

Step 1: Find out your take-home pay

Your take-home pay is how much money you have left every month after taxes, national insurance, student loan and other deductions. This amount is what you split 50/30/20.

To calculate your current take-home pay, either check your payslip or follow the guide in our article on calculating your take-home pay.

Let's say your take-home pay is £2,000 each month.

Step 2: Calculate your needs category

Next, work out 50% of your disposable income and allocate this towards your needs category.

So, 50% of £2,000 = £1,000 to spend across things like accommodation, utilities and food as just some examples.

Step 3: Calculate your wants category

Then, it's time to calculate the wants.

In our example, 30% of £2,000 = £600.

That means £600 a month can be spent across things that improve your quality of life. This might be going out with friends, hobbies and holidays.

Step 4: Calculate your savings category

Finally, the 20% is what you will have left. In this case, 20% of £2,000 = £400.

Think about how you can diversify £400 across your savings. It's recommended to have a savings buffer of 3-6 months worth of your monthly outgoings, so this might be a place to start before looking to invest.

Step 5: Review and adjust your budget

Don't worry folks, we're almost done.

The final step is to review your budget regularly and make adjustments as necessary.

Use online banking to track your monthly spending and fill these payments into our budget template. Then, fill in your take-home pay, and the rest is magic!

You’ll be able to see how much you’re ‘in the green’ or ‘in the red’ (otherwise known as a surplus/deficit for you fancy folk), and some juicy pie charts to see which areas you're over spending on. That way, you know where to cut back!

Still buzzing for budgets? Let us know your top budget tricks by joining one of our communities inside the Shares app.

Make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330). Shares App Ltd is a company registered in England and Wales with company number 13374448.