Well, they're good questions. And I'm certainly not promising that if you start investing you'll magically see 6 figures in your bank and become a LinkedIn influencer with thousands of followers, but with that said, there are plenty of possible benefits.

Here are 5 reasons why people tend to invest:

1. To grow wealth

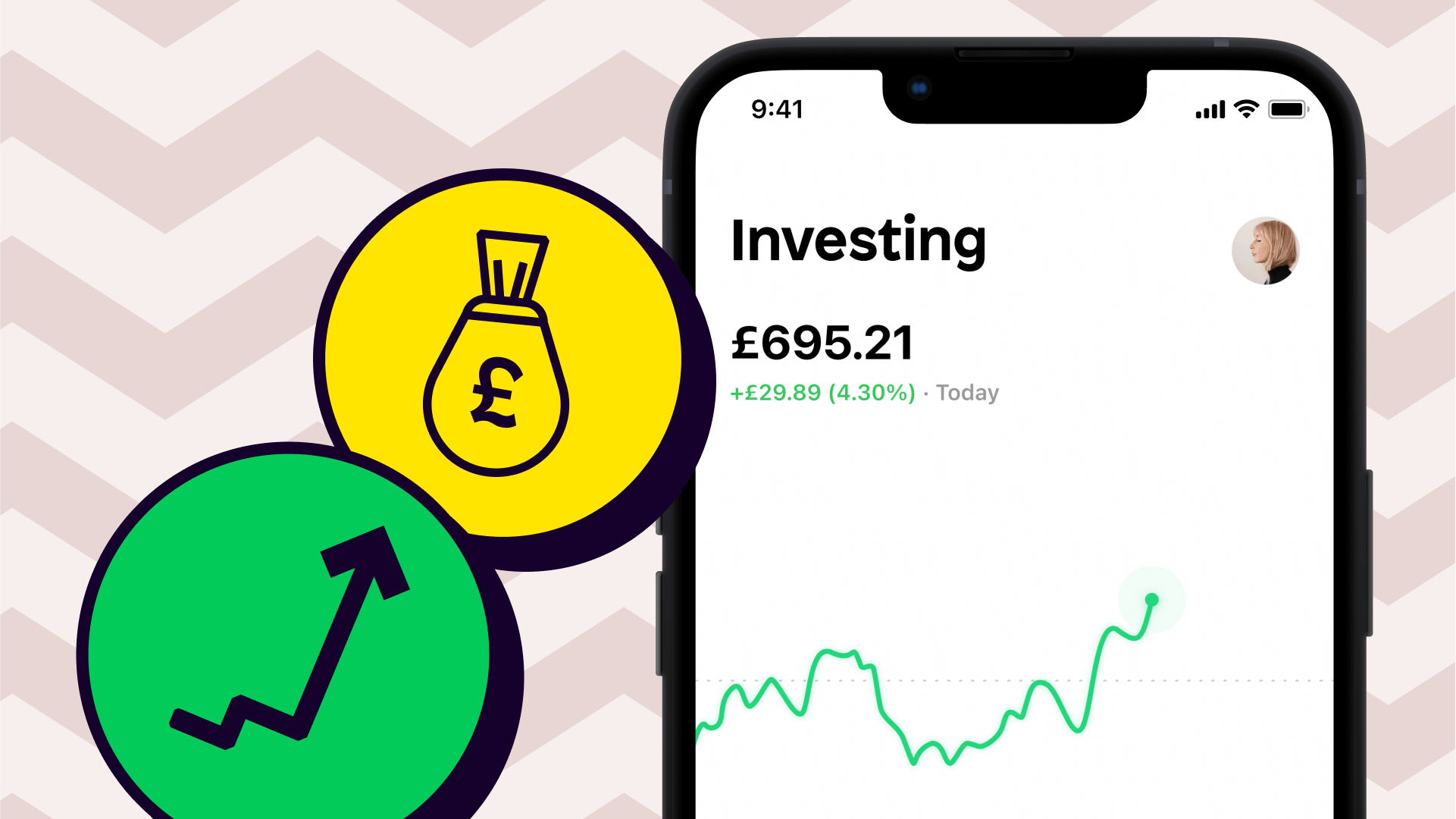

Investing can help you grow your wealth over time by providing a return on your investment.

It allows for the potential to receive higher returns than a savings account, though there isn’t a guarantee - capital is always at risk when investing.

Saving typically involves maintaining your wealth by setting money aside in a relatively low-risk account, with the primary goal being to maintain the value. Over time, you may experience some growth within this account, but due to the low-risk, it’s often low level growth.

Investing can be an effective way to have your money work for you and build wealth. Your money is invested into assets such as stocks and bonds, with an aim to give you a positive return on your investment.

That’s why an investor’s aim is always to grow their wealth. To increase the chance of this happening, many investors look to take advantage of compound interest. But what is this phenomenon and why did Albert Einstein call it the 8th wonder of our world?

Earning interest on an investment is simple. You make an investment, and the profit is known as interest. You can take this out of your investment and spend it on whatever you like. Gains baby!

But, what if you re-invested it instead? Welcome to compound interest. Suddenly, your investment is worth more meaning your next interest payment could be higher. This process being repeated is what's known as compound interest - and it's a powerful tool for building wealth.

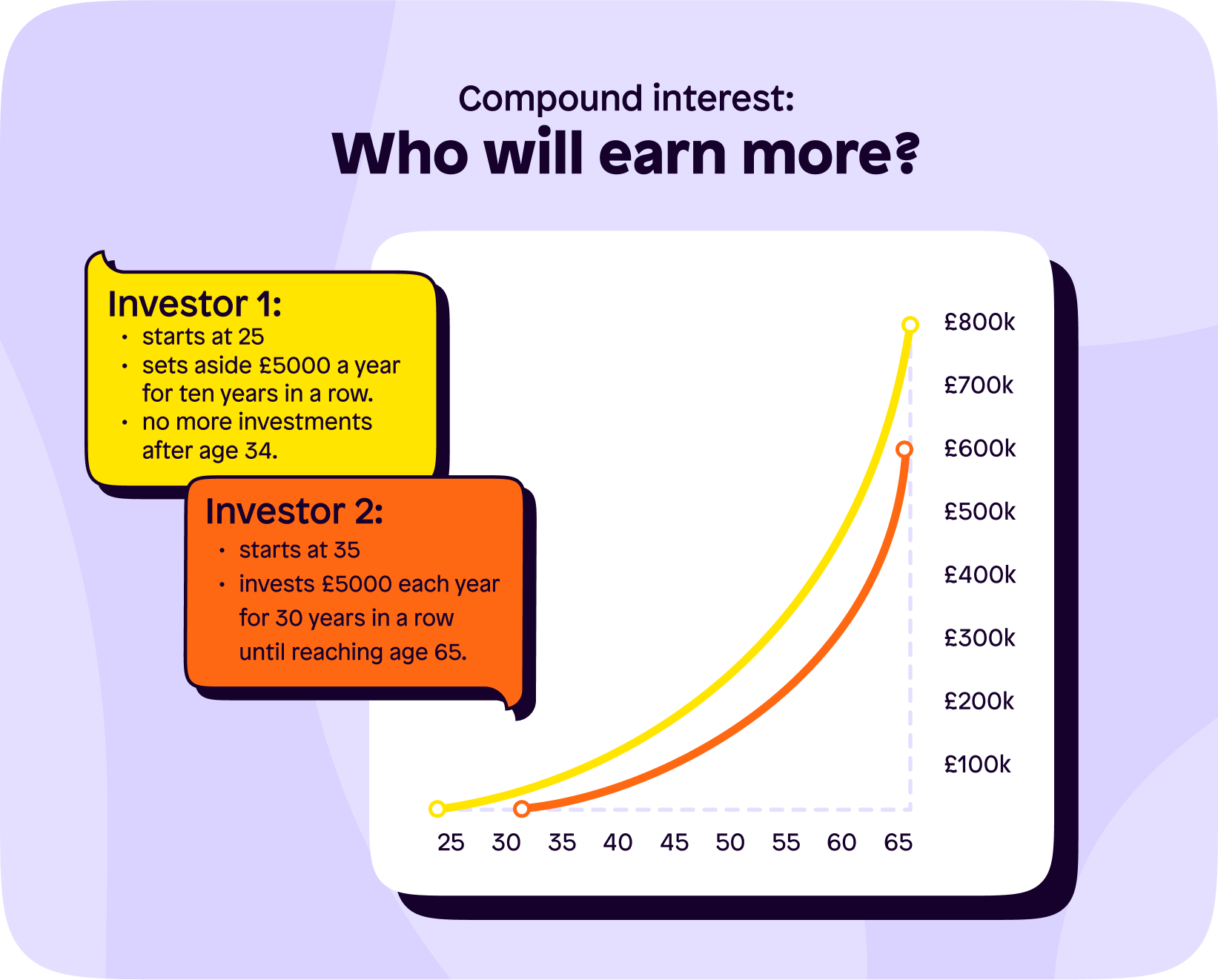

The earlier you start, the more chance you have of obtaining compound interest. Let’s look at an example:

Two people who are the same age invest into the stock market and receive an 8% return on average over their careers.

Investor 1 starts investing £5,000 each year at the age 25. They do this until they’re 35 and then stop

Investor 2 starts investing £5,000 each year at the age of 35. But, they carry this on until they’re 65, meaning they’ve invested an extra 20 years more than investor (as well as an extra £100,000)

Yet if both investors left their investments in the market, thanks to compound interest investor 1 would always have a larger amount, because they started earlier.

Struggling to grasp your head around the concept? You wouldn't be the first! Check out our article on compound interest where we talk about it in more detail.

2. To plan for retirement

As that elusive retirement age grows higher and higher, people have turned to investing to help shorten their working life. This is known as 'building a nest egg'.

Investing can help you build a nest egg that you can use to support yourself during retirement. By investing in assets such as stocks and bonds, individuals can potentially earn higher returns than they would with a savings account. More earned = a lower retirement age.

If you’re contributing to a workplace or private pension, you’re technically already investing. But you may not be investing enough. The same goes for the state pension in which you need 30 years of qualifying National Insurance contributions - use this Government page to see whether you’re contributing enough.

3. To generate income

Many of us love the idea of passive income - income that you earn without actively working for it. Although classic examples include owning a rental property where tenants pay you rent each month, it can be achieved by investing in two other assets.

Investing in income-producing assets such as dividend stocks or bonds, can provide a regular stream of income.

Dividend stocks - these are companies that pay you (typically 4 times a year) for simply owning its stock. The more of a stock you own, the more you're paid. You can check how much each company pays by checking its 'dividend yield' via the Shares app. In the S&P 500, the average dividend yield is around 1.74%.

Bonds - with a fixed rate bond, you lend your money to a company or the Government for a certain period of time, like a year or several years. And in return, they promise to pay you back your money, plus extra money called interest. How interesting!

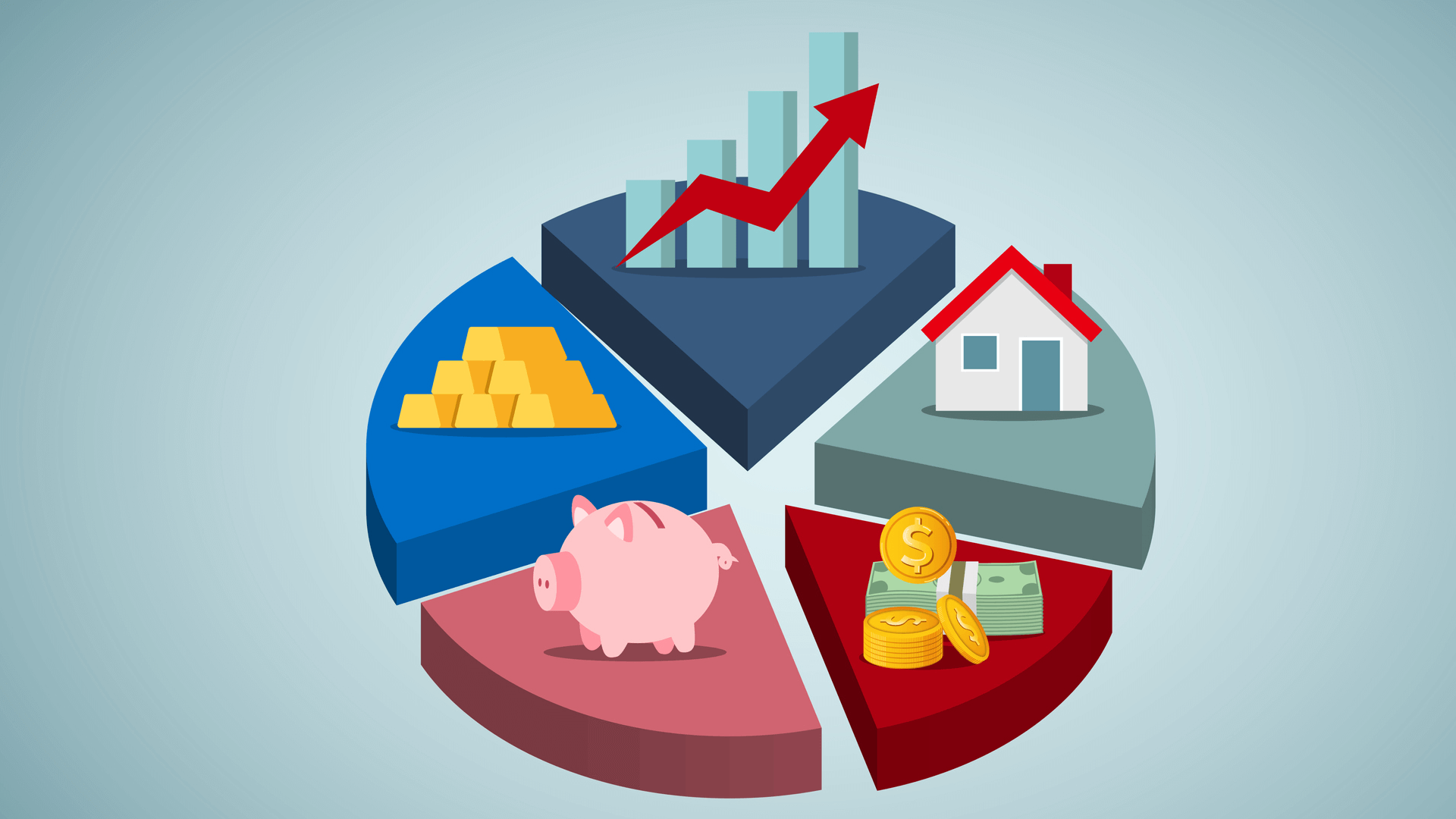

4. To diversify

Investing in a variety of assets can help you diversify your portfolio and reduce risk.

Many people sleep easier knowing their wealth isn't just in cash. As we saw in October 2022, the Great British Pound can fall in value; quickly and drastically.

There's no telling which asset will fall when, but if your wealth is distributed evenly when one asset falls, it helps limit the damage.

5. To beat inflation

Inflation is the rate at which the cost of goods and services (think food shops, fuel and haircuts) increase over time. When inflation is high, it erodes the purchasing power of your savings. Or in other words, you get less bang for your buck!

Investing can help counter inflation if your return on investment outweighs the country’s rate of inflation. For example, if your investment returns you 10% in 1 year and the inflation rate is 5%, you’ve beaten inflation by 5%.

The U.K's goal for inflation is 2%. But currently, we're around 9.3% (all part of the fun of being in a recession). Over the last 30 years, the stock market has produced returns around 10%, which is why many people choose to invest part of their wealth there. Keep in mind though, previous performance does not guarantee future results.

Examples:

Stocks - particularly ‘growth companies’ that have the potential to grow their earnings over time, and provide a return that outpaces inflation. Like our earlier example, if we invest in a company and its earnings are growing at a rate of 10% per year and inflation is running at 5% per year, the company's stock price has the potential to increase by 5% per year (above inflation).

Inflation linked bonds - investing in these bonds can be an effective way to counteract inflation. As their name suggests, interest payments here increase with inflation.

Commodities - investing in commodities like gold, silver, oil and wheat can also provide a hedge against inflation as their price generally moves with the rate of inflation, though past performances aren’t a guarantee for future performance.

Why might you not invest?

It's all well and good explaining the benefits investing can have. But for some people, it's best not to invest. Here are a few examples:

Prioritising paying off 'bad debt'. Investing may not be the smartest place to put your money if you have credit card loans and payday loans, as these short-term debts often have the biggest repayment rates!

If you aren't contributing to a pension or don't have an emergency fund in place, you may want to consider building these up before starting to invest. If your car breaks down, it's a lot easier to access cash than it is to sell off your stocks and wait for the funds to arrive in your account.

If you don't know your outgoings and incomings, it's time to whip out the spreadsheets! Budgeting helps you see what you can afford to spend - if you don't know this, how do you know how much to invest?

Ultimately, your reasons for investing can vary depending on your financial goals and risk tolerance; both of which we bang on a lot about here at Scoop.

For more help, check out whether you're ready to invest by answering these 5 simple questions, or seek a professional financial advisor if you're still unsure!

Keen to know more? Head over to the Shares app and get involved with our communities!

Make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

Shares does not provide investment advice. If you are unsure about anything, please seek advice from an authorised financial advisor. Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.