We all understand the concept of risk in our everyday lives. That message you sent your Hinge date. Leaving the house without a coat. Pressing snooze on your alarm.

But in the investing world, ‘risk’ has a specific meaning. Understanding the concept of risk within the world of stocks and shares is an important part of investing.

So, what is ‘risk’ in investing?

Risk is the degree of uncertainty or potential for financial loss that you face when you make an investment.

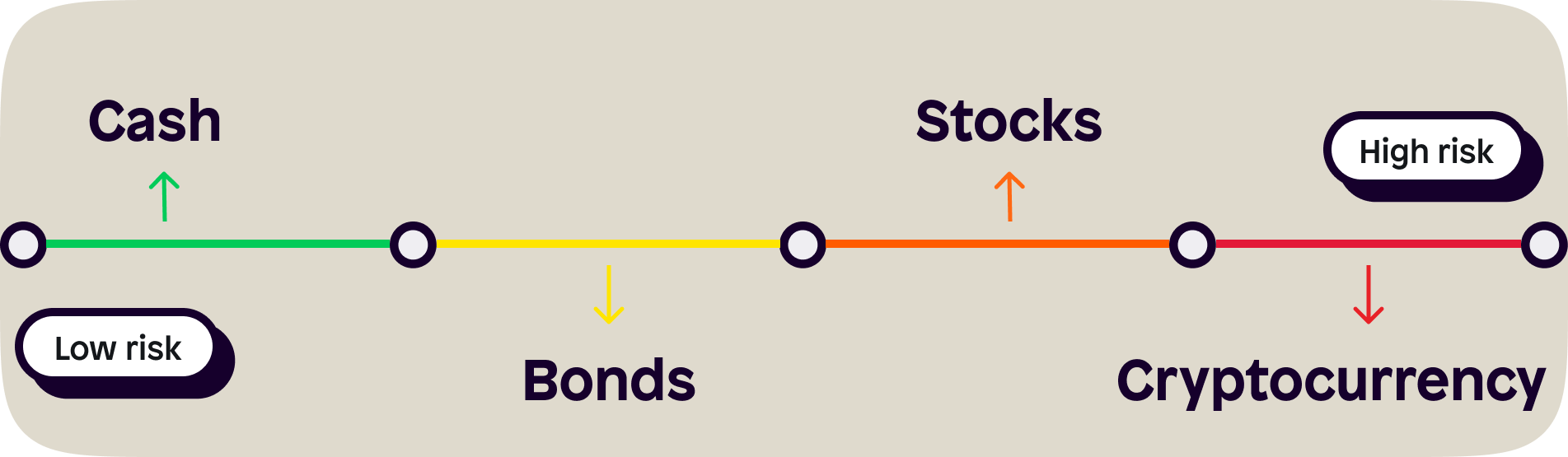

Imagine a spectrum in your mind. On one end of the spectrum is ‘low risk’ and on the other is ‘high risk’.

Depending on the investment you make, your place on the spectrum moves. For example, an investment into government bonds may be a lower risk investment than into an individual stock.

However you choose to think about risk, understanding it properly is crucial if you want to build a portfolio of investments.

Risk with profit and loss

Different types of investments carry varying levels of risk.

Generally, investments that are considered safer, such as government bonds or broad market ETFs may offer lower returns, but also lower risk.

Individual stocks, commodities and cryptocurrency have the potential for higher returns but often come with a higher degree of risk.

So, what separates the good investors from the great? The answer is those who understand the risk-return principle! Sound daunting? Don’t worry, it's more straightforward than you think.

The principle suggests that to earn higher profits, you need to accept higher levels of risk.

Likewise, if you want to minimise risk, they must be willing to accept lower returns.

Good investors delicately balance their risk tolerance in relation to their investment decisions, and ultimately, their financial goals.

So, ask yourself what kind of risk you’re comfortable taking on in relation to your own risk tolerance. Do that, and you’re already becoming a smarter investor.

Risk’s relationship with time

In the investing world, time is often on your side, hence why it’s called a ‘long-term game’. When investments are left for months, or even years, they are more likely to ride out short-term market fluctuations.

Shorter timeframes can make your investments subject to more volatility.

By giving yourself a longer timeframe, it’s giving your investment a chance to recover from any losses it may have initially experienced.

Types of risk

Now that we understand the principle of risk, it’s important to know what types of risk exist and how they can affect your investments.

Risk comes in different forms, but there are mainly seven an investor should be familiar with.

1) Market Risk

As the name suggests, this is risk associated with movement in the markets.

Factors such as economic conditions (inflation, interest rates), geopolitical events (war, political events), and market sentiment (fear/greed) can impact your investments.

2) Inflation Risk

This is all about the risk of not investing. Yep, you read that right.

Inflation erodes the purchasing power of money over time, meaning when you keep money in the bank, the numbers may stay the same, but it’s likely to be worth less as time goes on.

Why? Because inflation raises the price of everything from flats and houses, to milk and bread.

It’s a type of risk many people struggle to understand and aren’t even aware is happening.

3) Business Risk

This type of risk is more appropriate for individual stocks. Companies may face specific risks that harm their financial performance such as competition, management and even lawsuits.

Often, investors try to limit their risk here by diversifying their portfolio.

4) Credit Risk

Credit risk is often associated with bonds or other fixed-income securities.

Although institutions like governments are usually a reliable issuer, there’s always a risk of them defaulting. If this happens, they may not be able to make payments back to you.

5) Liquidity Risk

When an asset has a high liquidity, it means there are plenty of buyers and sellers of that asset.

Although an asset may be priced well, if it’s difficult to sell then you may not be able to cash out your investment. This can quickly leave you with a large loss.

6) Currency Risk

This is particularly important when investing in foreign assets. Currency fluctuations between the pound, dollar, or even a cryptocurrency can harm the overall value of your investment.

Make sure to research the difference between the currency your asset will be sold in vs your own native currency.

7) Political Risk

Governments make new policies all the time.

An example is Nvidia, one of the world’s largest companies. It’s potentially being banned from selling its products to China by the U.S. Government.

If this happens, sales will decrease and the stock may become less valuable through no fault of the company’s or investors.

How to reduce risk when investing

Unfortunately, there isn’t a magic 8-ball that tells us when our portfolio is about to take a hit.

But there are steps you can take to make sure your portfolio isn’t subject to high levels of risk.

Let’s have a look at some.

1) Diversify your investments

Spreading your investments across different asset classes (such as stocks, bonds, ETFs) can help reduce risk. By diversifying, you avoid putting all your eggs in one basket, as different investments may perform differently under varying market conditions.

2) Invest for the long term

Investing with a long-term perspective allows you to ride out short-term market fluctuations and benefit from compounding returns. Time in the market can help smooth out the impact of market volatility.

As investor Ken Fisher once said, “time in the market often beats timing the market”.

3) Define your risk tolerance

Ask yourself what level of risk you are prepared to take on.

Investing a small part of your salary early in your career may involve a different investment strategy to someone investing a large part of their net worth as they enter retirement.

Are you less likely to take on risk when investing larger parts of your net worth later on in life? If so, act accordingly.

4) Do your research

Thoroughly research the investments you are considering and understand their underlying risks.

Some assets are naturally more risky than others, so it’s important to know which assets match your own risk tolerance.

Not sure where to start? Check out our guide on how to research buying and selling stocks.

Overall, you must accept that any investment they make is subject to some risk. But, there are plenty of ways to ensure your portfolio is set up to avoid taking on high levels of risk.

Download the Shares app to get started with investing and make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

This content is for educational purposes only. Shares does not provide investment advice. If you are unsure about anything, please seek advice from an authorised financial advisor. Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.