If you ask ChatGPT, you'll be hit with a rather blunt, unhelpful answer. And rightly so, unless talking with a financial advisor, you should be wary of anyone dishing out financial advice.

Whilst we won't be naming any specific stocks, we can help you come to your own conclusions on the type of stocks that might suit your portfolio.

1. What do you specifically want from your investment?

Or in fancy talk, what are your investment goals?

What do you hope to achieve through investing in stocks? Are you looking for long term growth, passive income, a combination of both, or do you simply just want to beat inflation?

Once you know your goal, it's time to explore different types of stocks.

Non-cyclical stocks

These are stocks, sometimes referred to as 'defensive stocks' that tend to perform well when the economy is struggling.

These stocks are associated with necessities and services that are in constant demand, like:

Food

Utilities

Drug retailers

Healthcare providers

Growth stocks

These are stocks that are, as the name suggests, primarily focused on growth by reinvesting their earnings. Often, growth stocks flourish when the economy is booming.

As growth is the priority, dividends aren’t often paid as the earnings are pumped back into the company. Industries that typically attract growth stocks include:

Biotechnology firms

Technology companies

Other sectors with rapidly expanding industries

Dividend stocks

These companies tend to prioritise paying their shareholders, as a way to keep you invested in their stock. If regular, passive income is something you're interested in, these might be a type of stock to focus on.

Finding dividend stocks is pretty straightforward:

A company that is classified as a ‘dividend aristocrats’ has been paying dividends for over 25 years

A company that is classified as a ‘dividend king’ has been paying dividends for over 50 years

Value stocks

Stocks that are considered undervalued based on their financial performance.

Deciding which stocks are undervalued (and therefore a good buy) can be quite subjective. Often, it’s based on the investor’s future beliefs and interpretation of current affairs. This is why investing is as much an art as it is a science.

To help with knowing when to buy stocks, visit our article on when is the best time to buy and sell stocks?

2. Keep diversified

So, you've just decided what kind of stock you like. But that doesn't mean neglecting all the others.

Whilst you can still have an overall investing strategy, it's wise to keep a diversified portfolio. We don't know what the economy will do next, which can put people too heavily invested in one type of stock at risk.

Consider using the 60/40 rule which focuses on 60% of your capital invested in your main strategy, whilst 40% is spread across other areas to help mitigate risk.

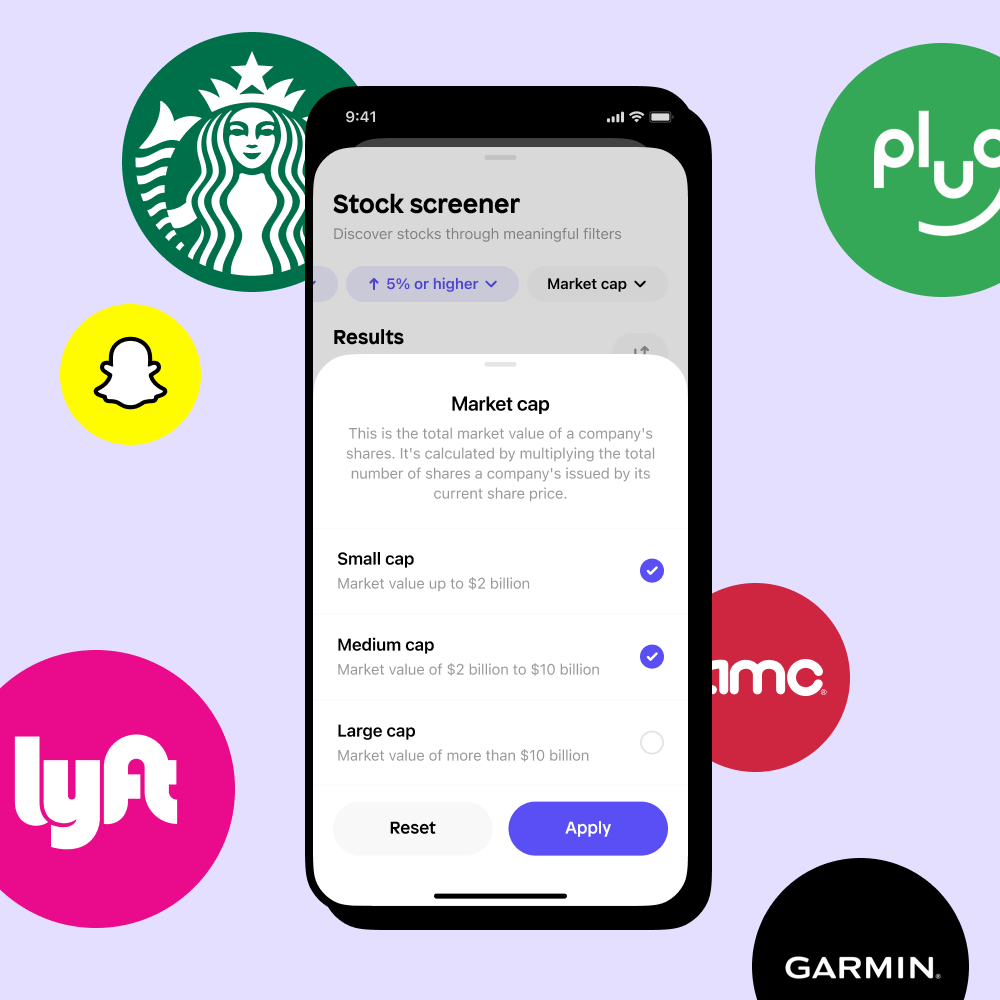

3. Evaluate companies

Okay, you've decided upon your goals and you're all set on diversifying to minimise risk.

Next comes evaluating the companies themselves, and this is where you put the hard yards in. To do this, conduct ‘fundamental analysis’ which is fancy talk for focusing on a company’s key figures:

Revenue - the amount of money a company generates from its business operations

Earnings - the amount of profit a company makes after accounting for all expenses

Gross profit margin - the % of revenue that remains after subtracting the cost of goods sold

Operating expenses - the costs involved with running the business, such as salaries, rent and marketing

Assets - resources a company owns, including cash, investments, property and equipment

Liabilities - the debts and loans a company owe

Dividend yield - the amount of money a company pays out in dividends as a % of its stock price. Too much and the company may run out of cash, too little and you might be in for a poor return on investment.

Ratios - if you really want to take things to the next level, visit our article on 3 ratios that help with buying and selling shares

You can find the most up-to-date figures during earnings season, which is when companies release their quarterly earnings. How a company is performing compared to their previous results and analysts' expectations can be a good indicator.

There are slightly more subjective aspects to fundamental analysis, that include:

Looking at the management team - what makes a good CEO may differ from person to person, but a positive track record can a good indicator

Assessing the company's position in the market - is there a big enough market? Is it too saturated? How will this company disrupt the current players?

Weighing up future growth potential - does the company look set to grow?

Hopefully that's helped. If you've got some stocks in mind, then be sure to give when is the right time to buy and sell stocks a read.

For more chat on all things stocks, be sure to download the Shares app and get involved with our communities! Make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330). Shares App Ltd is a company registered in England and Wales with company number 13374448.