But, it takes time, discipline, and favourable market conditions. And even then, there is no guarantee.

But we're going to be focusing on how compounding returns could help you achieve this using a theoretical example.

TL;DR

Becoming a millionaire through compound returns is possible, but it takes time, discipline and favourable market conditions. Always remember risk and loss is present within the world of investing

The earlier you start investing, the better chance you're giving your portfolio to grow

The amount you invest, how long you hold your investment, and market conditions are all important factors

As well as traditional assets like stocks, bonds, ETFs and mutual funds, don't forget about tax-advantage accounts like pensions and ISAs when aiming to grow your wealth.

As with all investing, you may get back less than what you put in. Your capital is at risk.

Compound interest

Compound interest is an investing strategy long-term investors use, often as an alternative to the usual cash-in-bank saving approach.

When you receive income from an investment (such as a dividend stock), it’s similar to receiving interest from a bank account. But, if you reinvest that income, it has the potential to compound so that you earn income on your income. This is compounding returns.

The earlier you start investing, the more time your money has to grow and compound. Often, people use dollar-cost averaging as their approach to keeping up long-term investments. See below for a classic example that assumes the market has returned 8% on average each year. (Note, the average return from 1992 to 2022 has been 7.92% on average)

Reaching a million

So how do you become a millionaire? Many people can't afford a £5,000 investment every year, especially during a recession.

Well, it depends on a couple factors:

The amount we invest - the less we invest, the longer we'll need to wait to hit those 6 magic figures

The market's return - it's generally accepted that in the last 30 years, the market has almost returned 8% on average, each year. Although, past performances don't guarantee future results.

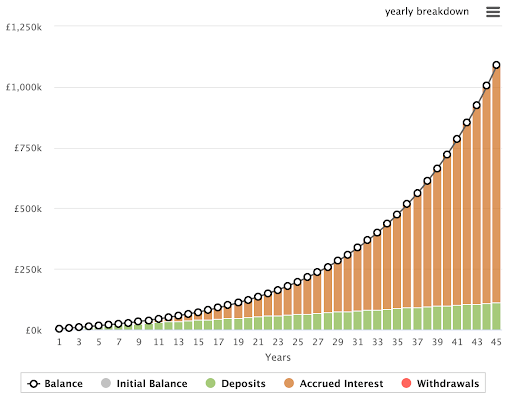

Let's say you were happy to invest for 45 years over the course of your career. You start with an initial £1,000 deposit and invest £200 each month. We’ll also assume the market has returned 8% on average, each year. Of course, keep in mind there’s no guarantee the market will return 8%, and returns have been closer to around 7.93% in the last 30 years.

45 years later, you'd have invested a total of £109,000 (each monthly investment + your initial £1,000 deposit).

If we combine your investments with an annual 8% market return each year and assumed you reinvested all of your gains, your portfolio would actually be worth £1,091,071. Staggering.

Here’s a projection of how your portfolio would have grown. Keep in mind this isn’t a projection of what will happen, it’s an illustration of how compound interest works assuming annual returns of 8% with £200 monthly contributions. It also doesn’t take into account taxes and fees.

Of course, you may not want to commit to this for 40 years. Have a play around with this calculator and see what looks realistic and achievable. Just remember to keep in mind with online calculators, it might not factor in tax, fees and your own risk tolerance!

I'm a millionaire, now what?

With a hefty portfolio of £1,000,000, you have a few options. The obvious might be to cash it in, and live your best life.

But, a lot of investors like to make their money work from them, and within the world of stocks and shares, dividend stocks are often a favoured asset to make this happen.

That’s because dividend stocks pay you for owning them. The S&P 500 has an average dividend yield of 1.74%. But, portfolios focusing on 'dividend kings and aristocrats' can experience a higher yield, between 3 to 4%.

Of course, 4% from our £1,000,000 investment equals £40,000. How's that for a bit of passive income, eh? Remember though, companies can cut their dividend payments at any time and there’s no guarantee the yield will remain at 4%. Also, when forecasting these numbers, view it like you would a job - you’d still have to pay capital gain tax and dividend tax, where applicable!

So, how do you become a millionaire? The secret is investing a lot across a range of diversified assets consistently over the long-term, and tracking your portfolio closely to see you are making your expected returns are some strategies worth exploring. Even then, an element of luck is still needed for favourable market returns.

Focusing on long term investing strategies like dollar-cost averaging, and avoiding trying to time the market can be a good place to start.

Once you’re ready to stop investing, the choice is yours. Cash in the potential gains after paying your capital gains tax, or make your portfolio work for you!

Want to chat more about this sorta' stuff? Head over to the Shares app and get involved with our communities!

Make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

Shares does not provide investment advice. If you are unsure about anything, please seek advice from an authorised financial advisor. Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.