It’s important because if one of your investments dips, your other holdings may prop up the rest of your portfolio. Being over exposed to one investment is very risky, because if it falls overnight, so will a large chunk of your portfolio.

When diversifying, the goal is to create a balanced portfolio that includes a mix of investments.

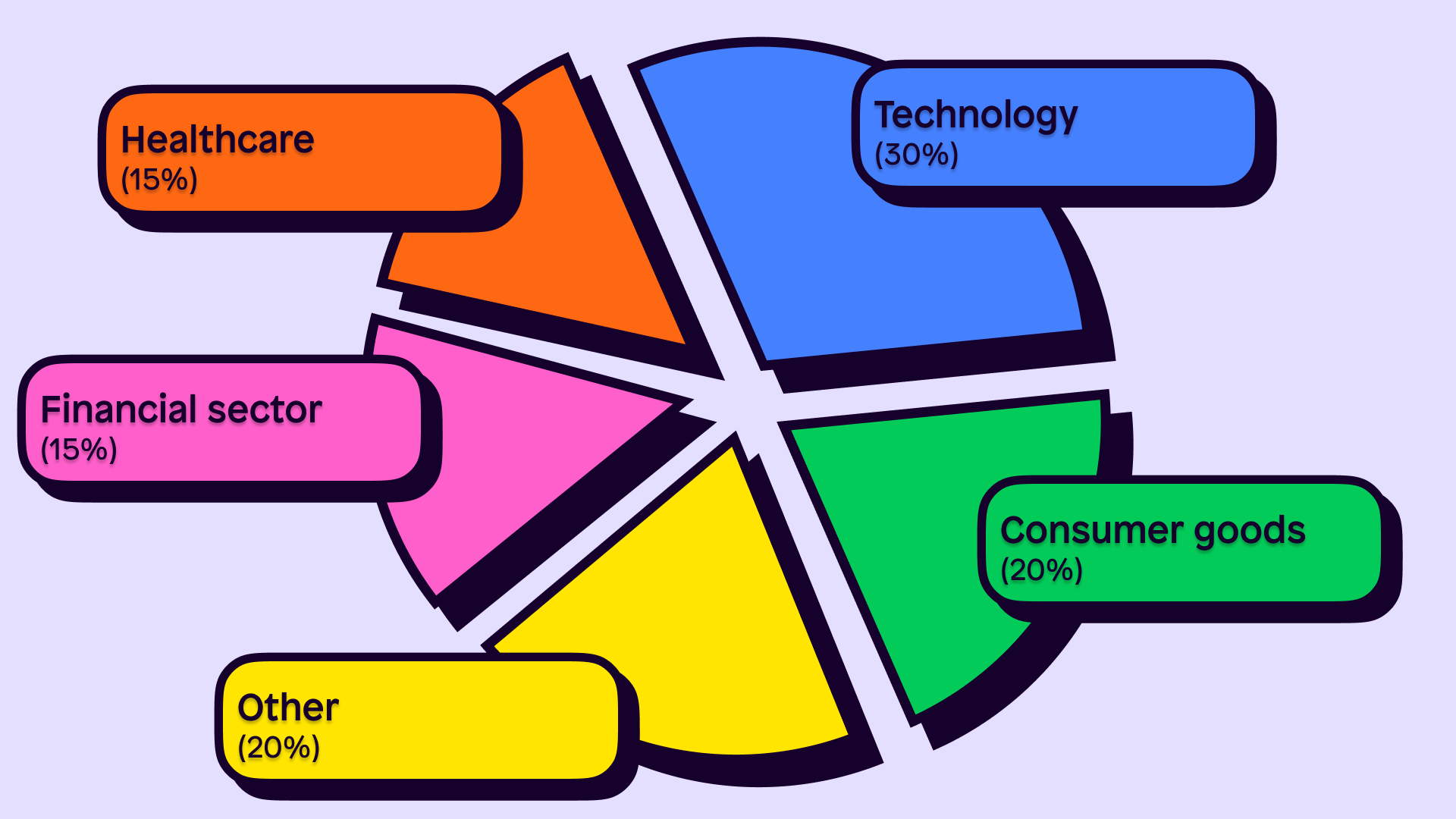

Example of diversification

Let's say you have £1,000 to invest in stocks. Instead of putting all your money into a single stock, you decide to diversify your portfolio across different sectors and companies.

Your portfolio might look something like this:

Technology sector: £300 (30% of your portfolio)

Consumer goods sector: £200 (20% of your portfolio)

Healthcare sector: £150 (15% of your portfolio)

Financial sector: £150 (15% of your portfolio)

Other sectors (energy, industrials, telecoms etc): £200 (20% of your portfolio)

Within each sector, you can then diversify further.

For example, £300 could be divided equally across large companies, mid-sized companies and smaller companies all within the tech space.

Does diversification reduce risk?

Diversification helps reduce risk, but there’s no guarantee it will prevent it altogether.

When done properly, your investments should have a low correlation with each other. A low correlation means that the performance of two or more of your investments move in different directions or have minimal association with each other.

For example, industries like tech and utilities are less likely to follow each other’s trends over time than utilities and energy.

This means if one of your investments suffers, it shouldn’t affect other holdings in your portfolio.

How many stocks to be diversified?

It’s commonly accepted that 20 assets or more makes for a diversified portfolio.

But true diversification doesn’t come from the amount of stocks in a portfolio, but rather, ensuring the stocks (or other assets) aren’t correlated with each other.

Let’s look at a quick example:

Phil had 30 large-cap tech stocks that were all listed on the Nasdaq when the dot-com bubble burst in the late 90s.

Kate only had 20 stocks, but these spanned across tech, healthcare, retail and ethical stocks.

Who do you think had a more diversified portfolio? Kate, of course! Whilst her tech stocks may have suffered, these were only a small part of her portfolio. Whereas Phil’s entire portfolio would have taken a huge hit.

Advantages of diversification

Reduced risk

In case you hadn’t caught the drift, diversification is all about reducing risk. By having small chunks of your net worth spread across different investments, you’re less likely to be wiped out should part of the market crash.

Peace of mind

Apps like Shares make checking your portfolio a breeze. But when it’s so easy to check, you may find yourself obsessing over every price change. Diversifying can help smooth out returns and remove some emotional stress of investing.

Exploring different markets

We tend to invest in areas we know about. Love all your Apple products? Your first thought may be to check out Apple stock. But diversifying into other sectors broadens your horizons and helps you see what other profitable industries exist.

Long-term returns

Diversification may not guarantee higher returns, but it can improve the potential for long-term returns. It increases your likelihood of capturing upside potential from different areas of the market. Over time, this broad exposure can contribute to better overall portfolio performance.

Disadvantages of diversification

Dilution of Returns

By taking on less risk, your potential returns are also lowered. The same way a sector could crash, it could also skyrocket, meaning your returns are limited. But for retail investors, the trade-off is almost always worth it, given we can’t analyse the markets every second of the day.

Over diversifying

If you’re too diversified, you might find your portfolio isn’t moving in any direction. Whilst it’s important to have a range of assets, the primary goal of investing is to grow your net worth. You can focus on industries you believe will perform well, whilst also being exposed to other sectors to ensure you’re maintaining a healthy balance.

Correlation Risk

Diversification does not guarantee that all investments will perform well independently of each other. Sometimes, macroeconomic conditions can affect the entire stock market and there’s nothing a diversified portfolio can do to prevent that. Always know you’re at risk when investing!

Limited control

By diversifying across various assets or sectors, you may have less control over specific investments you believe may outperform. This ties in with being over diversified, so make sure to strike a healthy balance.

Is diversification good or bad?

For the average beginner investor diversification is encouraged as it helps minimise risks. That’s why you often hear it’s a recommended investment strategy.

For someone who has experience in the markets, has a very high risk tolerance and is comfortable losing everything they invest, diversification may not be a priority in their investing strategy.

Do you need diversification?

Whether you’re a new investor or a seasoned pro, having some exposure to a diversified portfolio is a good idea.

Warren Buffett, arguably the most successful investor of all time, has a whopping 80% of his portfolio spread across just seven stocks.

Not very diversified, right? Well, when you’ve been as prolific at stock picking as him, diversification may be less of a priority, as honing in on specific stocks has allowed him to see bigger returns.

Of course, he did this over the course of a very long time (50+ years!) and still has 20% of his portfolio diversified across plenty of other stocks. Even if those seven stocks crashed, he’d still have enough wealth to last 10 lifetimes!

How to diversify

You can diversify across assets, market capitalisation, and industries/sectors. Let’s have a look.

Assets

There are many assets aside from stocks you can invest in. For example:

We have in-depth guides on each of these asset classes which can be found in our article ‘What can I invest in? A guide to understanding asset classes’.

Market capitalisation

Companies are categorised into three sizes based on their market capitalisation (“market cap”):

Small market cap - market capitalisation below $2 billion

Medium market cap - market capitalisations between $2 billion and $10 billion

Large market cap - market capitalisations above $10 billion

Industries/Sectors

Stocks and ETFs offer you a wide exposure to different industries. If you are focusing on these assets and you’re keen to diversify, consider gaining exposure in the following industries:

Communication services

Consumer discretionary

Consumer staples

Energy

Financials

Healthcare

Industrials

Materials

Real Estate/property

Technology

Utilities

Want an even deeper dive into diversification? Join our community inside the Shares app and ask any more questions you have to savvy investors!

Make sure to download the Shares app and follow us on our socials 👇

As with all investing, your capital is at risk and fees apply.

This content is for educational purposes only. Shares does not provide investment advice. If you are unsure about anything, please seek advice from an authorised financial advisor. Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.