Definition of an ETF

Well, before we get into all that, let's start with what it stands for. Because after all, the investing world loves an acronym.

ETF stands for 'exchange-traded fund'. Great! But what's that? 🤔

An exchange-traded fund is an investment asset that ‘bundles’ together a wide range of other investable assets. These might be a variety of stocks, bonds, or even involve tracking a country’s performance on the stock market.

When you invest in an ETF, you aren't limited to investing in just one company or asset. In fact, there may be stock ETFs that comprise over 1,000 companies, as well as country specific ETFs like Hong Kong. Despite how different each ETF can look, they all share one thing in common – they track a certain investment strategy.

So, why would you opt for an ETF over a traditional stock? Well, if you believe a business may perform well, you might be inclined to buy some shares in the company, right? But if you thought an entire industry would perform well, you might turn towards an ETF to receive a greater level of exposure.

Let's look at an example to help clarify.

Example of an ETF

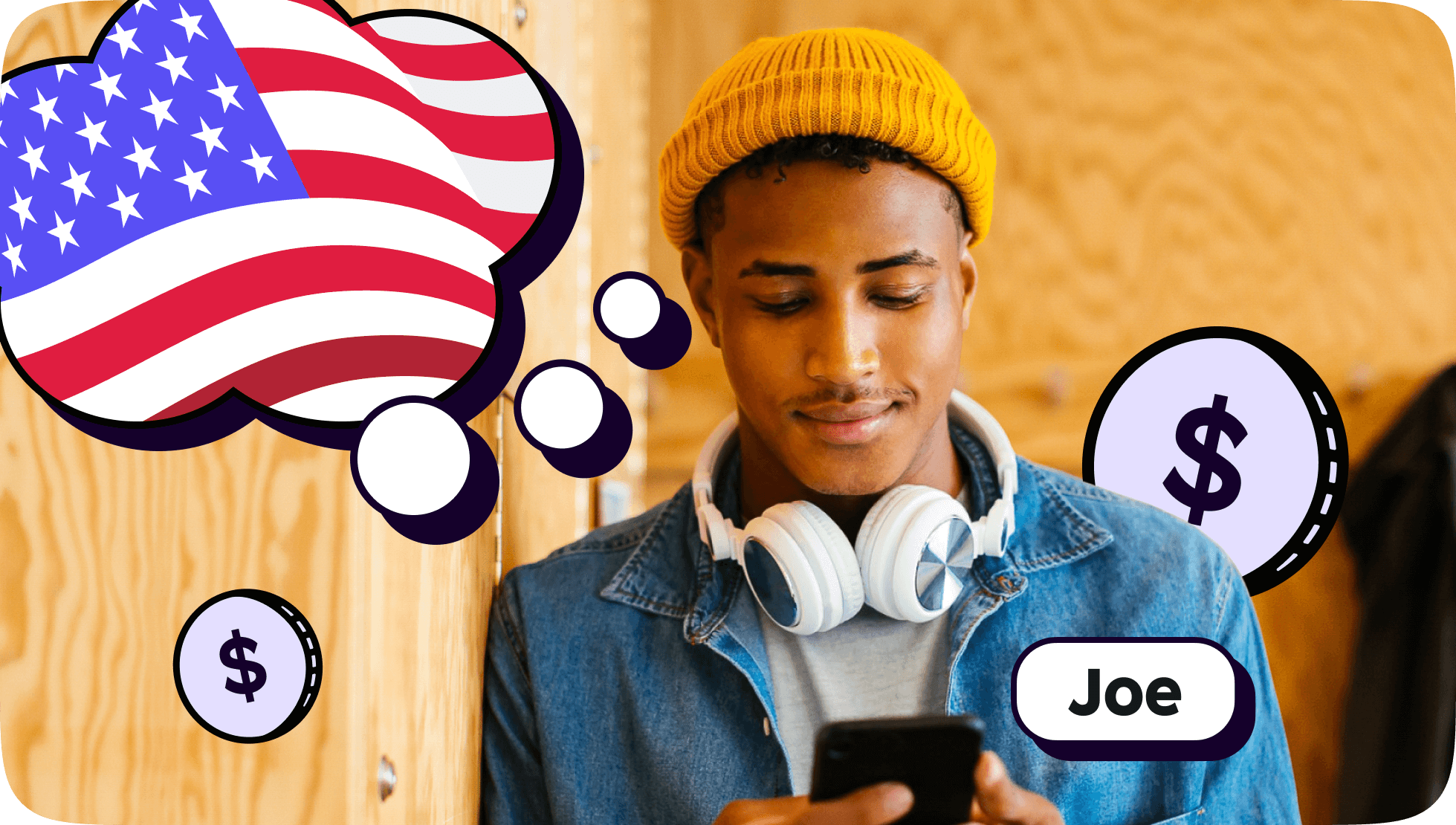

👋 Meet Joe.

Joe believes large U.S stocks are going to perform well over the next year, but he doesn't want to just buy one or two because he knows there are a number of reasons why individual stocks may perform badly. Clever thinking, Joe.

Instead, Joe chooses a wide index ETF fund like the S&P 500, as this tracks 500 of the largest companies in the U.S. Now, even if a few companies do perform badly due to unknown reasons, it shouldn’t affect the average performance of the S&P 500 too much. Just remember, past performance of an ETF does not guarantee future results as they can still go down as well as up.

This allows Joe to have a broader level of exposure to his main aim – investing in large U.S stocks. Of course, if Joe later thought a specific business would perform well, he may want to explore buying shares directly. Read up on our guide to learn more about how to do this!

Types of ETFs

As we said, an ETF can track a variety of different things. This could be individual industries, certain investment assets or even a country. Here are some main markets an ETF tracks:

Index ETFs – these track an index like the S&P 500, FTSE 100 or even a stock exchange itself like the NASDAQ

Industry ETFs – track particular industries like oil, technology and sustainability as just some examples

Bond/ fixed income ETFs – provides exposure to bonds

Commodity ETFs – tracks the price of hard and soft commodities such as gold, oil and wheat

Style ETFs – these focus on market capitalisation. For example, stocks with either a high, low or medium market cap

Foreign market ETFs – as the name suggests, these track markets abroad such as Hong Kong

ETFs vs Stocks: what’s the difference?

ETFs are created by asset management firms like Vanguard and iShares (BlackRock) create ETFs which people can invest in, either through their site or through trading apps. This differs from stocks, which are created when companies float on the stock market.

Of course, this makes them different to regular stocks, yet many beginner investors confuse the two.

Here are a few more similarities and differences between how an ETF works compared to a traditional stock:

Similarities:

✅ Bought and sold just like a stock using a stock exchange

✅ Has a ticker symbol just like a stock

✅ Price changes whilst the stock exchange is open

Differences:

❌ A stock is specific to one company, whilst an ETF is a 'package' of securities

❌ The amount of outstanding shares in an ETF can change, as new companies are created

❌ Often viewed as safer, as ETFs allow for more diversification. As with all investing though, your capital is still at risk.

ETFs vs mutual funds: what's the difference?

Once you’ve got your head around the difference between an ETF and a stock, you may think you’re home and dry. But oh no. Many people still confuse it with a mutual fund.

So, what is the difference?

ETFs and mutual funds are very similar as both are funds that allow an investor to invest in one overall asset, whilst receiving diversification. But, there is one key difference – the way they're traded.

An ETF's price fluctuates throughout the day, whereas a mutual fund is only traded once a day after the market has closed and is typically managed by an individual professional.

These professionals are known as 'fund managers' and have an obligation to work in their best interest to help meet their client’s investing goals.

Advantages of ETFs

Diversification – ETFs allow you to invest in one asset, yet receive greater levels of diversification compared to a single stock

The barrier to entry is low – they're straightforward to buy and don't require a large amount of capital

They're transparent – it's possible to view most holdings inside an ETF on a daily basis, meaning you know what you're investing into

Disadvantages of ETFs

Lower dividend yields – unless focusing specifically on a dividend orientated ETFs, dividend lovers shouldn’t expect to receive the same rate of return than if targeting dividend stocks

Operating costs – ETFs do a lot of the work for you, but with that can come a price. These costs are accounted for in the fund’s expense ratio, meaning a percentage of your investment will be paid into the fund

Lack of liquidity – some ETFs, especially the more niche ones, are thinly traded. A low trade volume can increase the volatility of the ETF, making its price unpredictable

That’s all for today, but make sure to read our guide on the different types of investment asset classes to learn more about different investments you can make.

For a detailed breakdown of each investment assets, check out our pieces on:

Download the Shares app and make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.