They are considered essential for daily life, as they're used to create things like food, clothing and energy. They’re also considered an investment asset, just like stocks, bonds and ETFs.

As these resources are typically grown, mined and processed, commodities are tangible, meaning you can touch and hold them. This differs from an investing asset such as cryptocurrency, which is intangible.

What makes investing in commodities different?

A stock’s price will alter based on the company’s performance – the better it performs, the more demand there is for the stock, causing the price to increase. But a commodity won't suffer from this.

Instead, commodities fluctuate based on current affairs like political events and natural disasters. This makes investing in them pretty risky, as no one knows what's going to happen.

Examples of commodities

Before diving into specific commodities, you should know there are two main types of commodities.

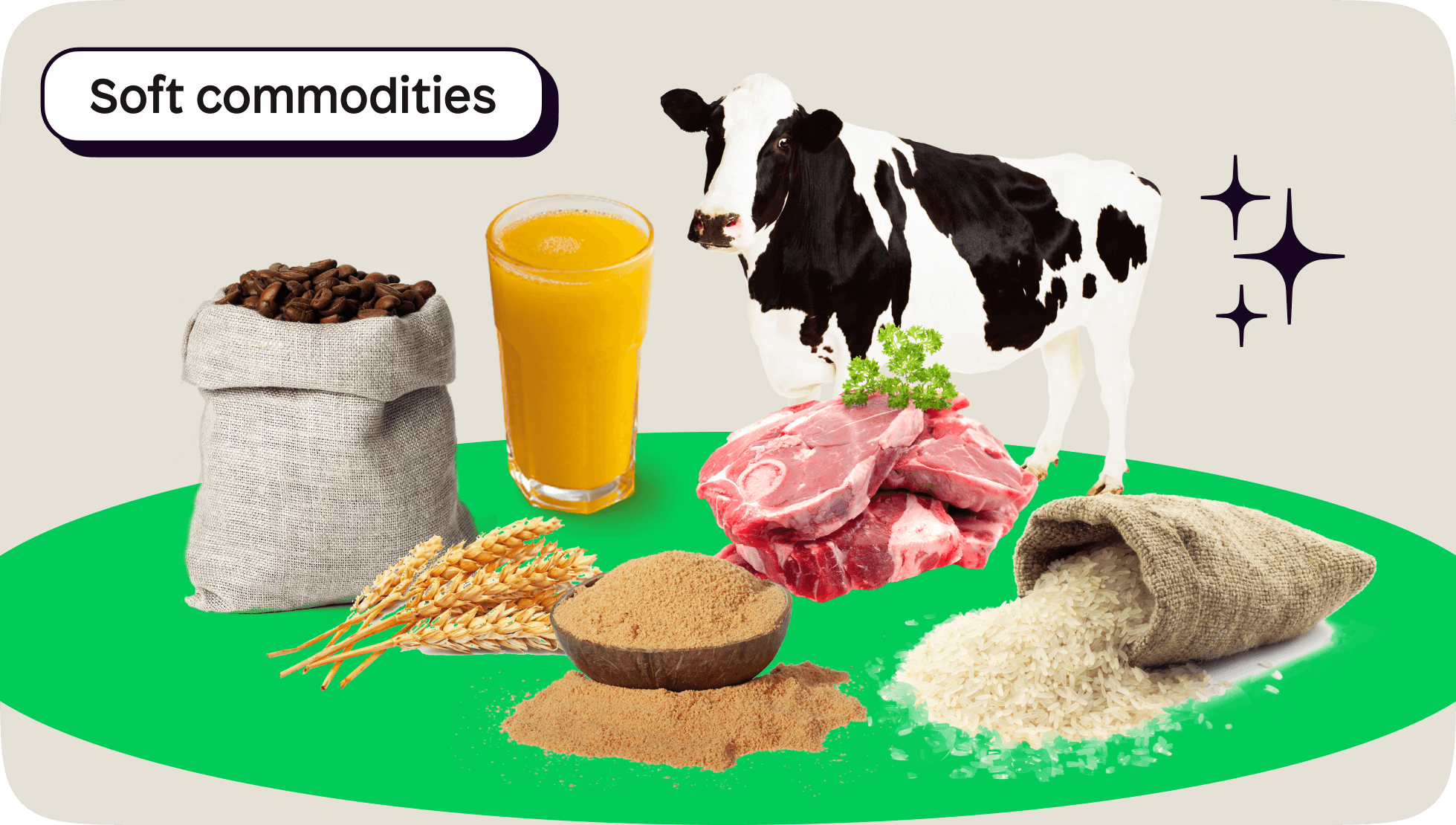

Soft commodities

These are often grown.

Examples include:

Meat

Coffee

Wheat

Corn

Sugar

Rice

Orange juice

Livestock

Hard commodities

Instead of being grown, these commodities are mined or extracted.

Examples include:

Gold

Silver

Lithium

Iron ore

Copper

Oil

Natural gas

How are commodities traded?

Whilst it’s possible to trade in physical commodities, it’s impractical for an investor. Think about it – do you really want to be lugging around bars of gold each time you buy and sell it? Don’t even get me started on how you’d go about storing natural gas.

Instead, something called a 'futures contract' is used. This is a financial contract that obligates the buyer to purchase an asset, or the seller to sell an asset, at a predetermined future date and price.

So, let's say I believe the price of gold will increase. I might buy a futures contract in gold, meaning I'm locked into buying it at today's price. When I come to sell, the hope is that gold’s price is higher than what I bought it for. This allows me to invest in gold, without having to physically interact with it. Clever!

Commodity traders will study the markets with the intention of buying low and selling high on a frequent basis. People who want to invest in commodities for the long-term usually do so as a hedge against inflation or to diversify their portfolio. Many long-term investors use ETFs to diversify into the commodity market, as opposed to just owning a commodity outright.

How risky is investing in commodities?

Investing in commodities can generate high returns, but that comes with higher levels of risk. Prices are subject to volatile swings thanks to macro factors such as:

Global supply and demand

Political events

War

Natural disasters

Like with all asset classes, factors outside our control can affect commodity prices, and it's for these reasons you should be extra diligent when investing.

That's it for today, but be sure to check out our guides on:

Are you a commodity fan? Let us know what your favourite commodities are by joining one of our communities inside the Shares app.

Make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330). Shares App Ltd is a company registered in England and Wales with company number 13374448.