Bonds are like an I.O.U (I owe you). You lend money to a business or the government, and they agree to pay you back by a certain date. Each payment made back to you comes with interest, which is of course how the investor benefits. That’s why they’re often called a ‘fixed-income instrument’.

What is an investment bond?

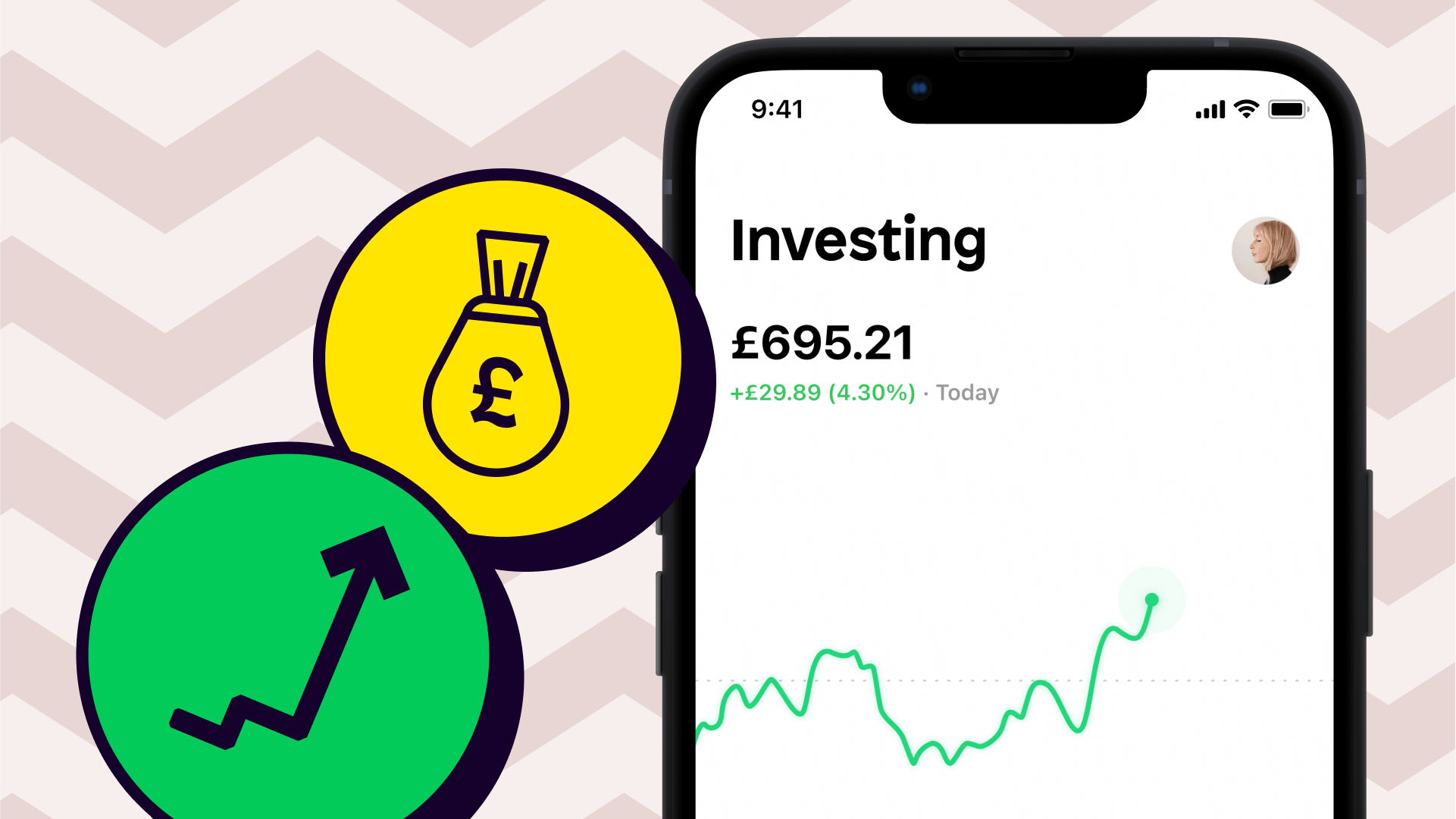

When you invest in a bond, you take on a role similar to a lender.

Your money is invested into someone else’s cause. This might be a government requiring capital to help build infrastructure like roads and schools, or a company needing more money to grow their business.

How often you’re paid back depends on your bond contract, though once every six months is a common agreement.

Of course, by the time you've been paid back in full, you will have more than you initially invested providing the borrower doesn’t go bankrupt or default on any payments. This is known as being paid back with interest.

Unlike stocks, bonds issued by companies don’t give you ownership rights. So you don't necessarily benefit from the company's growth, but you won't see as much impact when the company isn't doing as well, either – as long as it still has the resources to pay its loans, you can expect the return on your investment.

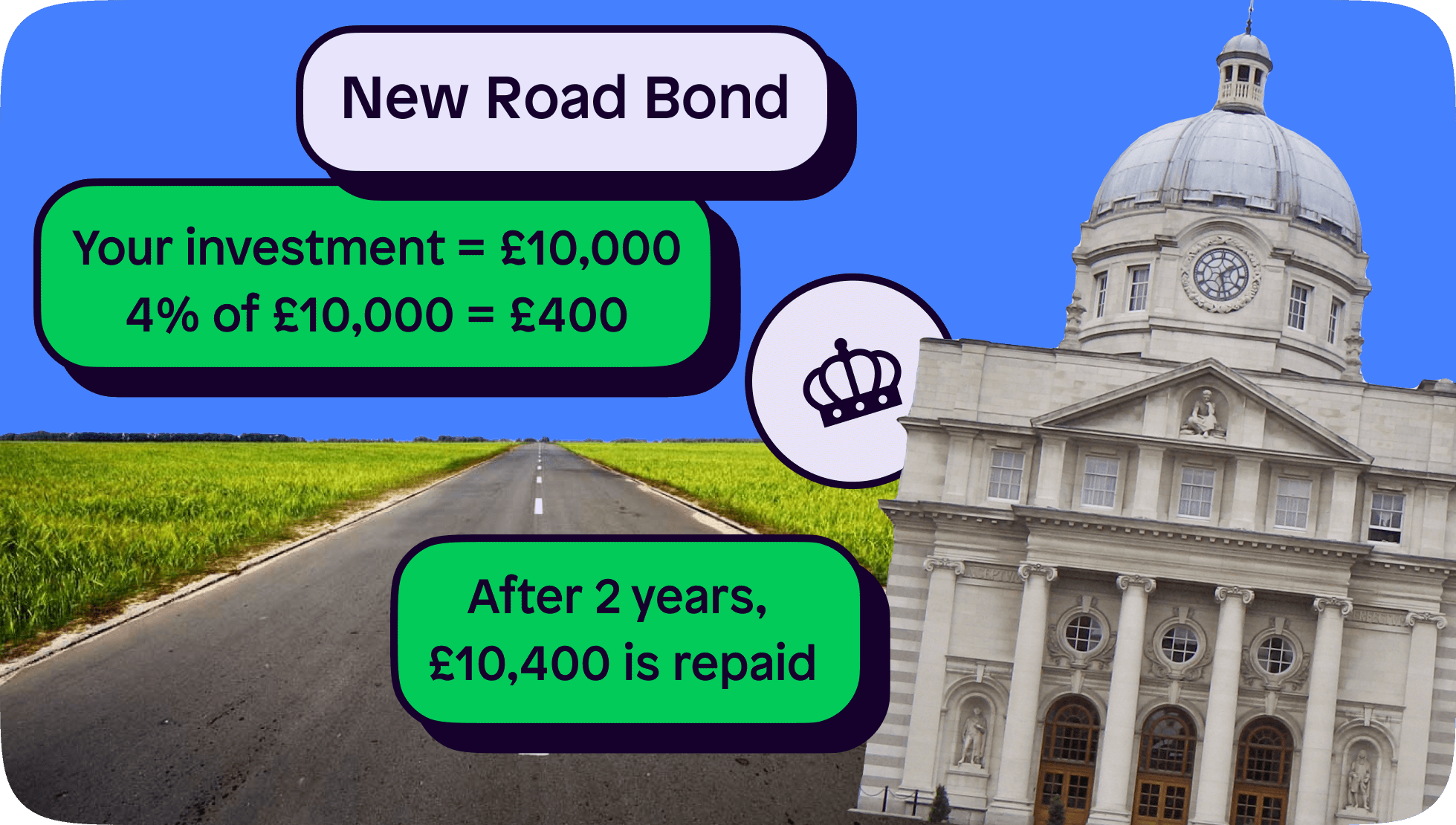

Example of investing in bonds

Let's say the government needs £500,000 to help with building a road for better transport.

They may issue a bond that has a 4% interest rate of return over two years, paid on a bi-yearly basis. Wow, slow down a sec. That all sounds pretty confusing.

Simply put, it means the following:

However much you invest (lend to the government), you will receive back with 4% interest

It'll take two years before you have your investment fully paid back to you (providing the government doesn't go bankrupt, and can keep up payments)

The government will pay you back in four instalments; twice a year for two years

So, let's say you lend the government £10,000.

4% of £10,000 is £400. And £10,000 + £400 = £10,400. This is how much you're set to receive.

But, it'll take two years until you receive the total amount, and the contract states you'll be paid twice a year.

So how much will you get in each payment? That’s £10,400 divided by 4 = £2,600. This means we can expect to receive a payment of £2,600 twice a year, for two years. Simple, right!

Of course, contracts may differ based on the borrower’s needs. In some instances, there are no repayments until the end of the contract where everything is paid at once.

Why are bonds seen as safe?

The first thing to remember is with investing, your capital is at risk.

With that said, some bonds are typically seen as a safer asset. But why is this?

When the government issues bonds, it's often to help build vital infrastructure like roads, buildings and schools. The demand for these types of infrastructure will always be high and a priority, which is good news for investors looking for some stability.

With businesses, risk can vary. Well established businesses with strong cash flow and a previous track record of meeting payments are likely to be a safer choice than a start-up company.

Of course, the government isn't dependent on income the same way a business is, as they can use revenue streams such as tax from businesses and employees, which is more reliable than a business’s income. For this reason, some people looking for a high level of safety tend to stick to government bonds.

Characteristics of a bond

To help recognise a bond, the majority will have the following details outlined from the beginning:

Initial price/ face value – how much the bond costs

Coupon rate – the % of interest you receive with each repayment. In most cases, this won’t change after the bond is issued

Coupon date – which dates you're paid back on (and how often)

Yield – this is a measure of interest that takes into account the bond's fluctuating changes in value

Maturity date – the date the final repayment is made

Secondary price – the amount the bond would currently cost on the secondary market

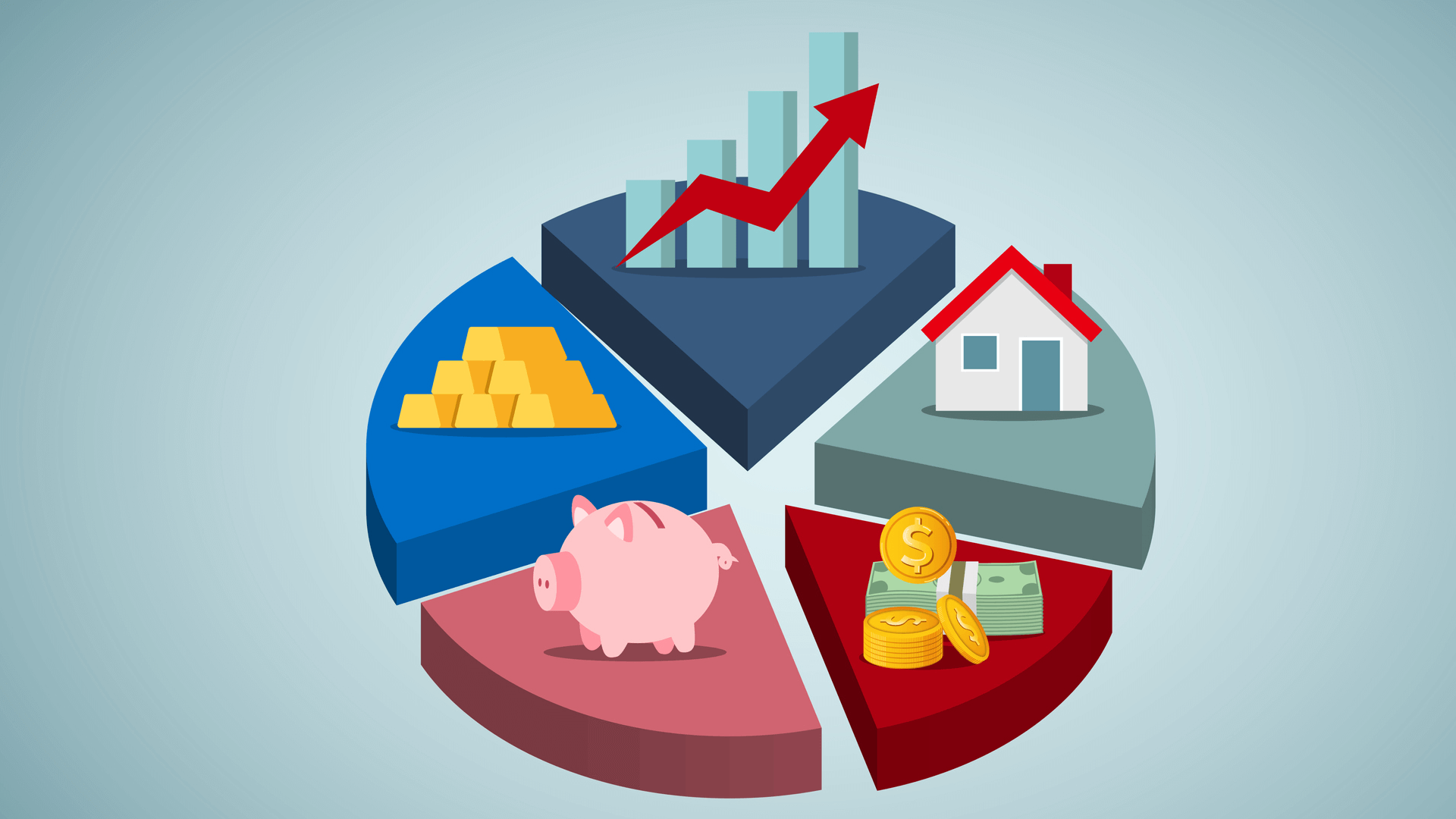

Types of bonds

There are different types of bonds, relating to who is issuing them and what kind of repayment structure they have. Here are some of the most well-known types:

Repayment type bonds

Fixed rate bonds – the interest is agreed upon beforehand and remains fixed until the contract is complete. For this reason, they remain resistant to market fluctuations and are often favoured for those looking for a safer investment

Floating rate bonds – the interest rate fluctuates based on the current market, often presenting an opportunity for investors when rates are low and expected to rise. Naturally, someone's risk appetite may be higher when exploring floating rates

Bond issuers

Corporate bonds – issued by private or public companies, directly to the bondholder

Municipal bonds – often referred to as 'munis', these are bonds issued by a city, country or government

Revenue bonds – funded by specific revenue sources, such as motorway tolls. If the revenue stream dries up, the bondholder may not be paid

General obligation – unlike revenue bonds, no specific revenue source is stated that will help with repayments. Instead, good faith is relied upon.

Conduit bonds – issued by the government, but on behalf of private entities such as a non-profit organisation or a hospital

Investment-grade – bonds with a higher credit rating, implying there is less risk as credit rating agencies are confident the issuer is able to make repayments. Usually, the interest rate is lower for the investor.

High-yield – bonds that have a lower credit rating and higher risk. With higher risk though, comes higher interest repayment rates for the investor

Advantages of bonds

Some bonds are seen as a safer investment choice compared to other assets

Fixed rate bonds are often great for peace of mind, as they outline the amount and date repayments will be made

There aren't just 'low risk, low reward' bonds. Those with a higher risk appetite can explore high-yield bonds

The investment is often put towards a good cause. Developing infrastructures like schools and buildings in society is beneficial for everyone.

Disadvantages of bonds

Risk of default – the issuer may fail to make timely payments, or the payments altogether should they go bankrupt

When inflation is high, the returns on bonds may be very low

Liquidity risk – if there aren't enough buyers of the bond, it can affect the initial offering price. The issuer may have to alter the interest rate, making it less favourable

As well as the risk of default, issuers can retire a bond before the maturity date if they have to. It's a bit like a homeowner needing to remortgage to prevent their property from being repossessed

That's all for today, but make sure to read about other investment assets such as:

Download the Shares app and make sure to follow us on our socials 👇

As with all investing, your capital is at risk.

Shares is a trading name of Shares App Ltd. Shares App Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.